Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

The Berkeley Group Holdings plc |

06.03.25 |

28.03.25 |

0.0033 |

The Berkeley Group Holdings plc |

09.09.24 |

20.09.24 |

1.7400 |

The Berkeley Group Holdings plc |

27.06.24 |

26.07.24 |

0.3300 |

The Berkeley Group Holdings plc |

07.03.24 |

28.03.24 |

0.3300 |

The Berkeley Group Holdings plc |

17.08.23 |

08.09.23 |

0.5930 |

The Berkeley Group Holdings plc |

02.03.23 |

24.03.23 |

0.6944 |

The Berkeley Group Holdings plc |

18.08.22 |

09.09.22 |

0.2125 |

The Berkeley Group Holdings plc |

06.09.21 |

17.09.21 |

3.7100 |

The Berkeley Group Holdings plc |

04.03.21 |

19.03.21 |

0.0913 |

The Berkeley Group Holdings plc |

20.08.20 |

11.09.20 |

1.0700 |

The Berkeley Group Holdings plc |

19.03.20 |

31.03.20 |

0.9932 |

The Berkeley Group Holdings plc |

22.08.19 |

13.09.19 |

0.2008 |

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 16.04.25 10:35:40 | Average London rent soars to £2,243 per month |  |

| The average UK monthly private rent rose to £1,332 in the 12 months to March, but in London tenants are paying on average £2,243, the highest in the country. Figures released by the Office for National Statistics (ONS) showed monthly rents in the private sector rose 7.7% to £1,332 over the 12-month period. This marks a modest slowdown from February’s annual growth rate of 8.1% and a further retreat from the 9.2% peak recorded in November. London remained the most expensive region for renters, with monthly rents reaching £2,243 —the highest in the UK. At the opposite end of the scale, the North East recorded the lowest average rent, at £725. The disparity was even more pronounced at the local authority level: in March, tenants in Kensington and Chelsea paid an average of £3,639 per month, while those in Dumfries and Galloway paid just £528. England saw average rents rise to £1,386 in March, a 7.8% annual increase — or £101 more than the previous year. Though still high, this marks a slowdown from the 8.3% rise in February. Regional differences were stark. The North East posted the fastest rental growth in England, with a 9.4% year-on-year increase, while Yorkshire and the Humber saw the slowest growth at 4.6%. Read more: The UK regions where houses sell the fastest In Wales, average rents climbed 8.9% to £792 — surpassing the 8.5% growth rate of the previous period but below the 9.9% high of November 2023. Scotland’s rental growth was more subdued, rising 5.7% to an average of £1,001. Northern Ireland recorded an 8.2% increase in January, bringing average rents to £838, slightly higher than the 8.1% rise in December 2024 but below the 9.9% peak in April last year. Outside the capital, the highest local average rent in March was in Elmbridge, South East England, at £1,893. Alex Upton, managing director of specialist mortgages at Hampshire Trust Bank, said: “The rental market remains under significant pressure, with demand continuing to outstrip supply. Letting agents are managing multiple applicants for every available property. “While stock levels have seen some movement, competition remains fierce. Until that imbalance shifts, rental prices will continue to rise.” Rents also varied significantly by property type and size. Detached homes attracted the highest average monthly rent at £1,522, while flats and maisonettes were the most affordable, at £1,306. Properties with four or more bedrooms commanded the highest rents overall at £1,996, compared with £1,079 for one-bedroom homes. Tom Bill, the head of UK residential research at Knight Frank, said: “Upwards pressure on rents is likely to intensify as landlords leave the sector due to tougher green regulations, higher mortgage costs and the impact of the Renters' Rights Bill, which makes it harder to regain possession of a property. Story Continues “Nobody would argue against protecting tenants from unscrupulous landlords, but the new legislation could be a lesson in the laws of unintended consequences.” The persistent rise in rental prices compounds tenants' affordability pressures as house prices continue to climb in parallel. The average UK house price increased by 5.4% in the year to February, with the annual growth rate rising from 4.8% in the year to January. Read more: Home renovation mistakes and how to avoid them Karen Noye, mortgage expert at Quilter, said: “First-time buyers paid an average of £227,000 last month, up 5.6% annually, while former owner-occupiers paid just under £330,000. That widening gap reinforces the affordability challenge facing those trying to step onto the ladder. "Meanwhile, the sharp 28.7% annual surge in new build prices, compared to just 3.2% for existing homes, risks compounding that issue, particularly if developers focus on premium stock that pushes buyers towards increasingly stretched borrowing. “Still, activity is picking up, with residential transactions up 28% year-on-year. Lenders are starting to respond, with mortgage rates edging down as financial markets anticipate further interest rate cuts." Average house prices increased to £292,000 in England (5.3% annual growth rate), £207,000 in Wales (4.1%), and £186,000 in Scotland (5.7%) over the 12 months to February. Separate data from estate agent Foxtons revealed that March saw a 14% increase in new rental listings across London compared to February. Applicant registrations rose by 11% month-on-month in March. Year on year, demand was stable, tracking just 2% below March 2024 levels The average rent in March stood at £565 per week, reflecting a 2% increase year on year. Gareth Atkins, managing director of Lettings, said: "The London lettings market is gaining momentum as we enter April, with March delivering a 14% surge in new listings – the largest uplift so far this year. Simultaneously, applicant registrations climbed 11%, reflecting strong seasonal interest and sustained confidence among renters. "With more choice coming to the market, renters are well-positioned this spring. At the same time, the steady flow of listings is helping to keep conditions balanced across much of the capital, creating a more stable and competitive environment for everyone navigating the market.” Download the Yahoo Finance app, available for Apple and Android. View Comments |

