Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

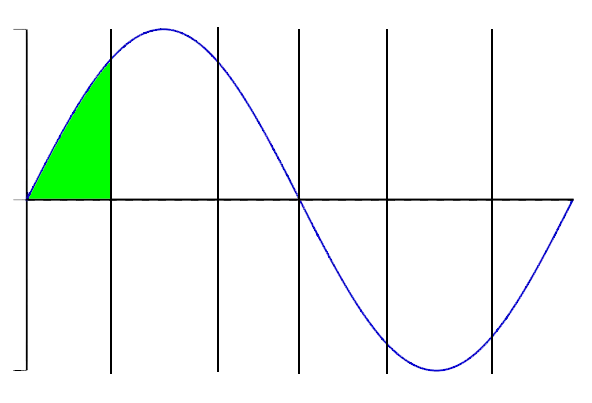

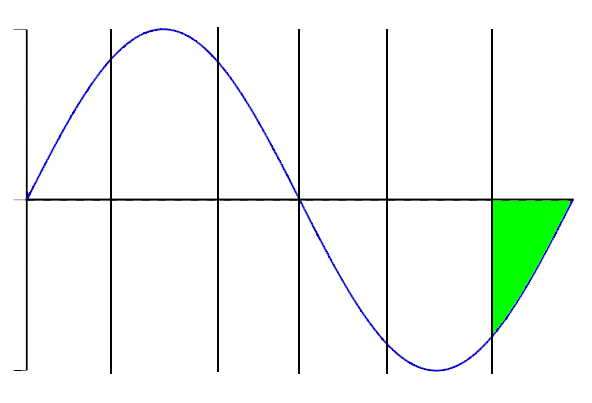

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

Halma PLC |

19.12.24 |

31.01.25 |

0.0009 |

Halma PLC |

11.07.24 |

16.08.24 |

0.1320 |

Halma PLC |

21.12.23 |

02.02.24 |

0.0841 |

Halma PLC |

13.07.23 |

18.08.23 |

0.1234 |

Halma PLC |

22.12.22 |

03.02.23 |

0.0786 |

Halma PLC |

14.07.22 |

18.08.22 |

0.1153 |

Halma PLC |

23.12.21 |

04.02.22 |

0.0735 |

Halma PLC |

08.07.21 |

12.08.21 |

0.1078 |

Halma PLC |

24.12.20 |

05.02.21 |

0.0687 |

Halma PLC |

27.08.20 |

01.10.20 |

0.0996 |

Halma PLC |

24.12.19 |

05.02.20 |

0.0654 |

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 18.03.25 13:40:09 | Is Halma (HLMAF) Outperforming Other Industrial Products Stocks This Year? |  |

| The Industrial Products group has plenty of great stocks, but investors should always be looking for companies that are outperforming their peers. Is Halma (HLMAF) one of those stocks right now? By taking a look at the stock's year-to-date performance in comparison to its Industrial Products peers, we might be able to answer that question. Halma is a member of the Industrial Products sector. This group includes 200 individual stocks and currently holds a Zacks Sector Rank of #12. The Zacks Sector Rank gauges the strength of our 16 individual sector groups by measuring the average Zacks Rank of the individual stocks within the groups. The Zacks Rank is a successful stock-picking model that emphasizes earnings estimates and estimate revisions. The system highlights a number of different stocks that could be poised to outperform the broader market over the next one to three months. Halma is currently sporting a Zacks Rank of #2 (Buy). The Zacks Consensus Estimate for HLMAF's full-year earnings has moved 3.1% higher within the past quarter. This is a sign of improving analyst sentiment and a positive earnings outlook trend. Our latest available data shows that HLMAF has returned about 2% since the start of the calendar year. At the same time, Industrial Products stocks have lost an average of 3.6%. This means that Halma is outperforming the sector as a whole this year. Another Industrial Products stock, which has outperformed the sector so far this year, is Komatsu Ltd. (KMTUY). The stock has returned 12.6% year-to-date. For Komatsu Ltd. the consensus EPS estimate for the current year has increased 14.6% over the past three months. The stock currently has a Zacks Rank #1 (Strong Buy). Looking more specifically, Halma belongs to the Security and Safety Services industry, a group that includes 18 individual stocks and currently sits at #47 in the Zacks Industry Rank. On average, this group has lost an average of 5.1% so far this year, meaning that HLMAF is performing better in terms of year-to-date returns. In contrast, Komatsu Ltd. falls under the Manufacturing - Construction and Mining industry. Currently, this industry has 7 stocks and is ranked #185. Since the beginning of the year, the industry has moved -4.7%. Halma and Komatsu Ltd. could continue their solid performance, so investors interested in Industrial Products stocks should continue to pay close attention to these stocks. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Story Continues Halma (HLMAF) : Free Stock Analysis Report Komatsu Ltd. (KMTUY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 15.02.25 09:06:25 | Halma (LON:HLMA) Has Some Way To Go To Become A Multi-Bagger |  |

