Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

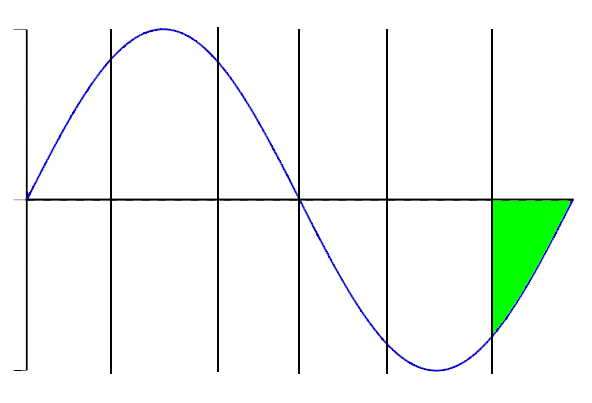

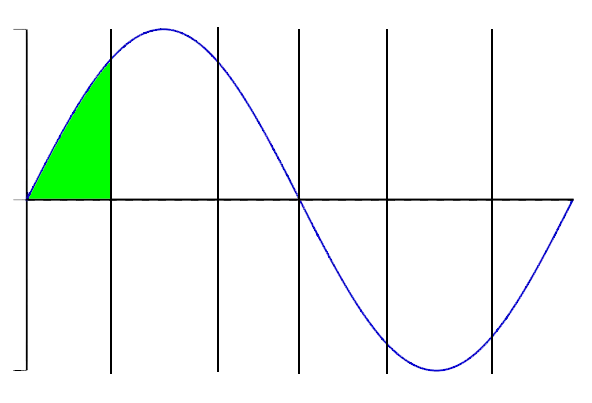

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

Deutsche Börse AG |

15.05.25 |

19.05.25 |

4.0000 € |

Deutsche Börse AG |

15.05.24 |

3.8000 € |

|

Deutsche Börse AG |

19.05.23 |

3.6000 € |

|

Deutsche Börse AG |

17.05.23 |

3.6000 € |

|

Deutsche Börse AG |

20.05.22 |

3.2000 € |

|

Deutsche Börse AG |

19.05.22 |

3.2000 € |

|

Deutsche Börse AG |

21.05.21 |

3.0000 € |

|

Deutsche Börse AG |

20.05.21 |

3.0000 € |

|

Deutsche Börse AG |

22.05.20 |

2.9000 € |

|

Deutsche Börse AG |

20.05.20 |

2.9000 € |

|

Deutsche Börse AG |

10.05.19 |

2.7000 € |

|

Deutsche Börse AG |

09.05.19 |

2.7000 € |

|

Deutsche Börse AG |

18.05.18 |

2.4500 € |

|

Deutsche Börse AG |

17.05.18 |

2.4500 € |

|

Deutsche Börse AG |

19.05.17 |

2.3500 € |

|

Deutsche Börse AG |

18.05.17 |

2.3500 € |

|

Deutsche Börse AG |

12.05.16 |

2.2500 € |

|

Deutsche Börse AG |

14.05.15 |

2.1000 € |

|

Deutsche Börse AG |

16.05.14 |

2.1000 € |

|

Deutsche Börse AG |

16.05.13 |

2.1000 € |

|

Deutsche Börse AG |

17.05.12 |

2.3000 € |

|

Deutsche Börse AG |

13.05.11 |

2.1000 € |

|

Deutsche Börse AG |

28.05.10 |

2.1000 € |

|

Deutsche Börse AG |

21.05.09 |

2.1000 € |

|

Deutsche Börse AG |

22.05.08 |

2.1000 € |

|

Deutsche Börse AG |

14.05.07 |

3.4000 € |

|

Deutsche Börse AG |

25.05.06 |

2.1000 € |

|

Deutsche Börse AG |

26.05.05 |

0.7000 € |

|

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 30.04.25 07:07:13 | Deutsche Boerse AG (DBOEF) Q1 2025 Earnings Call Highlights: Strong Revenue Growth Amid Market ... |  |