||

| 07.04.25 11:44:45 | Capital Allocation Trends At Berkeley Group Holdings (LON:BKG) Aren't Ideal |  |

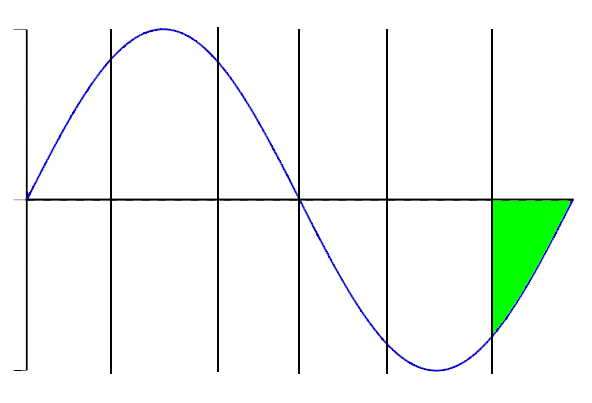

| If you're looking for a multi-bagger, there's a few things to keep an eye out for. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating Berkeley Group Holdings (LON:BKG), we don't think it's current trends fit the mold of a multi-bagger. AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early. Return On Capital Employed (ROCE): What Is It? Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Berkeley Group Holdings: Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities) 0.10 = UK£506m ÷ (UK£6.8b - UK£1.9b) (Based on the trailing twelve months to October 2024). So, Berkeley Group Holdings has an ROCE of 10%. In absolute terms, that's a satisfactory return, but compared to the Consumer Durables industry average of 8.3% it's much better. See our latest analysis for Berkeley Group Holdings LSE:BKG Return on Capital Employed April 7th 2025 Above you can see how the current ROCE for Berkeley Group Holdings compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Berkeley Group Holdings for free. The Trend Of ROCE On the surface, the trend of ROCE at Berkeley Group Holdings doesn't inspire confidence. Around five years ago the returns on capital were 18%, but since then they've fallen to 10%. Meanwhile, the business is utilizing more capital but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line. The Key Takeaway In summary, Berkeley Group Holdings is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. Additionally, the stock's total return to shareholders over the last five years has been flat, which isn't too surprising. All in all, the inherent trends aren't typical of multi-baggers, so if that's what you're after, we think you might have more luck elsewhere. Story Continues If you want to continue researching Berkeley Group Holdings, you might be interested to know about the 1 warning sign that our analysis has discovered. If you want to search for solid companies with great earnings, check out this freelist of companies with good balance sheets and impressive returns on equity. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 14.03.25 09:52:07 | Berkeley shares rise on reaffirmed long-term guidance |  |

| Investing.com -- Shares of Berkeley Group Holdings PLC (LON:BKGH) climbed 1.97% on Friday as the company reaffirmed its profit before tax (PBT) guidance for fiscal years 2025 and 2026, with expectations to deliver at least £975 million across the two years. This confidence comes despite a slight downward revision in the anticipated net cash position for April 2025, which is now expected to be around £300 million, a bit lower than the £350 million previously estimated. The uptick in Berkeley's stock follows the announcement that the company has made significant progress on 10 long-term regeneration sites and is in the process of finalizing Section 106 agreements and clearing conditions to implement these plans. Although the company has expressed concerns over the pace of regulatory changes, the management's ability to navigate this challenging environment has been noted. Barclays (LON:BARC) analysts have observed a modest improvement in sales reservations since the interim results were reported in early December, with sales rates surpassing those from the same period last year. "The group has seen the modest improvement in sales reservations that it noted at the time of the interim results in early December continue since then. Sales rates are ahead of those achieved during the same period last year," the analysts said in a note. Investors appear to be reassured by the company's steady performance and its proactive measures to accelerate shareholder returns, which have included £71.3 million in share buy-backs, purchasing 1.9 million shares at an average price of £37.92 each. Related Articles Berkeley shares rise on reaffirmed long-term guidance Kering shares plunge after it picks in-house designer for key Gucci brand Shares set for weekly drop, gold hits record high as tariffs risks lurk View Comments |