| What are the early trends we should look for to identify a stock that could multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. That's why when we briefly looked at Halma's (LON:HLMA) ROCE trend, we were pretty happy with what we saw. Understanding Return On Capital Employed (ROCE) If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Halma, this is the formula: Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities) 0.15 = UK£405m ÷ (UK£3.0b - UK£345m) (Based on the trailing twelve months to September 2024). Therefore, Halma has an ROCE of 15%. In absolute terms, that's a satisfactory return, but compared to the Electronic industry average of 11% it's much better. See our latest analysis for Halma LSE:HLMA Return on Capital Employed February 15th 2025 Above you can see how the current ROCE for Halma compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our freeanalyst report for Halma . What Does the ROCE Trend For Halma Tell Us? While the returns on capital are good, they haven't moved much. The company has consistently earned 15% for the last five years, and the capital employed within the business has risen 73% in that time. 15% is a pretty standard return, and it provides some comfort knowing that Halma has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders. In Conclusion... In the end, Halma has proven its ability to adequately reinvest capital at good rates of return. And given the stock has only risen 38% over the last five years, we'd suspect the market is beginning to recognize these trends. So because of the trends we're seeing, we'd recommend looking further into this stock to see if it has the makings of a multi-bagger. Halma does have some risks though, and we've spotted 1 warning sign for Halma that you might be interested in. For those who like to invest in solid companies, check out this freelist of companies with solid balance sheets and high returns on equity. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 07.02.25 14:40:13 | Is Cadre Holdings, Inc. (CDRE) Stock Outpacing Its Industrial Products Peers This Year? |  |

| Investors interested in Industrial Products stocks should always be looking to find the best-performing companies in the group. Has Cadre Holdings, Inc. (CDRE) been one of those stocks this year? A quick glance at the company's year-to-date performance in comparison to the rest of the Industrial Products sector should help us answer this question. Cadre Holdings, Inc. is a member of our Industrial Products group, which includes 201 different companies and currently sits at #10 in the Zacks Sector Rank. The Zacks Sector Rank considers 16 different groups, measuring the average Zacks Rank of the individual stocks within the sector to gauge the strength of each group. The Zacks Rank emphasizes earnings estimates and estimate revisions to find stocks with improving earnings outlooks. This system has a long record of success, and these stocks tend to be on track to beat the market over the next one to three months. Cadre Holdings, Inc. is currently sporting a Zacks Rank of #2 (Buy). Over the past three months, the Zacks Consensus Estimate for CDRE's full-year earnings has moved 3.3% higher. This means that analyst sentiment is stronger and the stock's earnings outlook is improving. Based on the most recent data, CDRE has returned 11.3% so far this year. Meanwhile, stocks in the Industrial Products group have gained about 2.3% on average. This means that Cadre Holdings, Inc. is outperforming the sector as a whole this year. Halma (HLMAF) is another Industrial Products stock that has outperformed the sector so far this year. Since the beginning of the year, the stock has returned 6.2%. For Halma, the consensus EPS estimate for the current year has increased 1.2% over the past three months. The stock currently has a Zacks Rank #2 (Buy). Breaking things down more, Cadre Holdings, Inc. is a member of the Security and Safety Services industry, which includes 18 individual companies and currently sits at #35 in the Zacks Industry Rank. On average, this group has gained an average of 1.6% so far this year, meaning that CDRE is performing better in terms of year-to-date returns. Halma is also part of the same industry. Going forward, investors interested in Industrial Products stocks should continue to pay close attention to Cadre Holdings, Inc. and Halma as they could maintain their solid performance. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report Halma (HLMAF) : Free Stock Analysis Report Story Continues To read this article on Zacks.com click here. Zacks Investment Research View Comments |

