Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

Qiagen NV |

29.01.25 |

1.1520 € |

|

Qiagen NV |

30.01.24 |

1.1703 € |

|

Qiagen NV |

29.01.24 |

1.3196 € |

|

Qiagen NV |

25.01.17 |

1.0800 € |

|

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 22.04.25 20:05:00 | QIAGEN Advances Cancer Genomic Profiling With New Products and Partnership Updates at AACR Annual Meeting 2025 |  |

| New QIAseq panels launched for use on next-generation sequencers to boost analysis of over 700 genes for comprehensive genomic profiling in research and clinical applications Advancing key partnerships: New QIAseq panels to be added to Element Bioscience’s Trinity workflow, new assay in development with Myriad Genetics planned for launch in 2025 QIAGEN Digital Insights introduces a free, feature-limited version of Human Somatic Mutation Database, making vital genomic insights more accessible to global research community VENLO, Netherlands, April 22, 2025--(BUSINESS WIRE)--QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) today announced a series of product and partnership updates designed to strengthen its portfolio for cancer genomic profiling. These new developments will be showcased at the American Association for Cancer Research (AACR) Annual Meeting 2025, from April 25-30 in Chicago. Important updates include a new set of QIAseq panels for comprehensive genomic profiling (CGP) and a new QIAcuity digital PCR (dPCR) kit and assays for cell and gene therapy quality control along with a new free, limited version of the Human Somatic Mutation Database (HSMD) from the QIAGEN Digital Insights (QDI) bioinformatics business. "The launch of the new QIAseq panels represents a significant step forward in enabling researchers to gain deeper, more accurate insights into cancer biology and biomarker discovery along the complete workflow from sample technologies to QIAGEN Digital Insights for powerful genomic data analysis and interpretation," said Nitin Sood, Senior Vice President and Head of Product Portfolio & Innovation at QIAGEN. "Additionally, our new QIAcuity digital PCR kit and assays support pharma companies in developing safe and effective biotherapeutics also for cancer patients. We are moving ahead in supporting scientists and clinicians in advancing cancer research and precision medicine." The new products and partnership updates include the following: The QIAseq xHYB CGP portfolio is being expanded to offer a highly curated solution for multimodal cancer genomic profiling. It includes DNA and RNA panels to capture critical genomic regions, and is designed to leverage actionable and interpretable variants sourced from the Human Somatic Mutation Database (HSMD) from QDI. QIAGEN will highlight the panel’s capabilities at AACR 2025 during a Spotlight Theater talk. Dr. Christopher Reynolds of Myriad Genetics will present a proof-of-concept study assessing the panel’s performance in variant detection using matched tumor/plasma samples from Stage III/IV prostate and ovarian cancer patients. The QIAcuity RCL Quant Kit and new QIAcuity CGT dPCR assays support quality control in cell and gene therapy with solutions for lentivirus-based applications that are used for applications including the manufacturing of CAR-T therapies, a novel type of cancer treatment. The new kit and assays reliably detect critical quality attributes in lentivirus-based biotherapeutics, ensuring therapy safety and efficacy. QIAGEN and Element Biosciences are building on their existing partnership by adding the new QIAseq xHYB CGP Panels to Element’s AVITI platform and Trinity workflow. This update, expected by late 2025, will make cancer genomic profiling faster, easier and more cost-effective by reducing hands-on time and equipment needs. In the partnership with Myriad Genetics, QIAGEN plans to launch globally (excluding Japan) a sequencing-based homologous recombination deficiency (HRD) assay designed to enable deeper molecular insights into DNA repair deficiencies. This solution will enhance the ability of researchers to investigate mechanisms of homologous recombination and optimize treatment strategies. Further supporting the research community, QIAGEN is introducing HSMD Research, a free, limited version of its HSMD database to make genomic data more widely available. This resource offers academic researchers curated insights on 25 key genes involved in solid tumors and blood cancers while covering gene annotations, variant distributions, functional impacts and clinical significance. Story Continues To learn more about QIAGEN’s latest innovations, visit booth #2620 at the AACR Annual Meeting 2025. More details about featured talks, poster presentations and product demonstrations are available at https://www.qiagen.com/applications/cancer-research/oncology-annual-meeting. About QIAGEN QIAGEN N.V., a Netherlands-based holding company, is the leading global provider of Sample to Insight solutions, enabling customers to extract and gain valuable molecular insights from samples containing the building blocks of life. Our Sample technologies isolate and process DNA, RNA and proteins from blood, tissue and other materials. Assay technologies prepare these biomolecules for analysis while bioinformatics software and knowledge bases can be used to interpret data to find actionable insights. Automation solutions bring these processes together into seamless and cost-effective workflows. QIAGEN serves over 500,000 customers globally in Life Sciences (academia, pharma R&D and industrial applications, primarily forensics) and Molecular Diagnostics for clinical healthcare. As of December 31, 2024, QIAGEN employed more than 5,700 people in over 35 locations worldwide. For more information, visit www.qiagen.com. Forward-Looking Statement Certain statements in this press release may constitute forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These statements, including those regarding QIAGEN's products, development timelines, marketing and / or regulatory approvals, financial and operational outlook, growth strategies, collaborations and operating results - such as expected adjusted net sales and adjusted diluted earnings - are based on current expectations and assumptions. However, they involve uncertainties and risks. These risks include, but are not limited to, challenges in managing growth and international operations (including the effects of currency fluctuations, regulatory processes and logistical dependencies), variability in operating results and allocations between customer classes, commercial development for our products to customers in the Life Sciences and clinical healthcare, changes in relationships with customers, suppliers or strategic partners; competition and rapid technological advancements; fluctuating demand for QIAGEN's products due to factors such as economic conditions, customer budgets and funding cycles; obtaining and maintaining regulatory approvals for our products; difficulties in successfully adapting QIAGEN's products into integrated solutions and producing these products; and protecting product differentiation from competitors. Additional uncertainties may arise from market acceptance of new products, integration of acquisitions, governmental actions, global or regional economic developments, natural disasters, political or public health crises, and other "force majeure" events. There is also no guarantee that anticipated benefits from acquisitions will materialize as expected. For a comprehensive overview of risks, please refer to the "Risk Factors" contained in our most recent Annual Report on Form 20-F and other reports filed with or furnished to the U.S. Securities and Exchange Commission. Source: QIAGEN N.V. Category: Life Sciences View source version on businesswire.com: https://www.businesswire.com/news/home/20250422055230/en/ Contacts Contacts QIAGEN: Investor Relations John Gilardi, +49 2103 29 11711 Domenica Martorana, +49 2103 29 11244 e-mail: ir@QIAGEN.com Public Relations Thomas Theuringer, +49 2103 29 11826 Lisa Specht, +49 2103 29 14181 e-mail: pr@QIAGEN.com View Comments |

