Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

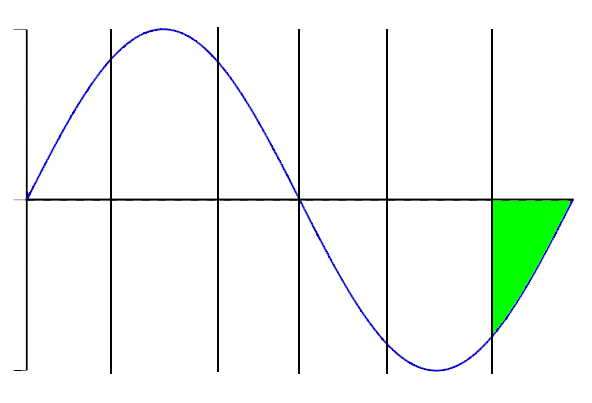

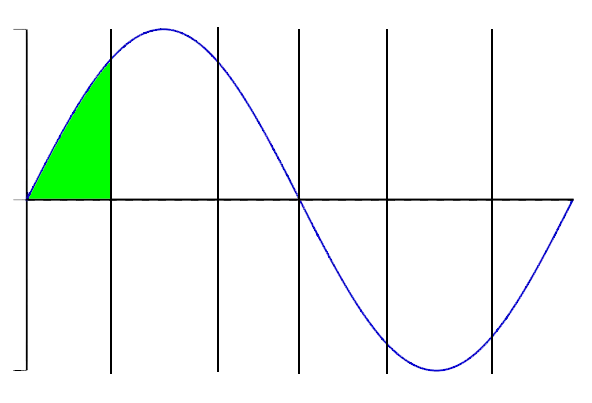

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

Barclays PLC |

27.02.25 |

04.04.25 |

0.0006 |

Barclays PLC |

15.08.24 |

20.09.24 |

0.0290 |

Barclays PLC |

29.02.24 |

03.04.24 |

0.0530 |

Barclays PLC |

10.08.23 |

15.09.23 |

0.0270 |

Barclays PLC |

23.02.23 |

31.03.23 |

0.0500 |

Barclays PLC |

11.08.22 |

16.09.22 |

0.0225 |

Barclays PLC |

03.03.22 |

05.04.22 |

0.0400 |

Barclays PLC |

12.08.21 |

17.09.21 |

0.0200 |

Barclays PLC |

25.02.21 |

01.04.21 |

0.0100 |

Barclays PLC |

27.02.20 |

03.04.20 |

0.0600 |

Barclays PLC |

08.08.19 |

23.09.19 |

0.0300 |

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 23.04.25 20:26:22 | Barclays price target lowered to 345 GBp from 350 GBp at Citi |  |

| Citi lowered the firm’s price target on Barclays (BCS) to 345 GBp from 350 GBp and keeps a Buy rating on the shares. Recent market volatility has resulted in record capital market volumes in March amd April, most notably in equities, the analyst tells investors in a research note. The firm recommends owning selective European banks into the Q1 results. Stay Ahead of the Market: Discover outperforming stocks and invest smarter with Top Smart Score Stocks. Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener. Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>> See the top stocks recommended by analysts >> Read More on BCS: Disclaimer & DisclosureReport an Issue Brookfield Asset Management, Barclays partner for payment acceptance business Crypto Exchange OKX Launches Service in U.S. General Motors (GM) Stock Falls as Rating and Price Target Are Slashed by Barclays Analysts Slam General Motors (GM) with Downgrades amid Trump’s Tariffs Storm Barclays price target lowered to 350 GBp from 375 GBp at Morgan Stanley View Comments |

||

| 23.04.25 16:21:54 | European Equities Surge Higher in Wednesday Trading; EC Fines Meta, Apple for DMA Violations |  |

| The European stock markets closed sharply higher in Wednesday trading as the Stoxx Europe 600 climbe PREMIUM Upgrade to read this MT Newswires article and get so much more. A Silver or Gold subscription plan is required to access premium news articles. Upgrade Already have a subscription? Sign in |

||

| 22.04.25 16:05:58 | European Equities Close Mostly Higher in Tuesday Trading; Consumer Confidence Continues to Fall |  |

| The European stock markets closed mostly higher in Tuesday trading as The Stoxx Europe 600 rose 0.24 PREMIUM Upgrade to read this MT Newswires article and get so much more. A Silver or Gold subscription plan is required to access premium news articles. Upgrade Already have a subscription? Sign in |