||

| 25.01.25 08:55:01 | With 89% ownership in Halma plc (LON:HLMA), institutional investors have a lot riding on the business |  |

| Key Insights Given the large stake in the stock by institutions, Halma's stock price might be vulnerable to their trading decisions 48% of the business is held by the top 25 shareholders Recent sales by insiders A look at the shareholders of Halma plc (LON:HLMA) can tell us which group is most powerful. We can see that institutions own the lion's share in the company with 89% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn). Last week’s 4.0% gain means that institutional investors were on the positive end of the spectrum even as the company has shown strong longer-term trends. The gains from last week would have further boosted the one-year return to shareholders which currently stand at 34%. Let's delve deeper into each type of owner of Halma, beginning with the chart below. See our latest analysis for Halma LSE:HLMA Ownership Breakdown January 25th 2025 What Does The Institutional Ownership Tell Us About Halma? Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices. Halma already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Halma's historic earnings and revenue below, but keep in mind there's always more to the story.LSE:HLMA Earnings and Revenue Growth January 25th 2025 Since institutional investors own more than half the issued stock, the board will likely have to pay attention to their preferences. Hedge funds don't have many shares in Halma. Our data shows that BlackRock, Inc. is the largest shareholder with 8.9% of shares outstanding. The Vanguard Group, Inc. is the second largest shareholder owning 4.8% of common stock, and FMR LLC holds about 3.1% of the company stock. Our studies suggest that the top 25 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder. Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future. Story Continues Insider Ownership Of Halma The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO. I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions. Our information suggests that Halma plc insiders own under 1% of the company. It is a very large company, so it would be surprising to see insiders own a large proportion of the company. Though their holding amounts to less than 1%, we can see that board members collectively own UK£7.7m worth of shares (at current prices). It is good to see board members owning shares, but it might be worth checking if those insiders have been buying. General Public Ownership The general public, who are usually individual investors, hold a 10% stake in Halma. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run. Next Steps: I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that Halma is showing 1 warning sign in our investment analysis, you should know about... But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future. NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 04.01.25 08:12:17 | Is Halma plc's (LON:HLMA) Latest Stock Performance Being Led By Its Strong Fundamentals? |  |