||

| 14.03.25 09:50:50 | Trending tickers: Ulta Beauty, Docusign, Rubrik, Tesla and Berkeley |  |

| Ulta Beauty (ULTA) Ulta Beauty’s (ULTA) shares surged by almost 7% in pre-market trading, following the beauty retailer’s strong performance in its fourth-quarter earnings, which exceeded expectations for both sales and profit. The results point to a solid holiday season as consumers flocked to Ulta’s stores for everything from cosmetics to perfumes. NasdaqGS - Delayed Quote•USD (ULTA) Follow View Quote Details 314.47 - (-4.48%) At close: March 13 at 4:00:01 PM EDT Advanced Chart While Ulta's (ULTA) fourth-quarter net sales saw a modest decline of 1.9%, totalling $3.49bn (£2.7bn), the figure surpassed analysts' expectations of $3.46bn. Additionally, the beauty giant posted a profit of $8.46 per share for the quarter ended 1 February, comfortably outpacing the anticipated $7.12 per share. The retailer’s strong holiday performance was partly driven by discounts offered during the Thanksgiving period, aimed at attracting shoppers eager to spend during the season. However, despite the upbeat results, Ulta (ULTA) issued a cautious outlook for the upcoming year, citing a combination of internal challenges, intensifying competition, and "consumer uncertainty." The company, which appointed Kecia Steelman as its new CEO in January, warned that it expects comparable sales in 2025 to remain flat or grow by just 1%, a slowdown compared to analyst expectations of a 1.2% increase. Read more: FTSE 100 LIVE: Stocks push higher and pound dips as UK economy unexpectedly shrinks 0.1% “I’ve shared our plan to make important guest-facing investments, which are necessary to improve our competitiveness and re-accelerate long term share growth,” said Steelman on a call with analysts. “These investments will pressure profitability in 2025 but we believe they are critical to driving long-term sustainable growth in a competitive, innovative category.” Ulta (ULTA) also lowered its full-year earnings guidance to a range of $22.50 to $22.90 per share, falling short of analysts’ forecast of $23.47, according to data from LSEG (LSEG.L). Docusign (DOCU) Shares in DocuSign Inc. (DOCU) rose by more than 10% in pre-market trading after the electronic signature company reported strong earnings and revenue for the fourth quarter of fiscal year 2025. NasdaqGS - Delayed Quote•USD (DOCU) Follow View Quote Details 74.70 - (-6.78%) At close: March 13 at 4:00:01 PM EDT Advanced Chart For the quarter ending January 31, DocuSign (DOCU) posted adjusted earnings of $0.86 per share, up from $0.76 per share in the same period a year ago. Revenue for the quarter reached $776.3m, marking a 9% year-over-year increase. Both figures exceeded analyst expectations, which had forecast earnings of 84 cents per share and revenue of $760.99m. Subscription revenue for the quarter grew by 9%, reaching $757.8m, while professional services and other revenue rose 11%, totalling $18.5m. Billings in the quarter also saw an 11% year-over-year increase, amounting to $932.2m. Story Continues Free cash flow for the quarter stood at $279.6m, an increase from $248.6m in the same period in fiscal year 2024. DocuSign (DOCU) closed the quarter with $1.1bn in cash, cash equivalents, restricted cash and investments. Key business developments in the quarter included the launch of updates to Web Forms in October, which introduced document exclusion rules and multi-recipient form support to streamline data collection. In November, DocuSign (DOCU) unveiled DocuSign for Developers, a tool allowing partners to build integrations and automate workflows using a robust set of application programming interfaces and software development kits. For the full fiscal year 2025, DocuSign (DOCU) reported adjusted earnings per share of $3.55, up from $2.98 in 2024, with total revenue reaching $2.98bn, an 8% increase compared to the previous year. Looking ahead, for the first quarter of fiscal 2026, the company expects revenue to range from $745m to $749m. For the full year, the company anticipates revenue between $3.129bn and $3.141bn. Rubrik (RBRK) Shares of Rubrik (RBRK) surged by 20% in pre-market trading on Friday following the cybersecurity company’s fourth-quarter earnings report and upbeat guidance for the coming year. NYSE - Delayed Quote•USD (RBRK) Follow View Quote Details 55.28 - (-3.20%) At close: March 13 at 4:00:02 PM EDT Advanced Chart For the period ending January 31, Rubrik (RBRK) reported an adjusted