||

| 21.04.25 15:45:12 | Barclays (BCS) Could Be a Great Choice |  |

| Whether it's through stocks, bonds, ETFs, or other types of securities, all investors love seeing their portfolios score big returns. But for income investors, generating consistent cash flow from each of your liquid investments is your primary focus. While cash flow can come from bond interest or interest from other types of investments, income investors hone in on dividends. A dividend is the distribution of a company's earnings paid out to shareholders; it's often viewed by its dividend yield, a metric that measures a dividend as a percent of the current stock price. Many academic studies show that dividends make up large portions of long-term returns, and in many cases, dividend contributions surpass one-third of total returns. Barclays in Focus Barclays (BCS) is headquartered in London, and is in the Finance sector. The stock has seen a price change of 10.76% since the start of the year. The financial holding company is paying out a dividend of $0.28 per share at the moment, with a dividend yield of 3.77% compared to the Banks - Foreign industry's yield of 4.12% and the S&P 500's yield of 1.69%. Taking a look at the company's dividend growth, its current annualized dividend of $0.55 is up 34.1% from last year. Over the last 5 years, Barclays has increased its dividend 5 times on a year-over-year basis for an average annual increase of 45.04%. Any future dividend growth will depend on both earnings growth and the company's payout ratio; a payout ratio is the proportion of a firm's annual earnings per share that it pays out as a dividend. Right now, Barclays's payout ratio is 16%, which means it paid out 16% of its trailing 12-month EPS as dividend. Earnings growth looks solid for BCS for this fiscal year. The Zacks Consensus Estimate for 2025 is $2.10 per share, which represents a year-over-year growth rate of 14.13%. Bottom Line Investors like dividends for many reasons; they greatly improve stock investing profits, decrease overall portfolio risk, and carry tax advantages, among others. However, not all companies offer a quarterly payout. Big, established firms that have more secure profits are often seen as the best dividend options, but it's fairly uncommon to see high-growth businesses or tech start-ups offer their stockholders a dividend. Income investors have to be mindful of the fact that high-yielding stocks tend to struggle during periods of rising interest rates. With that in mind, BCS presents a compelling investment opportunity; it's not only an attractive dividend play, but the stock also boasts a strong Zacks Rank of #1 (Strong Buy). Story Continues Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Barclays PLC (BCS) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 21.04.25 13:40:11 | Is Barclays (BCS) Stock Outpacing Its Finance Peers This Year? |  |

| For those looking to find strong Finance stocks, it is prudent to search for companies in the group that are outperforming their peers. Has Barclays (BCS) been one of those stocks this year? By taking a look at the stock's year-to-date performance in comparison to its Finance peers, we might be able to answer that question. Barclays is one of 859 companies in the Finance group. The Finance group currently sits at #5 within the Zacks Sector Rank. The Zacks Sector Rank considers 16 different groups, measuring the average Zacks Rank of the individual stocks within the sector to gauge the strength of each group. The Zacks Rank emphasizes earnings estimates and estimate revisions to find stocks with improving earnings outlooks. This system has a long record of success, and these stocks tend to be on track to beat the market over the next one to three months. Barclays is currently sporting a Zacks Rank of #1 (Strong Buy). Over the past three months, the Zacks Consensus Estimate for BCS' full-year earnings has moved 6.8% higher. This shows that analyst sentiment has improved and the company's earnings outlook is stronger. According to our latest data, BCS has moved about 10.8% on a year-to-date basis. In comparison, Finance companies have returned an average of -2.9%. As we can see, Barclays is performing better than its sector in the calendar year. One other Finance stock that has outperformed the sector so far this year is Progressive (PGR). The stock is up 10.8% year-to-date. Over the past three months, Progressive's consensus EPS estimate for the current year has increased 11.1%. The stock currently has a Zacks Rank #2 (Buy). Breaking things down more, Barclays is a member of the Banks - Foreign industry, which includes 66 individual companies and currently sits at #20 in the Zacks Industry Rank. On average, stocks in this group have gained 8.9% this year, meaning that BCS is performing better in terms of year-to-date returns. Progressive, however, belongs to the Insurance - Property and Casualty industry. Currently, this 43-stock industry is ranked #45. The industry has moved +12.1% so far this year. Investors interested in the Finance sector may want to keep a close eye on Barclays and Progressive as they attempt to continue their solid performance. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Barclays PLC (BCS) : Free Stock Analysis Report The Progressive Corporation (PGR) : Free Stock Analysis Report Story Continues This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 17.04.25 16:22:41 | SPACs Set to Capitalize on IPO Freeze With $1 Billion Deal Burst |  |