| Halma's (LON:HLMA) stock is up by 4.7% over the past three months. Given its impressive performance, we decided to study the company's key financial indicators as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Halma's ROE. ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments. Check out our latest analysis for Halma How Do You Calculate Return On Equity? The formula for ROE is: Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity So, based on the above formula, the ROE for Halma is: 16% = UK£287m ÷ UK£1.7b (Based on the trailing twelve months to September 2024). The 'return' refers to a company's earnings over the last year. That means that for every £1 worth of shareholders' equity, the company generated £0.16 in profit. What Is The Relationship Between ROE And Earnings Growth? So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features. Halma's Earnings Growth And 16% ROE To begin with, Halma seems to have a respectable ROE. On comparing with the average industry ROE of 10% the company's ROE looks pretty remarkable. This certainly adds some context to Halma's decent 8.5% net income growth seen over the past five years. As a next step, we compared Halma's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 10% in the same period.LSE:HLMA Past Earnings Growth January 4th 2025 The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Halma fairly valued compared to other companies? These 3 valuation measures might help you decide. Is Halma Using Its Retained Earnings Effectively? Halma has a healthy combination of a moderate three-year median payout ratio of 31% (or a retention ratio of 69%) and a respectable amount of growth in earnings as we saw above, meaning that the company has been making efficient use of its profits. Story Continues Moreover, Halma is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 26% of its profits over the next three years. As a result, Halma's ROE is not expected to change by much either, which we inferred from the analyst estimate of 16% for future ROE. Summary In total, we are pretty happy with Halma's performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. The latest industry analyst forecasts show that the company is expected to maintain its current growth rate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 03.01.25 17:00:12 | Halma (HLMAF) Upgraded to Buy: Here's What You Should Know |  |

| Halma (HLMAF) appears an attractive pick, as it has been recently upgraded to a Zacks Rank #2 (Buy). This upgrade primarily reflects an upward trend in earnings estimates, which is one of the most powerful forces impacting stock prices. The Zacks rating relies solely on a company's changing earnings picture. It tracks EPS estimates for the current and following years from the sell-side analysts covering the stock through a consensus measure -- the Zacks Consensus Estimate. Since a changing earnings picture is a powerful factor influencing near-term stock price movements, the Zacks rating system is very useful for individual investors. They may find it difficult to make decisions based on rating upgrades by Wall Street analysts, as these are mostly driven by subjective factors that are hard to see and measure in real time. As such, the Zacks rating upgrade for Halma is essentially a positive comment on its earnings outlook that could have a favorable impact on its stock price. Most Powerful Force Impacting Stock Prices The change in a company's future earnings potential, as reflected in earnings estimate revisions, has proven to be strongly correlated with the near-term price movement of its stock. The influence of institutional investors has a partial contribution to this relationship, as these big professionals use earnings and earnings estimates to calculate the fair value of a company's shares. An increase or decrease in earnings estimates in their valuation models simply results in higher or lower fair value for a stock, and institutional investors typically buy or sell it. Their bulk investment action then leads to price movement for the stock. Fundamentally speaking, rising earnings estimates and the consequent rating upgrade for Halma imply an improvement in the company's underlying business. Investors should show their appreciation for this improving business trend by pushing the stock higher. Harnessing the Power of Earnings Estimate Revisions Empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock movements, so it could be truly rewarding if such revisions are tracked for making an investment decision. Here is where the tried-and-tested Zacks Rank stock-rating system plays an important role, as it effectively harnesses the power of earnings estimate revisions. The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here >>>>. Story Continues Earnings Estimate Revisions for Halma This company is expected to earn $1.14 per share for the fiscal year ending March 2025, which represents a year-over-year change of 10.7%. Analysts have been steadily raising their estimates for Halma. Over the past three months, the Zacks Consensus Estimate for the company has increased 0.9%. Bottom Line Unlike the overly optimistic Wall Street analysts whose rating systems tend to be weighted toward favorable recommendations, the Zacks rating system maintains an equal proportion of 'buy' and 'sell' ratings for its entire universe of more than 4000 stocks at any point in time. Irrespective of market conditions, only the top 5% of the Zacks-covered stocks get a 'Strong Buy' rating and the next 15% get a 'Buy' rating. So, the placement of a stock in the top 20% of the Zacks-covered stocks indicates its superior earnings estimate revision feature, making it a solid candidate for producing market-beating returns in the near term. You can learn more about the Zacks Rank here >>> The upgrade of Halma to a Zacks Rank #2 positions it in the top 20% of the Zacks-covered stocks in terms of estimate revisions, implying that the stock might move higher in the near term. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Halma (HLMAF) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research View Comments |