| Net Revenue: Increased by 6% to EUR1.5 billion. Net Revenue (Excluding Treasury): Increased by 10%. Annual Recurring Revenue (ARR): Increased by 15% year-on-year to EUR618 million. Operating Costs: Increased by 6%, with underlying costs growing by 3%. EBITDA (Excluding Treasury): Increased by 11%. Share Buyback Program: EUR78 million repurchased, EUR422 million remaining. Trading and Clearing Net Revenue: Increased by 12% without treasury results. Fund Services Net Revenue Growth: Custody 23%, Settlement 30%, Distribution 20%. Securities Services Net Revenue: Increased by 19%. Assets Under Custody: Reached EUR16.1 trillion. Settlement Transactions: Reached a record of EUR9.5 million in March. Interest Income (Securities and Fund Services): Declined by 11% to EUR172 million. Full Year Guidance: Net revenue around EUR5.2 billion, EBITDA around EUR2.7 billion, both excluding treasury. Treasury Result Forecast: Around EUR850 million for 2025. Warning! GuruFocus has detected 7 Warning Sign with DBOEF. Release Date: April 29, 2025 For the complete transcript of the earnings call, please refer to the full earnings call transcript. Positive Points Deutsche Boerse AG (DBOEF) reported a strong 10% increase in net revenue without the treasury side, driven by double-digit growth in cash equities, fund services, and FX. Annual recurring revenue (ARR) increased by 15% year-on-year, reaching a record level of EUR618 million, indicating strong client momentum. The company achieved a 12% increase in net revenues in Trading and Clearing, with significant growth in cash equities and FX due to increased market volatility. Fund Services and Securities Services reached new all-time highs in custody and settlement, resulting in double-digit net revenue growth. Deutsche Boerse AG (DBOEF) has identified significant medium- to long-term growth opportunities from European equities inflows, defense and infrastructure investments, and the EU's Savings and Investment Union initiative. Negative Points Investment Management Solutions experienced stable net revenue performance due to high comparables from 2024, leading to lower upfront license revenues. Operating costs increased by 6% due to higher provisions for share-based compensation and a stronger US dollar, although underlying costs grew by 3%. The treasury result declined by 12% in the first quarter, impacting overall net revenue growth. There was a 25% decline in repo business revenue, attributed to strong prior year comparisons and sufficient market liquidity. The transition from on-premise to SaaS in Software Solutions led to a 32% decline in on-premise revenues, affecting overall revenue perception despite strong ARR growth. Story Continues Q & A Highlights Q: Can you provide details on the impact of FX exposure on your revenues and costs? A: Stephan Leithner, CEO, explained that the business is robust and largely euro-based, minimizing FX impact. Gregor Pottmeyer, CFO, added that FX provided a 1% tailwind on revenues and a 1% headwind on costs in Q1. The Investment Management Solutions (IMS) segment is most affected by FX, but the impact remains minimal. Q: Why did interest rate futures volumes increase by 18% but only a 7% increase in interest rate trading revenues? A: Gregor Pottmeyer, CFO, clarified that the 18% increase in interest rate derivatives revenue matched the volume growth. The overall 7% revenue growth was due to flat OTC clearing revenues and a 25% decline in repo business revenues, despite onboarding 200 new clients. Q: How is the transition from on-premise to SaaS affecting Investment Management Solutions revenues? A: Stephan Leithner, CEO, noted that while SaaS revenues grew by 18%, the on-premise business remains important for certain clients. The transition is ongoing, with SaaS expected to dominate by 2027. Gregor Pottmeyer, CFO, emphasized that ARR growth of 15% indicates strong client momentum, despite quarterly revenue fluctuations. Q: Can you explain the decline in ARR growth from 17% last quarter to 15%? A: Stephan Leithner, CEO, stated that the 15% ARR growth reflects stable and strong client momentum. The previous quarter's 17% was at the upper end of expectations, and the current growth rate remains robust. Q: What is the outlook for cash balances in Securities Services, and how long will fee holidays in short-term interest rates continue? A: Gregor Pottmeyer, CFO, expects cash balances to remain high at EUR19 billion, with a seasonal dip in Q3. Fee holidays in ESTR trading will likely continue until year-end to build liquidity pools and enhance netting efficiencies. For the complete transcript of the earnings call, please refer to the full earnings call transcript. This article first appeared on GuruFocus. View Comments |

||

| 28.04.25 16:00:06 | What Makes Deutsche Boerse AG (DBOEY) a Strong Momentum Stock: Buy Now? |  |