| (Bloomberg) -- President Donald Trump’s tariff war has hammered stocks and bonds, and shuttered the traditional IPO market. Yet even with risk appetite on hold, the area that could benefit most from the rampant volatility is among the most speculative: The SPAC market. Most Read from Bloomberg Trump Signs Executive Orders on Federal Purchasing, Office Space DOGE Places Entire Staff of Federal Homelessness Agency on Leave How Did This Suburb Figure Out Mass Transit? Why the Best Bike Lanes Always Get Blamed Nashville’s $3 Billion Transit Plan Brings a Call for Zoning Reform The blank-check industry has hummed along since the start of 2025, with sponsors pooling more than $1 billion in this month alone despite President Trump announcing global tariffs whose sweeping scale shocked investors. Equity volatility — which has wiped out more than $2 trillion in market value from the S&P 500 Index in the past two months — and blank-checks’ spotty track record have done little to deter repeat sponsors including Harry You and Alec Gores from planning to give the special-purpose acquisition company another go. Since Trump unveiled the wide-ranging tariffs on April 2, nearly a dozen SPAC sponsor teams filed for listings and are seeking to raise a combined $1.8 billion to help bring private companies onto public exchanges. “SPACs tend to gain momentum during periods when the traditional IPO market faces headwinds,” said Mark Schwartz, who leads IPO and SPAC advisory at consulting giant EY. “Prospective SPAC sponsors are optimistic about continued deal flow in the coming months and quarters, which is fueling the launch of new SPACs in the market.” After more than $4.1 billion was raised by SPACs in the year to date, and a small burst of mostly tiny deals were announced or completed, Ares Acquisition Corp. II announced a deal to merge with autonomous trucking startup Kodiak Robotics at a roughly $2.5 billion valuation. The news broke on April 14, the same day that former SPAC Webull Corp.’s shares soared as much as 500%, as momentum traders showed that the market for pumping low-float stocks is alive and well. Backwater No More Once seen as the backwater of the public markets, SPACs surged in popularity in 2020 and 2021 as bankers pitched the deals as a way to navigate a choppy market driven by the pandemic. That swiftly changed when heightened regulatory scrutiny forced Wall Street banks to rethink the vehicle, as high-profile blowups soured the deal landscape. Now, the blank-check universe is seeking a revitalization, in part because the many companies aiming to go public this year are staring at a market for traditional IPOs that’s almost totally frozen. Story Continues Companies most likely to strike blank-check deals will be doing it because they have no other option, according to David Erickson, formerly co-head of global equity capital markets at Barclays Plc and Lehman Brothers and now a lecturer at Columbia Business School. Are SPACs viable as an option in a stalled IPO market? “I wouldn’t say a great alternative, but an alternative for the have nots, which may not have access to the private markets and out-live their welcome there,” Erickson said. “If you’re a have-not, the SPAC sponsor knows that and they’re not going to give you a 2021 uplift, and the bells and whistles they did then. It is going to be a buyers’ market,” he said. Still, the average size of newly-funded SPACs is markedly lower than it was at the height of SPAC mania when Bill Ackman raised a record $4 billion blank check. And the market is reeling from a wave of deals that swiftly plunged to penny-stock status after their debuts, with dozens of firms going bankrupt in mere months. SPAC investors are increasingly choosing to exercise their option to swap shares for cash rather than take a stake in many proposed deals. “The number of success cases where public market investors that didn’t redeem have gotten decent returns has been incredibly small,” said University of Florida finance professor Jay Ritter. More than two-thirds of the roughly 550 SPACs to complete deals since 2019 are down more than 80%, SPAC Research data analyzed by Bloomberg show. Even worse, shares of only about 40 members of that group are trading higher than the $10 price the vehicles go public at, compared to a 77% return for the S&P 500 since the SPAC craze kicked off in early 2020. The slump has done little to deter hedge funds, who like the safety of a product that enables them to swap their shares for their money back — plus interest — while having the ability to profit handsomely if shares surge, according to Ritter. For the market to see a real revitalization, industry watchers agree that sky-high redemption rates need to come down, in order to prevent share prices in the newly-listed companies from quickly plunging. “High redemption rates and limited capital availability remain two of the most pressing challenges in SPAC transactions today,” said EY’s Schwartz. “For there to be a meaningful resurgence in SPAC formation, we would need to see a sustained recovery in the aftermarket performance of completed SPAC deals.” Most Read from Bloomberg Businessweek Trade Tensions With China Clear Path for Salt-Powered Batteries GM’s Mary Barra Has to Make a $35 Billion EV Bet Work in Trump’s America How Mar-a-Lago Memberships Explain Trump’s Tariff Obsession Trump Is Firing the Wrong People, on Purpose The Monastery Where Founders Meditate on Code and Profit ©2025 Bloomberg L.P. View Comments |