||

| 30.08.24 05:35:59 | The Returns At Halma (LON:HLMA) Aren't Growing |  |

| If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of Halma (LON:HLMA) looks decent, right now, so lets see what the trend of returns can tell us. Understanding Return On Capital Employed (ROCE) If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Halma is: Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities) 0.14 = UK£377m ÷ (UK£3.0b - UK£372m) (Based on the trailing twelve months to March 2024). So, Halma has an ROCE of 14%. That's a relatively normal return on capital, and it's around the 13% generated by the Electronic industry. View our latest analysis for Halma roce In the above chart we have measured Halma's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Halma for free. So How Is Halma's ROCE Trending? While the returns on capital are good, they haven't moved much. Over the past five years, ROCE has remained relatively flat at around 14% and the business has deployed 98% more capital into its operations. 14% is a pretty standard return, and it provides some comfort knowing that Halma has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns. What We Can Learn From Halma's ROCE In the end, Halma has proven its ability to adequately reinvest capital at good rates of return. However, over the last five years, the stock has only delivered a 36% return to shareholders who held over that period. So to determine if Halma is a multi-bagger going forward, we'd suggest digging deeper into the company's other fundamentals. If you're still interested in Halma it's worth checking out our FREE intrinsic value approximation for HLMA to see if it's trading at an attractive price in other respects. For those who like to invest in solid companies, check out this freelist of companies with solid balance sheets and high returns on equity. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View comments |

||

| 28.08.24 13:40:12 | Are Industrial Products Stocks Lagging GormanRupp (GRC) This Year? |  |

| For those looking to find strong Industrial Products stocks, it is prudent to search for companies in the group that are outperforming their peers. Is Gorman-Rupp (GRC) one of those stocks right now? Let's take a closer look at the stock's year-to-date performance to find out. Gorman-Rupp is a member of our Industrial Products group, which includes 218 different companies and currently sits at #13 in the Zacks Sector Rank. The Zacks Sector Rank includes 16 different groups and is listed in order from best to worst in terms of the average Zacks Rank of the individual companies within each of these sectors. The Zacks Rank is a proven system that emphasizes earnings estimates and estimate revisions, highlighting a variety of stocks that are displaying the right characteristics to beat the market over the next one to three months. Gorman-Rupp is currently sporting a Zacks Rank of #2 (Buy). Over the past three months, the Zacks Consensus Estimate for GRC's full-year earnings has moved 19.4% higher. This shows that analyst sentiment has improved and the company's earnings outlook is stronger. Based on the most recent data, GRC has returned 9.9% so far this year. At the same time, Industrial Products stocks have gained an average of 7.7%. As we can see, Gorman-Rupp is performing better than its sector in the calendar year. One other Industrial Products stock that has outperformed the sector so far this year is Halma (HLMAF). The stock is up 18.1% year-to-date. For Halma, the consensus EPS estimate for the current year has increased 2.4% over the past three months. The stock currently has a Zacks Rank #2 (Buy). Breaking things down more, Gorman-Rupp is a member of the Manufacturing - General Industrial industry, which includes 44 individual companies and currently sits at #181 in the Zacks Industry Rank. This group has gained an average of 8.1% so far this year, so GRC is performing better in this area. On the other hand, Halma belongs to the Security and Safety Services industry. This 20-stock industry is currently ranked #83. The industry has moved +19.5% year to date. Gorman-Rupp and Halma could continue their solid performance, so investors interested in Industrial Products stocks should continue to pay close attention to these stocks. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Gorman-Rupp Company (The) (GRC) : Free Stock Analysis Report Halma (HLMAF) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research View comments |

||

| 13.08.24 13:55:28 | With 88% institutional ownership, Halma plc (LON:HLMA) is a favorite amongst the big guns |  |