loss of $0.18 per share, while revenue surged 47% year-over-year to $258.1m. This included $243.7m from subscription revenue and $3.38m from its maintenance segment. Rubrik (RBRK) also saw growth in its customer base, ending the quarter with 2,246 customers who spent $100,000 or more in annual recurring revenue. Analysts had expected a larger adjusted loss of $0.39 per share on $233.2m in revenue. “Fiscal 2025 was a milestone year for Rubrik,” said Bipul Sinha, Rubrik’s (RBRK) chief executive officer. “Our strong growth at scale demonstrates that we’re winning the cyber resilience market. However, we are still very early in Rubrik’s journey to achieve the company’s full potential and I’m confident that what's ahead of us is even more important and exciting.” Read more:UK economy shrinks in January in further setback for Rachel Reeves Looking ahead, Rubrik (RBRK) expects an adjusted loss between $0.31 and $0.32 per share for the first quarter of fiscal 2026, with revenue forecasted between $259m and $261m. Analysts had anticipated a larger adjusted loss of $0.50 per share and revenue of $243.3m. For the full fiscal year, Rubrik (RBRK) forecasts revenue between $1.15bn and $1.16bn, exceeding the analyst estimate of $1.11bn. The company expects an adjusted loss of between $1.13 and $1.23 per share, a smaller loss than the anticipated $1.25 per share. Subscription annual recurring revenue for fiscal 2026 is projected to be between $1.35bn and $1.36bn, with free cash flow expected to range from $45m to $65m. Tesla (TSLA) Tesla's (TSLA) shares rebounded by 1.4% in pre-market trading, recovering some of the losses from the previous session, where the stock dropped nearly 3%. The electric vehicle maker issued a warning that president Donald Trump’s trade policies could negatively impact its business, despite CEO Elon Musk being a close ally of the president. NasdaqGS - Delayed Quote•USD (TSLA) Follow View Quote Details 240.68 - (-2.99%) At close: March 13 at 4:00:00 PM EDT Advanced Chart Tesla (TSLA) said it is important to ensure that the Trump administration's efforts to address trade issues "do not inadvertently harm US companies". It added it is eager to avoid retaliation of the type it faced in prior trade disputes, which resulted in increased tariffs on electric vehicles imported into countries subject to US tariffs. "US exporters are inherently exposed to disproportionate impacts when other countries respond to US trade actions," Tesla (TSLA) said in the letter. "For example, past trade actions by the United States have resulted in immediate reactions by the targeted countries, including increased tariffs on EVs imported into those countries." The letter, which was unsigned but printed on Tesla’s (TSLA) company letterhead, did not specify the author within the company. Berkeley (BKG.L) Shares in Berkeley Group (BKG.L) were higher as the UK housebuilder reaffirmed its earnings guidance, but warned that planned government regulatory changes are placing “significant” pressure on the delivery of new homes. The government is set to introduce the building safety levy, which will require developers to contribute to the costs of addressing historic building safety defects, including unsafe fire cladding, in an effort to protect leaseholders and taxpayers from bearing the financial burden. “Berkeley (BKG.L) remains concerned by the impact of the extent and pace of regulatory changes of recent years, as we now await details of the new building safety levy,” the company said in a trading statement on Friday. Despite this, the FTSE 100 (^FTSE) company reported that sales enquiries remained at a “consistently good level,” with a modest improvement in reservations continuing through the four months to February 28. However, the company cautioned that a full recovery in sales rates, bringing them closer to levels seen three years ago, would require greater confidence in the trajectory of interest rate reductions and broader economic stability. Berkeley (BKG.L) maintained its earnings forecast for the year ending 30 April at £525m, with a forecast of £450m for the following year. Other companies in the news on Friday 14 March Allianz (ALVD.XC) Bodycote (BOY.L) Vanquis Banking (VANQ.L) AIA (1299.HK) Hon Hai Precision 2317 (2317.TW) BMW (BMW.DE) Daimler Truck (DTG.DE) Download the Yahoo Finance app, available for Apple and Android. View Comments |

||

| 02.03.25 07:33:17 | Berkeley Group Holdings (LON:BKG) Will Pay A Dividend Of £0.33 |  |