||

| 17.04.25 06:20:47 | Barclays sells stake in payments business to Brookfield |  |

| By Lawrence White LONDON (Reuters) -Barclays has agreed terms for Brookfield Asset Management to buy most of its British payments business, the bank said on Thursday, ending a more than year-long effort to offload the business which processes payments for retailers. Under the complex terms of the deal, the two parties will create a standalone entity for the business, into which Barclays plans to invest approximately 400 million pounds ($528.2 million), Barclays said. The British bank remains the sole shareholder in that unit for the first three years, but Brookfield may acquire an approximately 70% ownership interest, the bank said, on top of its initial 10% stake, and subject to certain conditions. Those include Barclays recovering the full value of its investment into the partnership. The bank said it expects to retain the remaining 20% stake. Barclays has been trying to offload all or part of the business since December 2023, having said it was no longer the best owner for the unit which processes payments on behalf of retailers. The British bank follows other lenders in cutting back investments in the payments processing business, which is becoming a scale game dominated by fewer players. Valuations in European payments firms have fallen amid concerns over revenue outlooks at companies such as Worldline, Nexi and Adyen. Barclays initially sought a valuation of more than 2 billion pounds ($2.65 billion) for the whole business, Reuters has reported, but found few takers given the technological complexities of any such deal. The business provides critical infrastructure to the UK economy, processing billions of pounds of payments annually for small businesses as well as domestic and international corporate clients, Barclays said. The deal will not have any material impact on the bank's financial guidance or targets, it said. ($1 = 0.7573 pounds) (Reporting by Lawrence White; Editing by Jan Harvey and Ros Russell) |

||

| 17.04.25 01:01:00 | Barclays Bank PLC Updates Announcement of 3 Cash Tender Offers and Consent Solicitations |  |