| Momentum investing is all about the idea of following a stock's recent trend, which can be in either direction. In the 'long' context, investors will essentially be "buying high, but hoping to sell even higher." And for investors following this methodology, taking advantage of trends in a stock's price is key; once a stock establishes a course, it is more than likely to continue moving in that direction. The goal is that once a stock heads down a fixed path, it will lead to timely and profitable trades. While many investors like to look for momentum in stocks, this can be very tough to define. There is a lot of debate surrounding which metrics are the best to focus on and which are poor quality indicators of future performance. The Zacks Momentum Style Score, part of the Zacks Style Scores, helps address this issue for us. Below, we take a look at Deutsche Boerse AG (DBOEY), a company that currently holds a Momentum Style Score of A. We also talk about price change and earnings estimate revisions, two of the main aspects of the Momentum Style Score. It's also important to note that Style Scores work as a complement to the Zacks Rank, our stock rating system that has an impressive track record of outperformance. Deutsche Boerse AG currently has a Zacks Rank of #1 (Strong Buy). Our research shows that stocks rated Zacks Rank #1 (Strong Buy) and #2 (Buy) and Style Scores of A or B outperform the market over the following one-month period. You can see the current list of Zacks #1 Rank Stocks here >>> Set to Beat the Market? In order to see if DBOEY is a promising momentum pick, let's examine some Momentum Style elements to see if this company holds up. Looking at a stock's short-term price activity is a great way to gauge if it has momentum, since this can reflect both the current interest in a stock and if buyers or sellers have the upper hand at the moment. It is also useful to compare a security to its industry, as this can help investors pinpoint the top companies in a particular area. For DBOEY, shares are up 1.51% over the past week while the Zacks Securities and Exchanges industry is up 0.92% over the same time period. Shares are looking quite well from a longer time frame too, as the monthly price change of 10.12% compares favorably with the industry's 0.6% performance as well. Considering longer term price metrics, like performance over the last three months or year, can be advantageous as well. Over the past quarter, shares of Deutsche Boerse AG have risen 30.97%, and are up 65.69% in the last year. In comparison, the S&P 500 has only moved -9.16% and 10.9%, respectively. Story Continues Investors should also take note of DBOEY's average 20-day trading volume. Volume is a useful item in many ways, and the 20-day average establishes a good price-to-volume baseline; a rising stock with above average volume is generally a bullish sign, whereas a declining stock on above average volume is typically bearish. Right now, DBOEY is averaging 320,529 shares for the last 20 days. Earnings Outlook The Zacks Momentum Style Score encompasses many things, including estimate revisions and a stock's price movement. Investors should note that earnings estimates are also significant to the Zacks Rank, and a nice path here can be promising. We have recently been noticing this with DBOEY. Over the past two months, 2 earnings estimates moved higher compared to none lower for the full year. These revisions helped boost DBOEY's consensus estimate, increasing from $1.12 to $1.25 in the past 60 days. Looking at the next fiscal year, 2 estimates have moved upwards while there have been no downward revisions in the same time period. Bottom Line Given these factors, it shouldn't be surprising that DBOEY is a #1 (Strong Buy) stock and boasts a Momentum Score of A. If you're looking for a fresh pick that's set to soar in the near-term, make sure to keep Deutsche Boerse AG on your short list. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Deutsche Boerse AG (DBOEY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 09.04.25 16:00:08 | Deutsche Boerse (DBOEY) Upgraded to Strong Buy: Here's What You Should Know |  |

| Investors might want to bet on Deutsche Boerse AG (DBOEY), as it has been recently upgraded to a Zacks Rank #1 (Strong Buy). This upgrade is essentially a reflection of an upward trend in earnings estimates -- one of the most powerful forces impacting stock prices. The Zacks rating relies solely on a company's changing earnings picture. It tracks EPS estimates for the current and following years from the sell-side analysts covering the stock through a consensus measure -- the Zacks Consensus Estimate. The power of a changing earnings picture in determining near-term stock price movements makes the Zacks rating system highly useful for individual investors, since it can be difficult to make decisions based on rating upgrades by Wall Street analysts. These are mostly driven by subjective factors that are hard to see and measure in real time. As such, the Zacks rating upgrade for Deutsche Boerse is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price. Most Powerful Force Impacting Stock Prices The change in a company's future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. That's partly because of the influence of institutional investors that use earnings and earnings estimates for calculating the fair value of a company's shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their transaction of large amounts of shares then leads to price movement for the stock. Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for Deutsche Boerse imply an improvement in the company's underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher. Harnessing the Power of Earnings Estimate Revisions Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions. The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here >>>>. Story Continues Earnings Estimate Revisions for Deutsche Boerse This company is expected to earn $1.22 per share for the fiscal year ending December 2025, which represents a year-over-year change of -0.8%. Analysts have been steadily raising their estimates for Deutsche Boerse. Over the past three months, the Zacks Consensus Estimate for the company has increased 10.4%. Bottom Line Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of 'buy' and 'sell' ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a 'Strong Buy' rating and the next 15% get a 'Buy' rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term. You can learn more about the Zacks Rank here >>> The upgrade of Deutsche Boerse to a Zacks Rank #1 positions it in the top 5% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Deutsche Boerse AG (DBOEY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 09.04.25 13:40:06 | Are Finance Stocks Lagging BB Seguridade Participacoes (BBSEY) This Year? |  |