| Key Insights Significantly high institutional ownership implies Halma's stock price is sensitive to their trading actions 48% of the business is held by the top 25 shareholders Recent sales by insiders To get a sense of who is truly in control of Halma plc (LON:HLMA), it is important to understand the ownership structure of the business. We can see that institutions own the lion's share in the company with 88% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company. Given the vast amount of money and research capacities at their disposal, institutional ownership tends to carry a lot of weight, especially with individual investors. As a result, a sizeable amount of institutional money invested in a firm is generally viewed as a positive attribute. Let's take a closer look to see what the different types of shareholders can tell us about Halma. View our latest analysis for Halma ownership-breakdown What Does The Institutional Ownership Tell Us About Halma? Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing. Halma already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Halma's historic earnings and revenue below, but keep in mind there's always more to the story. earnings-and-revenue-growth Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. We note that hedge funds don't have a meaningful investment in Halma. BlackRock, Inc. is currently the largest shareholder, with 9.0% of shares outstanding. Meanwhile, the second and third largest shareholders, hold 4.8% and 3.0%, of the shares outstanding, respectively. Our studies suggest that the top 25 shareholders collectively control less than half of the company's shares, meaning that the company's shares are widely disseminated and there is no dominant shareholder. Story continues Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future. Insider Ownership Of Halma The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO. Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances. Our information suggests that Halma plc insiders own under 1% of the company. It is a very large company, so it would be surprising to see insiders own a large proportion of the company. Though their holding amounts to less than 1%, we can see that board members collectively own UK£8.2m worth of shares (at current prices). In this sort of situation, it can be more interesting to see if those insiders have been buying or selling. General Public Ownership The general public-- including retail investors -- own 10% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies. Next Steps: It's always worth thinking about the different groups who own shares in a company. But to understand Halma better, we need to consider many other factors. Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow. If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future. NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View comments |

||

| 12.08.24 13:40:12 | Has Apogee Enterprises (APOG) Outpaced Other Industrial Products Stocks This Year? |  |

| Investors interested in Industrial Products stocks should always be looking to find the best-performing companies in the group. Apogee Enterprises (APOG) is a stock that can certainly grab the attention of many investors, but do its recent returns compare favorably to the sector as a whole? By taking a look at the stock's year-to-date performance in comparison to its Industrial Products peers, we might be able to answer that question. Apogee Enterprises is one of 218 companies in the Industrial Products group. The Industrial Products group currently sits at #9 within the Zacks Sector Rank. The Zacks Sector Rank gauges the strength of our 16 individual sector groups by measuring the average Zacks Rank of the individual stocks within the groups. The Zacks Rank is a proven system that emphasizes earnings estimates and estimate revisions, highlighting a variety of stocks that are displaying the right characteristics to beat the market over the next one to three months. Apogee Enterprises is currently sporting a Zacks Rank of #2 (Buy). Within the past quarter, the Zacks Consensus Estimate for APOG's full-year earnings has moved 7.1% higher. This signals that analyst sentiment is improving and the stock's earnings outlook is more positive. Based on the latest available data, APOG has gained about 16.1% so far this year. At the same time, Industrial Products stocks have gained an average of 3.6%. This means that Apogee Enterprises is outperforming the sector as a whole this year. Another stock in the Industrial Products sector, Halma (HLMAF), has outperformed the sector so far this year. The stock's year-to-date return is 9.9%. The consensus estimate for Halma's current year EPS has increased 2.4% over the past three months. The stock currently has a Zacks Rank #2 (Buy). Looking more specifically, Apogee Enterprises belongs to the Glass Products industry, a group that includes 4 individual stocks and currently sits at #30 in the Zacks Industry Rank. On average, stocks in this group have lost 16.8% this year, meaning that APOG is performing better in terms of year-to-date returns. Halma, however, belongs to the Security and Safety Services industry. Currently, this 20-stock industry is ranked #96. The industry has moved +15.4% so far this year. Going forward, investors interested in Industrial Products stocks should continue to pay close attention to Apogee Enterprises and Halma as they could maintain their solid performance. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Story continues Apogee Enterprises, Inc. (APOG) : Free Stock Analysis Report Halma (HLMAF) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research View comments |

||