| NEW YORK, April 17, 2025--(BUSINESS WIRE)--Barclays Bank PLC (the "Issuer") announced today that, in connection with its previously announced cash tender offers (each, an "Offer") to purchase any and all of its outstanding exchange-traded notes (the "Notes" or the "ETNs") of the three separate series listed in tables below (each, a "Series") and the solicitation of consents (each, a "Consent Solicitation") from holders of the Notes (the "Noteholders") to amend certain provisions of the Notes with respect to each Series, it has: determined the results of the Offer and Consent Solicitation for the Series included in Table 1 below (the "Expired Series"); and extended the expiration deadline for the Offer and Consent Solicitation with respect to each Series included in Table 2 below (each, an "Extended Series"). The purchase price per Note (the "Purchase Price") for each Extended Series is set forth in Table 2 below. Each Offer and Consent Solicitation is subject to the conditions and restrictions set out in the Initial Statement, as supplemented by Supplement No. 15 dated April 16, 2025 (as so supplemented, and as it may be further supplemented or amended from time to time, the "Statement"). The "Initial Statement" is the Offer to Purchase and Consent Solicitation Statement dated December 7, 2023, as supplemented by Supplement No. 1 dated March 7, 2024, Supplement No. 2 dated March 20, 2024, Supplement No. 3 dated April 4, 2024, Supplement No. 4 dated May 20, 2024, Supplement No. 5 dated June 5, 2024, Supplement No. 6 dated July 16, 2024, Supplement No. 7 dated July 31, 2024, Supplement No. 8 dated September 10, 2024, Supplement No. 9 dated September 25, 2024, Supplement No. 10 dated November 4, 2024, Supplement No. 11 dated November 20, 2024, Supplement No. 12 dated January 13, 2025, Supplement No. 13 dated January 29, 2025 and Supplement No. 14 dated March 26, 2025. Capitalized terms used and not otherwise defined in this announcement have the meanings given in the Statement. Expired Series The Offer and Consent Solicitation for the Expired Series expired at 6:00 p.m., New York City time, on April 16, 2025 (with respect to the Expired Series, the "Expiration Deadline"). For the Expired Series, the Issuer has received and accepted the specified number of Notes validly tendered and not validly withdrawn prior to the Expiration Deadline. All conditions to the Offer for the Expired Series were deemed satisfied or waived by the Issuer as of the Expiration Deadline. The aggregate purchase price of the Notes for the Expired Series accepted by the Issuer will be the specified dollar amount set forth in Table 1 below, reflecting the previously announced Purchase Price per Note. On April 23, 2025 (the "Settlement Date"), Noteholders whose Notes have been accepted for purchase pursuant to the relevant Offer will receive the previously announced applicable Purchase Price. No Offer or Consent Solicitation is currently open in respect of the Expired Series. Story Continues Table 1: Expired Series Title of Note Bloomberg Ticker CUSIP / ISIN Purchase Price per Note Number of Notes Tendered Aggregate Purchase Price iPath® Bloomberg Livestock Subindex Total ReturnSM ETN COWTF 06739H743 / US06739H7439 $25.00 40,372 $1,009,300.00 Pursuant to the Consent Solicitation for the Expired Series, the Issuer has obtained the requisite consents to the Proposed Amendment, as described in the Initial Statement, with respect to that Series. Notes purchased by the Issuer pursuant to the Offer with respect to the Expired Series will be cancelled on the Settlement Date. The Issuer currently intends to effectuate the Proposed Amendment for the Expired Series promptly after the Expiration Date and redeem all outstanding Notes at any time after the Proposed Amendment becomes effective with respect to that Series. As described in the Initial Statement, the Issuer will publicly announce any decision to redeem the outstanding Notes of the Expired Series by issuing a redemption notice. The payment upon redemption to Noteholders for the Expired Series may be greater than or less than the Purchase Price for that Series pursuant to the relevant Offer but will not include any premium payment or any amount in excess of the applicable Closing Indicative Note Value on the Valuation Date of such redemption. Extended Series The Offer and Consent Solicitation with respect to each Extended Series were previously scheduled to expire at 6:00 p.m., New York City time, on April 16, 2025 and will instead expire at 6:00 p.m., New York City time, on June 25, 2025 (with respect to each Extended Series, the "Expiration Deadline"), unless the Offer with respect to any Extended Series is further extended or early terminated by the Issuer, in which case notification to that effect will be given by or on behalf of the Issuer in accordance with the methods set out in the Statement. The specified Purchase Price per Note for each Extended Series reflects a premium to the Closing Indicative Note Value of that Series on April 16, 2025. The Purchase Price may be lower than the trading price of the Notes of that Series on the Expiration Date. Table 2: Extended Series Title of Note Bloomberg Ticker CUSIP / ISIN Purchase Price per Note* Closing Indicative Note Value on April 16, 2025 Number of Notes Tendered