| For those looking to find strong Finance stocks, it is prudent to search for companies in the group that are outperforming their peers. Is BB Seguridade Participacoes SA (BBSEY) one of those stocks right now? Let's take a closer look at the stock's year-to-date performance to find out. BB Seguridade Participacoes SA is a member of our Finance group, which includes 859 different companies and currently sits at #4 in the Zacks Sector Rank. The Zacks Sector Rank gauges the strength of our 16 individual sector groups by measuring the average Zacks Rank of the individual stocks within the groups. The Zacks Rank emphasizes earnings estimates and estimate revisions to find stocks with improving earnings outlooks. This system has a long record of success, and these stocks tend to be on track to beat the market over the next one to three months. BB Seguridade Participacoes SA is currently sporting a Zacks Rank of #2 (Buy). Within the past quarter, the Zacks Consensus Estimate for BBSEY's full-year earnings has moved 12.7% higher. This means that analyst sentiment is stronger and the stock's earnings outlook is improving. Our latest available data shows that BBSEY has returned about 15.5% since the start of the calendar year. Meanwhile, the Finance sector has returned an average of -9.3% on a year-to-date basis. This means that BB Seguridade Participacoes SA is performing better than its sector in terms of year-to-date returns. Another stock in the Finance sector, Deutsche Boerse AG (DBOEY), has outperformed the sector so far this year. The stock's year-to-date return is 21.7%. Over the past three months, Deutsche Boerse AG's consensus EPS estimate for the current year has increased 10.4%. The stock currently has a Zacks Rank #1 (Strong Buy). Looking more specifically, BB Seguridade Participacoes SA belongs to the Financial - Miscellaneous Services industry, which includes 88 individual stocks and currently sits at #52 in the Zacks Industry Rank. This group has lost an average of 24% so far this year, so BBSEY is performing better in this area. In contrast, Deutsche Boerse AG falls under the Securities and Exchanges industry. Currently, this industry has 7 stocks and is ranked #24. Since the beginning of the year, the industry has moved +1.6%. Investors interested in the Finance sector may want to keep a close eye on BB Seguridade Participacoes SA and Deutsche Boerse AG as they attempt to continue their solid performance. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Story Continues BB Seguridade Participacoes SA (BBSEY) : Free Stock Analysis Report Deutsche Boerse AG (DBOEY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 01.04.25 13:05:10 | Deutsche Börse's (ETR:DB1) Shareholders Will Receive A Bigger Dividend Than Last Year |  |

| Deutsche Börse AG's (ETR:DB1) dividend will be increasing from last year's payment of the same period to €4.00 on 19th of May. Although the dividend is now higher, the yield is only 1.5%, which is below the industry average. Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit. Deutsche Börse's Future Dividend Projections Appear Well Covered By Earnings If it is predictable over a long period, even low dividend yields can be attractive. However, prior to this announcement, Deutsche Börse's dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow. Looking forward, earnings per share is forecast to rise by 23.3% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 33%, which is in the range that makes us comfortable with the sustainability of the dividend.XTRA:DB1 Historic Dividend April 1st 2025 View our latest analysis for Deutsche Börse Deutsche Börse Has A Solid Track Record The company has an extended history of paying stable dividends. Since 2015, the annual payment back then was €2.10, compared to the most recent full-year payment of €4.00. This works out to be a compound annual growth rate (CAGR) of approximately 6.7% a year over that time. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns. The Dividend Looks Likely To Grow Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see that Deutsche Börse has been growing its earnings per share at 14% a year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for Deutsche Börse's prospects of growing its dividend payments in the future. Deutsche Börse Looks Like A Great Dividend Stock Overall, a dividend increase is always good, and we think that Deutsche Börse is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity. It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Deutsche Börse that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 22.03.25 07:06:31 | Deutsche Börse Full Year 2024 Earnings: EPS Beats Expectations |  |