||

| 22.04.25 16:26:41 | Is There An Opportunity With Qiagen N.V.'s (NYSE:QGEN) 33% Undervaluation? |  |

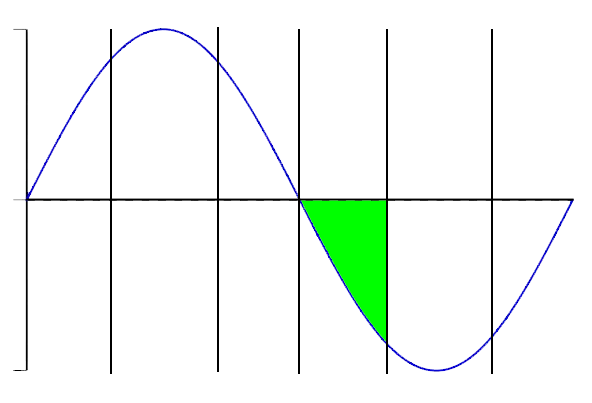

| Key Insights The projected fair value for Qiagen is US$60.71 based on 2 Stage Free Cash Flow to Equity Qiagen is estimated to be 33% undervalued based on current share price of US$40.48 The US$49.23 analyst price target for QGEN is 19% less than our estimate of fair value Today we will run through one way of estimating the intrinsic value of Qiagen N.V. (NYSE:QGEN) by estimating the company's future cash flows and discounting them to their present value. We will use the Discounted Cash Flow (DCF) model on this occasion. Believe it or not, it's not too difficult to follow, as you'll see from our example! Companies can be valued in a lot of ways, so we would point out that a DCF is not perfect for every situation. If you still have some burning questions about this type of valuation, take a look at the Simply Wall St analysis model. We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free. Is Qiagen Fairly Valued? We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To start off with, we need to estimate the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years. A DCF is all about the idea that a dollar in the future is less valuable than a dollar today, so we discount the value of these future cash flows to their estimated value in today's dollars: 10-year free cash flow (FCF) estimate 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Levered FCF ($, Millions) US$476.3m US$521.8m US$568.0m US$600.0m US$626.1m US$650.3m US$673.3m US$695.5m US$717.3m US$738.9m Growth Rate Estimate Source Analyst x4 Analyst x4 Analyst x3 Analyst x2 Est @ 4.35% Est @ 3.87% Est @ 3.53% Est @ 3.30% Est @ 3.13% Est @ 3.02% Present Value ($, Millions) Discounted @ 7.1% US$445 US$455 US$463 US$456 US$445 US$431 US$417 US$402 US$387 US$373 ("Est" = FCF growth rate estimated by Simply Wall St) Present Value of 10-year Cash Flow (PVCF) = US$4.3b Story Continues We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 2.8%. We discount the terminal cash flows to today's value at a cost of equity of 7.1%. Terminal Value (TV)= FCF2034 × (1 + g) ÷ (r – g) = US$739m× (1 + 2.8%) ÷ (7.1%– 2.8%) = US$18b Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$18b÷ ( 1 + 7.1%)10= US$8.8b The total value is the sum of cash flows for the next ten years plus the discounted terminal value, which results in the Total Equity Value, which in this case is US$13b. To get the intrinsic value per share, we divide this by the total number of shares outstanding. Compared to the current share price of US$40.5, the company appears quite undervalued at a 33% discount to where the stock price trades currently. The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent.NYSE:QGEN Discounted Cash Flow April 22nd 2025 The Assumptions The calculation above is very dependent on two assumptions. The first is the discount rate and the other is the cash flows. Part of investing is coming up with your own evaluation of a company's future performance, so try the calculation yourself and check your own assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Qiagen as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 7.1%, which is based on a levered beta of 1.000. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business. View our latest analysis for Qiagen SWOT Analysis for Qiagen Strength Debt is not viewed as a risk. Weakness Earnings declined over the past year. Dividend is low compared to the top 25% of dividend payers in the Life Sciences market. Opportunity Annual earnings are forecast to grow faster than the American market. Trading below our estimate of fair value by more than 20%. Threat Annual revenue is forecast to grow slower than the American market. Next Steps: Although the valuation of a company is important, it shouldn't be the only metric you look at when researching a company. The DCF model is not a perfect stock valuation tool. Preferably you'd apply different cases and assumptions and see how they would impact the company's valuation. For instance, if the terminal value growth rate is adjusted slightly, it can dramatically alter the overall result. What is the reason for the share price sitting below the intrinsic value? For Qiagen, we've compiled three further items you should assess: Risks: You should be aware of the 2 warning signs for Qiagen we've uncovered before considering an investment in the company. Future Earnings: How does QGEN's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart. Other Solid Businesses: Low debt, high returns on equity and good past performance are fundamental to a strong business. Why not explore our interactive list of stocks with solid business fundamentals to see if there are other companies you may not have considered! PS. Simply Wall St updates its DCF calculation for every American stock every day, so if you want to find the intrinsic value of any other stock just search here. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 16.04.25 13:50:06 | Why Qiagen (QGEN) is a Top Momentum Stock for the Long-Term |  |

| Taking full advantage of the stock market and investing with confidence are common goals for new and old investors alike. Achieving those goals is made easier with the Zacks Style Scores, a unique set of guidelines that rates stocks based on popular investing methodologies, namely value, growth, and momentum. The Style Scores can help you narrow down which stocks are better for your portfolio and which ones can beat the market over the long-term. Is This 1 Momentum Stock a Screaming Buy Right Now? Momentum investors, who live by the saying "the trend is your friend," are most interested in taking advantage of upward or downward trends in a stock's price or earnings outlook. Utilizing one-week price change and the monthly percentage change in earnings estimates, among other factors, the Momentum Style Score can help determine favorable times to buy high-momentum stocks. Qiagen (QGEN) Based in Venlo, the Netherlands, QIAGEN N.V. is one of the world’s leading providers of technologies and products for the separation, purification and handling of nucleic acids DNA/RNA. The company provides innovative technologies and products for pre-analytical sample preparation and molecular diagnostics solutions. It has developed a comprehensive portfolio of over 500 proprietary, consumable products, and automated solutions for sample collection. QGEN sits at a Zacks Rank #3 (Hold), holds a Momentum Style Score of A, and has a VGM Score of B. The stock is up 7% and up 4.5% over the past one-week and four-week period, respectively, and Qiagen has gained 2.7% in the last one-year period as well. Additionally, an average of 1,467,935.75 shares were traded over the last 20 trading sessions. A company's earnings performance is important for momentum investors as well. For fiscal 2025, one analyst revised their earnings estimate higher in the last 60 days for QGEN, while the Zacks Consensus Estimate has increased $0 to $2.27 per share. QGEN also boasts an average earnings surprise of 3.6%. With strong earnings growth, a good Zacks Rank, and top-tier Momentum and VGM Style Scores, investors should think about adding QGEN to their portfolios. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report QIAGEN N.V. (QGEN) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 15.04.25 18:03:58 | Qiagen Plans 3 New Sample Preparation Instrument Launches Through 2026 |  |