iPath® CBOE S&P 500 BuyWrite IndexSM ETN BWVTF 06739F135 / GB00B1WL1590 $130.00 $108.38 6,552 iPath® Bloomberg Energy Subindex Total ReturnSM ETN JJETF 06739H750 / US06739H7504 $7.50 $4.95 27,706 * The Purchase Price for each Series is a set dollar amount and may be lower than the Closing Indicative Note Value of that Series on the Expiration Date. If a Noteholder has already validly tendered and not withdrawn its Notes of an Extended Series pursuant to an Offer set forth in the Initial Statement, such Noteholder is not required to take any further action with respect to such Notes and such tender constitutes a valid tender for purposes of the relevant Offer, as amended hereby. As of 5:00 p.m., New York City time, on April 16, 2025, Noteholders have validly tendered the number of Notes specified in Table 2 above. The Purchase Price is payable on July 2, 2025, unless the relevant Offer is further extended or early terminated by the Issuer. Because the Closing Indicative Note Value for each Series is calculated based on the applicable Closing Index Level, if the applicable Closing Index Level has increased as of the Expiration Date, the Purchase Price of that Series may be significantly less than the Closing Indicative Note Value on the Expiration Date. In addition, the Notes of any Series may trade at a substantial premium to or discount from the applicable Closing Indicative Note Value. Accordingly, the Purchase Price for any Series may be lower than the trading price of the Notes of that Series on the Expiration Date. If on or prior to the Expiration Date, the applicable Closing Index Level with respect to any Series set forth in Table 2 above has increased or decreased from its level on April 16, 2025, the Issuer may amend the Offer and Consent Solicitation with respect to that Series, including by increasing or decreasing the Purchase Price of that Series, or in its sole and absolute discretion, to further extend, withdraw or terminate such Offer or Consent Solicitation. On each Trading Day while an Offer remains open, the Purchase Price for the relevant Series, as well as the Closing Index Level and the Closing Indicative Note Value for that Trading Day for the relevant Series, will be published for that Series by 5:00 p.m., New York City time, at http://ipathetn.barclays/static/tenderoffers.app. In the event that publication of the Closing Index Level for any Series on any Trading Day is delayed, the Issuer will publish such information as soon as practicable following the publication of that Closing Index Level. Subject to applicable law, the Offer and Consent Solicitation for each Series is being made independently of the Offer and Consent Solicitation for each other Series, and the Issuer reserves the right, subject to applicable law, to withdraw or terminate the Offer and Consent Solicitation for any Series if any of the conditions described in the Statement have not been satisfied or waived without also withdrawing or terminating any other Offer or Consent Solicitation. In addition, the Issuer reserves the right, subject to applicable law, to extend or amend the Offer and Consent Solicitation for any Series at any time and for any reason without also extending or amending any other Offer or Consent Solicitation. For Further Information A complete description of the terms and conditions of the Offers is set out in the Statement. Copies of the Statement are available at http://ipathetn.barclays/static/tenderoffers.app. Further details about the transaction can be obtained from: The Dealer Manager Barclays Capital Inc. 745 Seventh Avenue New York, New York 10019, United States Telephone: +1 212-528-7990 Attn: Barclays ETN Desk Email: etndesk@barclays.com The Tender Agent The Bank of New York Mellon 160 Queen Victoria Street London EC4V 4LA United Kingdom Attn: Debt Restructuring Services Telephone: +44 1202 689644 Email: debtrestructuring@bnymellon.com DISCLAIMER This announcement must be read in conjunction with the Statement. No offer or invitation to acquire or exchange any securities is being made pursuant to this announcement. This announcement and the Statement contain important information, which must be read carefully before any decision is made with respect to the Offers and Consent Solicitations. If any Noteholder is in any doubt as to the action it should take, it is recommended to seek its own legal, tax and financial advice, including as to any tax consequences, from its stockbroker, bank manager, lawyer, accountant or other independent financial adviser. Any individual or company whose Notes are held on its behalf by a broker, dealer, bank, custodian, trust company or other nominee must contact such entity if it wishes to participate in an Offer and Consent Solicitation. None of the Issuer, the Dealer Manager or the Tender Agent (or any person who controls, or is a director, officer, employee or agent of such persons, or any affiliate of such persons) makes any recommendation as to whether Noteholders should participate in any Offer and Consent Solicitation. General Neither this announcement, the Statement nor the electronic transmission thereof constitutes an offer to buy or the solicitation of an offer to sell Notes (and tenders of Notes for purchase pursuant to the Offers will not be accepted from