| Deutsche Börse (ETR:DB1) Full Year 2024 Results Key Financial Results Revenue: €5.80b (up 15% from FY 2023). Net income: €1.95b (up 13% from FY 2023). Profit margin: 34% (in line with FY 2023). EPS: €10.60 (up from €9.35 in FY 2023).XTRA:DB1 Revenue and Expenses Breakdown March 22nd 2025 All figures shown in the chart above are for the trailing 12 month (TTM) period Deutsche Börse EPS Beats Expectations Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 2.2%. The primary driver behind last 12 months revenue was the Trading & Clearing segment contributing a total revenue of €2.41b (41% of total revenue). The largest operating expense was General & Administrative costs, amounting to €1.74b (45% of total expenses). Explore how DB1's revenue and expenses shape its earnings. Looking ahead, revenue is forecast to grow 5.0% p.a. on average during the next 3 years, compared to a 3.7% growth forecast for the Capital Markets industry in Germany. Performance of the German Capital Markets industry. The company's shares are down 1.0% from a week ago. Risk Analysis You still need to take note of risks, for example - Deutsche Börse has 1 warning sign we think you should be aware of. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 11.03.25 12:15:34 | Deutsche Boerse's Clearstream to offer bitcoin and ether custody services |  |

| By Elizabeth Howcroft (Reuters) - Germany's Deutsche Boerse will offer cryptocurrency custody and settlement services for institutional clients from next month, the company said on Tuesday, becoming the latest firm to offer custody management for bitcoin and ether. The service aims to allow crypto trading from various trading venues to be settled and held in Clearstream, Deutsche Boerse's settlement business. It marks an expansion into crypto services for the German exchange, after last year it launched its own crypto trading platform for institutional investors. From April clients will be able to use Clearstream for bitcoin and ether - the two largest cryptocurrencies - and the company is considering adding additional cryptocurrencies, based on demand. Deutsche Boerse's subsidiary Crypto Finance will act as a sub-custodian. "Offering crypto custody is the next step on Clearstream’s journey to digitise financial markets," said Jens Hachmeister, Clearstream's head of issuer services and new digital markets. European financial institutions are increasingly making moves in cryptocurrencies, after the European Union introduced a landmark regulatory framework, the Markets in Crypto-Assets regulation (MiCA) in 2023. The news, first reported by Bloomberg, comes after Crypto Finance obtained a MiCA licence in January. Other custody managers to offer crypto custody services include Bank of New York Mellon, which began offering it in 2022, and State Street, which expanded its digital asset services last year. Deutsche Boerse launched a regulated platform for institutional investors to trade cryptocurrencies in March last year, as part of a separate entity which has been merged into Deutsche Boerse's 360T subsidiary, a spokesperson for Deutsche Boerse said. The election of Donald Trump as U.S. President last year has raised expectations of more mainstream financial institutions getting involved in crypto, and U.S. regulators this month made it easier for banks to engage in crypto activities. Some European banks are also expanding. Spanish bank BBVA said on Monday it had received approval from the country's securities regulator to offer bitcoin and ether trading services in Spain. Bitcoin rallied sharply following the election of Trump, but has since declined. (Reporting by Elizabeth Howcroft in Paris; Editing by Tommy Reggiori Wilkes and Louise Heavens) View Comments |

||

| 04.03.25 04:01:18 | Deutsche Börse (ETR:DB1) Is Paying Out A Larger Dividend Than Last Year |  |