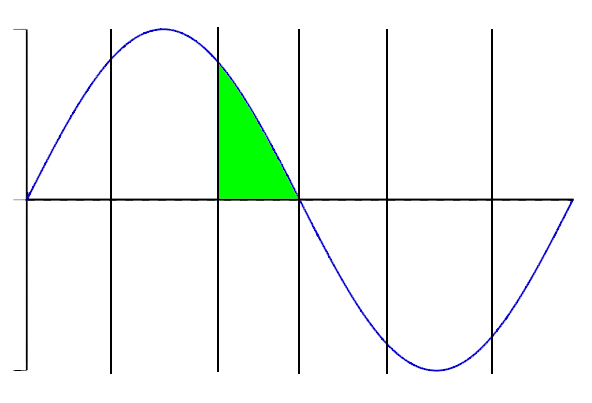

| The board of The Berkeley Group Holdings plc (LON:BKG) has announced that it will pay a dividend of £0.33 per share on the 28th of March. Including this payment, the dividend yield on the stock will be 1.8%, which is a modest boost for shareholders' returns. Check out our latest analysis for Berkeley Group Holdings Berkeley Group Holdings' Future Dividend Projections Appear Well Covered By Earnings It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. However, Berkeley Group Holdings' earnings easily cover the dividend. This means that most of its earnings are being retained to grow the business. Looking forward, earnings per share is forecast to fall by 11.8% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 63%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.LSE:BKG Historic Dividend March 2nd 2025 Dividend Volatility Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was £2.02 in 2015, and the most recent fiscal year payment was £0.66. The dividend has fallen 67% over that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges. The Dividend's Growth Prospects Are Limited Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. In the last five years, Berkeley Group Holdings' earnings per share has shrunk at approximately 3.8% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. Our Thoughts On Berkeley Group Holdings' Dividend In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Berkeley Group Holdings' payments, as there could be some issues with sustaining them into the future. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think Berkeley Group Holdings is a great stock to add to your portfolio if income is your focus. Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Berkeley Group Holdings that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 17.02.25 08:52:10 | Investors in Berkeley Group Holdings (LON:BKG) have unfortunately lost 21% over the last five years |  |

| In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term The Berkeley Group Holdings plc (LON:BKG) shareholders for doubting their decision to hold, with the stock down 36% over a half decade. The falls have accelerated recently, with the share price down 14% in the last three months. Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business. Check out our latest analysis for Berkeley Group Holdings In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time. During the five years over which the share price declined, Berkeley Group Holdings' earnings per share (EPS) dropped by 3.9% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 9% per year, over the period. So it seems the market was too confident about the business, in the past. The low P/E ratio of 9.91 further reflects this reticence. The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).LSE:BKG Earnings Per Share Growth February 17th 2025 It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free interactive report on Berkeley Group Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further. What About Dividends? It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Berkeley Group Holdings' TSR for the last 5 years was -21%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return. A Different Perspective Investors in Berkeley Group Holdings had a tough year, with a total loss of 20% (including dividends), against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 4% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Berkeley Group Holdings you should know about. Story Continues There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this freelist of undervalued small cap companies that insiders are buying. Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 31.01.25 09:36:58 | A Look At The Fair Value Of The Berkeley Group Holdings plc (LON:BKG) |  |