Noteholders) in any circumstances in which such Offer or solicitation is unlawful. In those jurisdictions where the Notes, blue sky or other laws require the Offers to be made by a licensed broker or dealer and the Dealer Manager or any of its affiliates is such a licensed broker or dealer in any such jurisdiction, the Offers shall be deemed to be made by such Dealer Manager or such affiliate, as the case may be, on behalf of the Issuer in such jurisdiction. None of the Issuer, the Dealer Manager or the Tender Agent (or any director, officer, employee, agent or affiliate of, any such person) makes any recommendation as to whether Noteholders should tender Notes in the Offers or Consent Solicitations. In addition, each Noteholder participating in an Offer will be deemed to give certain representations in respect of the other jurisdictions referred to below and generally as set out in the Statement under the section entitled "Procedures for Participating in the Offer." Any tender of Notes for purchase pursuant to an Offer from a Noteholder that is unable to make these representations will not be accepted. About Barclays Barclays is a British universal bank. We are diversified by business, by different types of customers and clients, and by geography. Our businesses include consumer banking and payments operations around the world, as well as a full-service corporate and investment bank. For further information about Barclays, please visit our website www.barclays.com. Selected Risk Considerations An investment in the ETNs described herein involves risks. Selected risks are summarized here, but we urge you to read the more detailed explanation of risks described under "Risk Factors" in the applicable prospectus supplement and pricing supplement. You May Lose Some or All of Your Principal: The ETNs are exposed to any change in the level of the underlying index (the "index") between the inception date and the applicable valuation date. Additionally, if the level of the index is insufficient to offset the negative effect of the investor fee and other applicable costs, you will lose some or all of your investment at maturity or upon redemption, even if the level of such index has increased or decreased, as the case may be. The ETNs are riskier than ordinary unsecured debt securities and have no principal protection. Credit of Barclays Bank PLC: The ETNs are unsecured debt obligations of Barclays Bank PLC and are not, either directly or indirectly, an obligation of or guaranteed by any third party. Any payment to be made on the ETNs, including any payment at maturity or upon redemption, depends on the ability of Barclays Bank PLC to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of Barclays Bank PLC will affect the market value, if any, of the ETNs prior to maturity or redemption. In addition, if Barclays Bank PLC were to default on its obligations, you may not receive any amounts owed to you under the terms of the ETNs. Market and Volatility Risk: The market value of the ETNs may be influenced by many unpredictable factors and may fluctuate between the date you purchase them and the maturity date or redemption date. You may also sustain a significant loss if you sell your ETNs in the secondary market. Factors that may influence the market value of the ETNs include prevailing market prices of the commodity markets, the U.S. stock markets or the U.S. Treasury market, the index components included in the underlying index, and prevailing market prices of options on such index or any other financial instruments related to such index; and supply and demand for the ETNs, including economic, financial, political, regulatory, geographical or judicial events that affect the level of such index or other financial instruments related to such index. Concentration Risk: Because the ETNs are linked to an index composed of futures contracts on a single commodity or in only one commodity sector, the ETNs are less diversified than other exchange traded notes or funds. The ETNs can therefore experience greater volatility than other exchange traded notes, funds or investments. A Trading Market for the ETNs May Not Develop: The ETNs are not listed on any securities exchange. A trading market for the ETNs may not develop and the liquidity of the ETNs may be limited. No Interest Payments from the ETNs: You may not receive any interest payments on the ETNs. Uncertain Tax Treatment: Significant aspects of the tax treatment of the ETNs are uncertain. You should consult your own tax advisor about your own tax situation. The ETNs may be sold throughout the day through certain brokerage accounts. Commissions may apply and there are tax consequences in the event of sale, redemption or maturity of ETNs. Sales in the secondary market may result in significant losses. © 2025 Barclays Bank PLC. All rights reserved. iPath, iPath ETNs and the iPath logo are registered trademarks of Barclays Bank PLC. All other trademarks, servicemarks or registered trademarks are the property, and used with the permission, of their respective owners. NOT FDIC INSURED · NO BANK GUARANTEE · MAY LOSE VALUE View source version on businesswire.com: https://www.businesswire.com/news/home/20250416419010/en/ Contacts Press Contact: Ann Thielke +1 212 526 1472 Ann.Thielke@barclays.com View Comments |