| Deutsche Börse AG's (ETR:DB1) dividend will be increasing from last year's payment of the same period to €4.00 on 19th of May. Although the dividend is now higher, the yield is only 1.6%, which is below the industry average. See our latest analysis for Deutsche Börse Deutsche Börse's Future Dividend Projections Appear Well Covered By Earnings Even a low dividend yield can be attractive if it is sustained for years on end. However, Deutsche Börse's earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow. Over the next year, EPS is forecast to expand by 20.3%. If the dividend continues on this path, the payout ratio could be 33% by next year, which we think can be pretty sustainable going forward.XTRA:DB1 Historic Dividend March 4th 2025 Deutsche Börse Has A Solid Track Record The company has an extended history of paying stable dividends. Since 2015, the dividend has gone from €2.10 total annually to €4.00. This works out to be a compound annual growth rate (CAGR) of approximately 6.7% a year over that time. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns. The Dividend Looks Likely To Grow The company's investors will be pleased to have been receiving dividend income for some time. Deutsche Börse has seen EPS rising for the last five years, at 14% per annum. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting. Deutsche Börse Looks Like A Great Dividend Stock Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. Distributions are quite easily covered by earnings, which are also being converted to cash flows. All in all, this checks a lot of the boxes we look for when choosing an income stock. Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Deutsche Börse that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 28.02.25 09:48:51 | ECB's multi-trillion payments breakdown sends shudders through Europe |  |

| By Tom Sims, Francesco Canepa and John O'Donnell FRANKFURT (Reuters) - Banks struggled to process payments on Friday, after an unprecedented day-long breakdown in the European Central Bank's machine underpinning trillions of euros of money movements. The ECB said late on Thursday it had fixed the roughly seven-hour outage in its payment system, which had left transactions likely worth trillions of euros from firms, consumers and investors up in the air. The breakdown, which has dealt a blow to the international standing of the central bank behind one of the globe's most important currencies, continued to reverberate on Friday. The malfunction of the so-called Target 2 system (T2), used to settle more than 3 trillion euros ($3.12 trillion) of daily payments and financial trades, meant transactions between banks could not go through. The breakdown meant some ordinary bank payments, such as wages, pensions and social welfare transfers, have been delayed and could take several hours longer than usual to arrive, said a spokesperson for Germany's central bank, the Bundesbank. Deutsche Boerse's Clearstream, which processes the trading of securities such as company stock, and handles around 500,000 transactions daily, also reported delays. The company said that there was still a residual impact on Friday, although it had largely restored services. The incident lasted until early on Friday morning, delaying money sent in the night for about six hours, said a person familiar with the breakdown, and upsetting the system for what is likely to be a number of days. While it remained unclear whether the mishap would be felt by regular bank customers, it has raised a question mark over the transactions between lenders that underpin the very functioning of the euro zone's economy. In its statement late on Thursday, the ECB said T2 was again functioning normally but that all the deadlines to settle the day's payment flows had been postponed by several hours. It said the outage was caused by a "hardware defect" and had not involved "malicious (or) foul play". "This is a wake-up call that all serious digital payment and currency systems need ... backups," said Rebecca Christie of Bruegel, a Brussels-based economic think tank. "Outages dent ... credibility." Banks, which depend on the system to settle their accounts with one another, had been instructed to keep placing their payments in the queue until the issue was finally fixed. ($1 = 0.9614 euros) (Additional reporting by Frank Siebelt in Frankfurt; Editing by Matthias Williams, Thomas Seythal, Gareth Jones, Philippa Fletcher and Susan Fenton) View Comments |

||

| 15.02.25 06:45:40 | Deutsche Börse (ETR:DB1) Will Pay A Larger Dividend Than Last Year At €4.00 |  |

| Deutsche Börse AG (ETR:DB1) will increase its dividend from last year's comparable payment on the 19th of May to €4.00. Even though the dividend went up, the yield is still quite low at only 1.6%. See our latest analysis for Deutsche Börse Deutsche Börse's Projected Earnings Seem Likely To Cover Future Distributions While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, prior to this announcement, Deutsche Börse's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business. Looking forward, earnings per share is forecast to rise by 16.8% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 34% by next year, which is in a pretty sustainable range.XTRA:DB1 Historic Dividend February 15th 2025 Deutsche Börse Has A Solid Track Record The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was €2.10 in 2015, and the most recent fiscal year payment was €4.00. This implies that the company grew its distributions at a yearly rate of about 6.7% over that duration. Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination as it provides a nice boost to shareholder returns. The Dividend Looks Likely To Grow Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Deutsche Börse has seen EPS rising for the last five years, at 14% per annum. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting. Deutsche Börse Looks Like A Great Dividend Stock Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. Taking this all into consideration, this looks like it could be a good dividend opportunity. Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've picked out 1 warning sign for Deutsche Börse that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||