| Key Insights Using the 2 Stage Free Cash Flow to Equity, Berkeley Group Holdings fair value estimate is UK£39.70 Berkeley Group Holdings' UK£38.82 share price indicates it is trading at similar levels as its fair value estimate Our fair value estimate is 14% lower than Berkeley Group Holdings' analyst price target of UK£46.15 Does the January share price for The Berkeley Group Holdings plc (LON:BKG) reflect what it's really worth? Today, we will estimate the stock's intrinsic value by taking the forecast future cash flows of the company and discounting them back to today's value. Our analysis will employ the Discounted Cash Flow (DCF) model. There's really not all that much to it, even though it might appear quite complex. Companies can be valued in a lot of ways, so we would point out that a DCF is not perfect for every situation. Anyone interested in learning a bit more about intrinsic value should have a read of the Simply Wall St analysis model. View our latest analysis for Berkeley Group Holdings The Model We use what is known as a 2-stage model, which simply means we have two different periods of growth rates for the company's cash flows. Generally the first stage is higher growth, and the second stage is a lower growth phase. To start off with, we need to estimate the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years. Generally we assume that a dollar today is more valuable than a dollar in the future, and so the sum of these future cash flows is then discounted to today's value: 10-year free cash flow (FCF) forecast 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Levered FCF (£, Millions) UK£190.7m UK£221.3m UK£231.4m UK£259.3m UK£278.2m UK£294.3m UK£308.0m UK£320.0m UK£330.7m UK£340.6m Growth Rate Estimate Source Analyst x8 Analyst x8 Analyst x7 Analyst x2 Est @ 7.32% Est @ 5.76% Est @ 4.66% Est @ 3.90% Est @ 3.36% Est @ 2.99% Present Value (£, Millions) Discounted @ 8.7% UK£175 UK£187 UK£180 UK£185 UK£183 UK£178 UK£171 UK£164 UK£156 UK£147 ("Est" = FCF growth rate estimated by Simply Wall St) Present Value of 10-year Cash Flow (PVCF) = UK£1.7b Story Continues The second stage is also known as Terminal Value, this is the business's cash flow after the first stage. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (2.1%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 8.7%. Terminal Value (TV)= FCF2034 × (1 + g) ÷ (r – g) = UK£341m× (1 + 2.1%) ÷ (8.7%– 2.1%) = UK£5.3b Present Value of Terminal Value (PVTV)= TV / (1 + r)10= UK£5.3b÷ ( 1 + 8.7%)10= UK£2.3b The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is UK£4.0b. To get the intrinsic value per share, we divide this by the total number of shares outstanding. Relative to the current share price of UK£38.8, the company appears about fair value at a 2.2% discount to where the stock price trades currently. The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent.LSE:BKG Discounted Cash Flow January 31st 2025 Important Assumptions The calculation above is very dependent on two assumptions. The first is the discount rate and the other is the cash flows. If you don't agree with these result, have a go at the calculation yourself and play with the assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Berkeley Group Holdings as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 8.7%, which is based on a levered beta of 1.365. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business. SWOT Analysis for Berkeley Group Holdings Strength Debt is not viewed as a risk. Dividends are covered by earnings and cash flows. Weakness Earnings declined over the past year. Dividend is low compared to the top 25% of dividend payers in the Consumer Durables market. Opportunity Good value based on P/E ratio and estimated fair value. Significant insider buying over the past 3 months. Threat Annual earnings are forecast to decline for the next 3 years. Looking Ahead: Although the valuation of a company is important, it shouldn't be the only metric you look at when researching a company. DCF models are not the be-all and end-all of investment valuation. Rather it should be seen as a guide to "what assumptions need to be true for this stock to be under/overvalued?" For instance, if the terminal value growth rate is adjusted slightly, it can dramatically alter the overall result. For Berkeley Group Holdings, we've put together three important items you should look at: Risks: For example, we've discovered 1 warning sign for Berkeley Group Holdings that you should be aware of before investing here. Future Earnings: How does BKG's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart. Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing! PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the LSE every day. If you want to find the calculation for other stocks just search here. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 31.01.25 07:36:55 | UK house prices barely rise in January amid high borrowing costs |  |

| January’s house price growth in the UK slowed more than expected, rising by just 0.1% month-on-month to £268,213, following a 0.7% gain in December. The surprise slowdown suggests potential impact of high borrowing costs on the housing market amid record mortgage rates. According to Nationwide, house prices are still up 4.1% compared to the same time last year, but the annual growth rate has slow downed from 4.7% in December. The latest data suggests that the UK property market may be losing some of its previous momentum, as borrowing remains expensive and the cost of living crisis continues to affect many buyers. Robert Gardner, Nationwide’s chief economist, said that while there has been a modest improvement in affordability over the past year, the situation remains difficult by historical standards. “A prospective buyer earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 36% of their take-home pay – well above the long-run average of 30%,” he explained. Read more: The cheapest and most expensive places to rent in Britain House prices are still high relative to average earnings. The first-time buyer house price to earnings ratio stood at 5.0 at the end of 2024, significantly higher than the long-term average of 3.9. This has made it challenging for many to save for a deposit, with the burden worsened by the record rise in rents in recent years. The cost of living crisis has further eroded the ability of renters to save for a home. Sarah Coles, Yahoo Finance UK columnist and head of personal finance at Hargreaves Lansdown said: “Prices are still under pressure from buyers trying to clamber through the stamp duty holiday window, before it slams shut at the end of March.” “Given these hurdles, it is not surprising that a significant proportion of first-time buyers are relying on financial assistance from family or friends,” Gardner added. “In 2023/24, around 40% of first-time buyers had some form of deposit help, whether through a gift, loan or inheritance.” Despite these pressures, the rate of homeownership has remained largely stable in recent years. Nationwide's analysis cites data from the latest English Housing Survey, which shows the homeownership rate at 65% in 2024, unchanged from the previous year. Also, the proportion of people owning their homes with a mortgage has edged up, though the majority (around 55%) own outright. This reflects shifting demographic trends, particularly among older households. Gardner pointed out that while homeownership among younger age groups remains below 2004 levels, there has been some improvement. For instance, the homeownership rate for those aged 25-34 has gradually risen from 36% in 2014 to 45% in 2024, though still far below the 59% peak seen in 2004. Story Continues Nationwide warned that the housing market in the UK is facing mounting affordability challenges, which, combined with rising borrowing costs, could lead to a further slowdown in price growth. Read more:UK mortgage approvals up in December ahead of stamp duty increase Alice Haine, personal finance expert at Bestinvest, said: “While the start to 2025 is slightly more muted than the previous month, demand remains robust, something likely to continue over the next couple of months as buyers rush through deals ahead of an increase in stamp duty land tax from the start of April. "The government’s decision not to extend the current relief on stamp duty thresholds beyond the end of March is likely to be a motivating factor for many first-time buyers." Read more: Best UK mortgage deals of the week Karen Noye, mortgage expert at Quilter, commented: “For those thinking about moving, 2025 is a good time to reassess plans. While the signs of market stabilisation are encouraging, there’s still some uncertainty, and careful financial planning will be key to navigating what could be a tricky year.” Nathan Emerson, chief executive of property professionals’ body Propertymark, said: “Currently, it’s likely a lot of movement in the market is due to people wanting to push through with their purchases and sales before the stamp duty rises in England and Northern Ireland in April.” From April 1, the “nil rate” stamp duty band for first-time buyers in England and Northern Ireland will reduce from £425,000 to £300,000. Download the Yahoo Finance app, available for Apple and Android. View Comments |