||

| 16.04.25 21:19:34 | Is Barclays PLC (BCS) The Dirt Cheap Stock To Invest In Now? |  |

| We recently published a list of 10 Dirt Cheap Stocks To Invest In Now. In this article, we are going to take a look at where Barclays PLC (NYSE:BCS) stands against other dirt cheap stocks to invest in now. Investor’s Guide to Navigating the Volatilitc The stock market has been experiencing volatility and has quickly shifted from the post-election highs to being priced for recession. As of April 8, the S&P 500 had declined 19% from the all-time highs. The magnitude of this fall is slightly shy of the bear market threshold, thereby creating a sense of confusion for the investors to pave their way forward. To talk about the investment strategy during times of volatility, Prime Capital Financial CIO Will McGough joined Yahoo Finance on April 11 for an interview. McGough noted that they have been telling their clients and advisors to prepare for the volatility before the start of 2025. This is partly due to the new regime in Washington DC and its policies. However, more importantly, the market has had two really great years with more than 20% gains back to back, as a result, the price-to-earnings ratios were extended to historical extremes and earnings growth was delivering around 15% to 20%. These figures suggested that the market was almost at its peak with very little upside potential left to explore, which pointed towards risks of volatility. McGough presented his investment strategy during this time of volatility. He highlighted that they have been advising investors to look for diversity and increased exposure, which essentially means to be cognizant of the exposure your portfolio has in terms of growth and value stocks. He noted that if you have the “Mag Seven” in your portfolio, they are concentrated and are categorized as large-cap growth, which suggests that the portfolio should be balanced with value and dividend-paying stocks as well. McGough noted that this helps temper the volatility and provides some stability. He also highlighted that after 15 years the market is finally moving away from the Mag Seven and in this scenario, the investors simply need to look for Market Weight stocks rather than Overweight. Another area for investors to look at is the international market. McGough pointed out that for a greater chunk of recent history, the United States market has dominated international stocks, however, the current market tightening and Trump administration policies are encouraging international stocks to increase spending and promote revenue growth. Therefore this can be a good time for investors to look ahead of the United States market into international stocks such as those based in Europe and Germany. McGough concluded that all of the market situation points towards a single mantra of being diversified rather than placing all the eggs in a single basket. Story Continues Our Methodology To compile the list of 10 dirt cheap stocks to invest in now, we used the Finviz stock screener, Seeking Alpha, and Yahoo Finance. Using the screener we first aggregated a list of stocks trading below the Forward P/E of less than 10 with earnings expected to grow during the year. After sorting the list by market capitalization, we cross-checked each stock’s P/E and earnings growth from Seeking Alpha and Yahoo Finance, respectively. Lastly, we ranked the stocks in ascending order of the number of hedge fund holders, sourced from Insider Monkey’s database. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).Is Barclays PLC (BCS) The Dirt Cheap Stock To Invest In Now? An investor looking at a stock chart, representing the bank's securities dealing. Barclays PLC (NYSE:BCS) Forward P/E Ratio: 6.18 Earnings Growth This Year: 29.05% Number of Hedge Fund Holders: 25 Barclays PLC (NYSE:BCS) is a Britain-based international financial services company that provides various banking services. The company operates through five key divisions including Barclays UK, UK Corporate Bank, Private and Wealth Management, Investment Bank, and US Consumer Bank. It has operations in over 40 countries around the globe. On April 7, J.P. Morgan analyst Kian Abouhossein maintained a Buy rating on the stock. The bank has been focused on executing its three-year strategic plan, which led to improved financial results in fiscal 2024. During the year, Barclays PLC (NYSE:BCS) delivered a Return on Tangible Equity of 10.5% which exceeded the target of 10%. In addition, profitability before tax increased by 24% year-over-year to £8.1 billion, reflecting strong operational and financial improvements. Moreover, Ariel Global Fund in its Q4 2024 investor letter stated that they expect Barclays PLC (NYSE:BCS) to benefit from the global capital market recovery. The fund expects the bank to pursue its target of distributing £3 billion as dividends and £10 billion as share repurchases to shareholders. It is one of the dirt-cheap stocks to invest in now. Ariel Global Fund stated the following regarding Barclays PLC (NYSE:BCS) in its Q4 2024 investor letter: “We bought global bank and financial services provider, Barclays PLC (NYSE:BCS). We expect shares to benefit from a recovery in global capital markets and net interest income (NII) growth driven by macroeconomic hedging and asset flows. The bank is also planning to expand its investment banking advisory business. Moreover, its U.S. credit card business presents opportunities for either a potential sale or a quicker earnings recovery. Taken together, we see a reasonable path for Barclays to pursue its return targets, which include the distribution of £3 billion and £10 billion to shareholders through dividends and share repurchases between 2024 and 2026 and achieving a return on tangible common equity of about 12%.” Overall, BCS ranks 10th on our list of dirt cheap stocks to invest in now. While we acknowledge the potential of BCS to grow, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. There is an AI stock that went up since the beginning of 2025, while popular AI stocks lost around 25%. If you are looking for an AI stock that is more promising than BCS but that trades at less than 5 times its earnings, check out our report about this cheapest AI stock. READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires. Disclosure: None. This article is originally published at Insider Monkey. View Comments |

||

| 16.04.25 20:56:43 | Barclays Flags Medtronic, J&J as Most at Risk from Looming Pharma Tariffs |  |

| Barclays analysts say upcoming global tariffs on pharmaceutical goods, expected to be imposed soon by President Donald Trump, will have varying impacts across the MedTech space. In a new report, the firm outlined which companies appear most and least exposed to the potential trade changes. Warning! GuruFocus has detected 1 Warning Sign with MSFT. Among large-cap firms, Abbott (NYSE:ABT), Baxter (NYSE:BAX), Edwards Lifesciences (NYSE:EW), and Intuitive Surgical (NASDAQ:ISRG) all rated Overweight are expected to be among the least affected. Zimmer Biomet (NYSE:ZBH), rated Underweight, is also seen as having limited exposure. In the small- and mid-cap group, Barclays highlighted Globus Medical (NYSE:GMED), Alphatec (NASDAQ:ATEC), and Tandem Diabetes Care (NASDAQ:TNDM) as relatively insulated from tariff risk, citing limited reliance on overseas manufacturing for U.S.-bound products. On the other hand, companies more exposed include Medtronic (NYSE:MDT), Johnson & Johnson (NYSE:JNJ), and BD (NYSE:BDX) all rated Overweight along with Insulet (NASDAQ:PODD), InMode (NASDAQ:INMD), and Bausch + Lomb (NYSE:BLCO), which are rated Equal-Weight. These firms are more reliant on global production chains, potentially amplifying the impact of future trade restrictions. Barclays suggests that tariff exposure could become a differentiating factor in the sector, as the policy takes shape. This article first appeared on GuruFocus. View Comments |

||