||

| 04.01.25 09:19:36 | The Berkeley Group Holdings plc's (LON:BKG) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong? |  |

| Berkeley Group Holdings (LON:BKG) has had a rough three months with its share price down 19%. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Particularly, we will be paying attention to Berkeley Group Holdings' ROE today. Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity. View our latest analysis for Berkeley Group Holdings How Is ROE Calculated? Return on equity can be calculated by using the formula: Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity So, based on the above formula, the ROE for Berkeley Group Holdings is: 11% = UK£382m ÷ UK£3.5b (Based on the trailing twelve months to October 2024). The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each £1 of shareholders' capital it has, the company made £0.11 in profit. Why Is ROE Important For Earnings Growth? We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes. Berkeley Group Holdings' Earnings Growth And 11% ROE At first glance, Berkeley Group Holdings seems to have a decent ROE. On comparing with the average industry ROE of 6.0% the company's ROE looks pretty remarkable. However, we are curious as to how the high returns still resulted in flat growth for Berkeley Group Holdings in the past five years. We reckon that there could be some other factors at play here that's limiting the company's growth. These include low earnings retention or poor allocation of capital. Next, when we compared with the industry, which has shrunk its earnings at a rate of 0.4% in the same 5-year period, we still found Berkeley Group Holdings' performance to be quite bleak, because the company has been shrinking its earnings faster than the industry.LSE:BKG Past Earnings Growth January 4th 2025 Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Berkeley Group Holdings is trading on a high P/E or a low P/E, relative to its industry. Story Continues Is Berkeley Group Holdings Using Its Retained Earnings Effectively? Berkeley Group Holdings' low three-year median payout ratio of 18%, (meaning the company retains82% of profits) should mean that the company is retaining most of its earnings and consequently, should see higher growth than it has reported. Additionally, Berkeley Group Holdings has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company is expected to rise to 60% over the next three years. Accordingly, the expected increase in the payout ratio explains the expected decline in the company's ROE to 8.7%, over the same period. Summary In total, it does look like Berkeley Group Holdings has some positive aspects to its business. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return and is reinvesting ma huge portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that's preventing growth. Additionally, the latest industry analyst forecasts show that analysts expect the company's earnings to continue to shrink in the future. To know more about the company's future earnings growth forecasts take a look at this freereport on analyst forecasts for the company to find out more. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 27.12.24 05:57:57 | Seven of 2024's most expensive properties |  |

| For sale at £175m, this duplex penthouse at One Hyde Park in Knightsbridge is Britain's priciest home. Photo: Sotheby's International Realty/JamesEdition Although Knight Frank reported that global sales of super-prime residential properties – those costing $10m (£8m) or more — slowed down in the third quarter, 2024 has still seen a substantial number of record-breaking deals and listings at the top of the market. These are some of the most interesting. 1. Aston Martin Residences, Miami, Florida, sold for $21m (£16.75m)The striking tower is right on the waterfront. Photo: Aston Martin When the final Sky Penthouse in this 66-storey tower sold in February, it became the most costly property in downtown Miami's history. The 9,573 square-foot branded residence is the last word in luxury, with four bedrooms, seven bathrooms, staff quarters, a gym and an indoor pool, plus a massive outdoor terrace and access to four floors of unrivalled amenities. These include two cinemas, a boxing gym, a playroom, a virtual golf room and a beauty salon. Fortunately there’s a garage and valet parking as the penthouse came with a bespoke Aston Martin (AML.L) DBX supercar. Via David Rocca at The Agency. 2. Domaine de Vignette, St Barthelemy, for sale at $59m (£47.07m)Every day feels like a holiday here. Photo: Christie's International Real Estate Currently the French Caribbean island's priciest listing, this secluded compound perches on a lush hillside overlooking Colombier beach, which can only be reached on foot or by boat. It consists of nine bungalows and lush tropical gardens arranged around a central pool deck, lounge and bar with 180-degree ocean and island views. An extensive multimillion-dollar renovation by award-winning interior designer Rémi Tessier was completed recently. By Sibarth Real Estate, an affiliate of Christie’s International Real Estate. Read more: 8 amazing houses to buy with a £10m+ budget 3. Belgravia, London, sold for £65mThis stucco-fronted townhouse was fully renovated prior to selling. Photo: Zoopla The most expensive abode sold on Zoopla in the past 12 months was this grand period townhouse a stone’s throw from Hyde Park and Harrods. It’s on Grosvenor Crescent, which appears on Lloyds’ list of the UK’s most expensive streets, with an average price of just under £14m. The stucco-fronted property has been renovated to the highest standard and fully interior designed, and has six ensuite bedrooms, elegant reception rooms, a formal dining room, a chef’s kitchen and a spa. 4. Long Island, New York, USA, sold for $88.5m (£70.61m)La Dune sold at auction for substantially less than it was once listed for. Photo: Concierge Auctions/Gavin Zeigler The new owner of this sprawling seaside estate might regard it as something of a bargain as it was once listed for $150m, making it the most expensive property in the Hamptons, the summer playground of Manhattan’s high society. Having gone on and off the market for a number of years, it finally sold at auction in January. La Dune consists of two oceanfront mansions — one built in 1892 and the other in 2001 — along with four acres of landscaped grounds and 400 feet of beach frontage. Story Continues Woody Allen fans will probably recognise it as many scenes in his 1978 film Interiors were shot here. Sold via Concierge Auctions. 5. Aspen, Colorado, USA, sold for $108m (£86.19m)This modern mansion was the first home in Colorado to sell for over $100m. Photo: David O Marlow As the world’s most expensive ski resort, Aspen is no stranger to multi-million dollar properties. Yet it’s likely that quite a few jaws dropped when a 22,400 square foot mansion changed hands in April as it was the first to break the $100m barrier in the entire state of Colorado. Read more: 8 amazing homes designed by esteemed architects Occupying a four-and-a-half acre site close to the slopes of the exclusive Red Mountain neighbourhood, the house has 11 bedrooms, 17 bathrooms and enjoys sweeping views of the surrounding mountains. It’s believed that the purchaser paid cash. Through Riley Warwick of Douglas Elliman Real Estate. 6. San Juan Capistrano, Orange County, California, USA, for sale at $150m (£119.7m)Once complete, this estate could provide several profitable income streams. Photo: Douglas Elliman Despite laying claim to the highest price tag in California, Casa Grande is a work in progress. When complete this 42 acre mixed-use estate will include a 38,000 square foot mansion with all-round ocean, mountain, and sea views, guest and staff accommodation, a barn and stabling for up to 10 horses, all with planning permission in place. Three flats, offices and storage facilities have already been built, and there’s a working avocado farm, a citrus grove and potential to set up a thriving agave business that could produce tequila or mescal. For sale via John Stanaland and David Stoll of Douglas Elliman. 7. One Hyde Park, Knightsbridge, London SW1, for sale at £175mOne Hyde Park offers unparalled luxury, service and security. Photo: Sotheby's International Realty/JamesEdition It’s only fitting that the priciest property currently listed in the UK is in its most exclusive development on the most expensive street. This 10th and 11th floor penthouse is spread over 18,000 square feet, looks out over Hyde Park and boasts a double-height reception room, wraparound terraces, five bedrooms with ensuite marble bathrooms, a cocktail bar, cinema, two studies, a spa and staff suite. One Hyde Park is managed by the Mandarin Oriental Hotel Group and residents can book bespoke services such as a maid and catering. Through Becky Fatemi of Sotheby’s International Realty and JamesEdition. Read more: Rightmove's most viewed homes, from £45m mansion to Juergen Klopp's house What will the UK housing market look like in 2025? The features that make properties desirable, according to buyers Download the Yahoo Finance app, available for Apple and Android. View Comments |

||