| Qiagen (QGEN) said Tuesday it plans to launch three new sample preparation instruments, QIAsymphony PREMIUM Upgrade to read this MT Newswires article and get so much more. A Silver or Gold subscription plan is required to access premium news articles. Upgrade Already have a subscription? Sign in |

||

| 15.04.25 05:30:00 | QIAGEN Advancing Plans to Launch Three New Sample Preparation Instruments by 2026 to Improve Lab Automation |  |

| Three new innovative instrument launches expand reach into further lab segments and sample preparation customers as QIAGEN strengthens market-leading position QIAsymphony Connect set to start phased launch in 2025, first customer sessions being held to highlight enhanced capabilities for oncology and genomics workflows QIAsprint and QIAmini on track for 2026 launches, expanding options for high- and low-throughput lab demands VENLO, Netherlands, April 15, 2025--(BUSINESS WIRE)--QIAGEN (NYSE: QGEN; Frankfurt Prime Standard: QIA) today announced that plans are advancing to launch three new sample preparation instruments during 2025 and 2026 to expand and strengthen its portfolio for automated sample preparation. These systems are designed to deliver new levels of efficiency and sustainability for laboratories worldwide and address different customer segments: QIAsymphony Connect, which marks the next generation of the flagship QIAsymphony with over 3,300 cumulative placements, is progressing well toward a phased launch to selected customers starting in 2025. Early customer sessions are being held at industry events during 2025 – including at the ESCMID (European Society of Clinical Microbiology and Infectious Diseases) conference in April 2025 in Vienna – to showcase the system’s enhanced capabilities in select settings upon request. The QIAsymphony Connect addresses pathogen nucleic acid extraction and various other applications including liquid biopsy, a non-invasive method for detecting cancer and other diseases through blood samples, as well as oncology, genomics, and clinical research workflows. The system can process up to 96 samples at a time and features improved automation capabilities for sample tracking and new applications, higher yield for increase in assay sensitivity and digital connectivity. It is compatible with QIAsphere, QIAGEN’s cloud-based platform for remote monitoring, software updates and instrument status. It is being designed for in vitro diagnostic (IVD) use globally, enabling compliant workflows in most countries and including the U.S. and Europe. QIAsprint Connect, on track for launch in 2026, marks the entry of QIAGEN into automated high-throughput sample processing. The first demonstrations of QIAsprint Connect have showcased the system’s potential to process up to 192 samples per run with less than 30 minutes of hands-on time, enabling labs to scale up to 600 samples per day. The system supports both pre-programmed and customizable protocols, and its consumables are designed with sustainability in mind, reducing plastic waste by up to 50%. "We were excited to test the QIAsprint. Its user-friendly design and ability to process large sample numbers efficiently is an ideal solution for laboratories like ours," said Kerstin Luxa of the Max Planck Institute for Plant Breeding Research in Cologne, Germany. The system supports a wide range of sample types, such as plant, microbial, soil, stool and human tissues, and is already being used to develop nine different applications. Its flexibility makes it ideal for labs working across various areas. QIAmini, also on track for launch in 2026, expands QIAGEN’s automation portfolio into the low-throughput segment. This cost-effective and low-complexity entry into automation brings the reliability of QIAGEN trusted kits to smaller labs and batch sizes. Ideal for replacing tedious pipetting, it delivers the reproducibility of automation with the flexibility to scale as needed. QIAmini complements QIAGEN’s portfolio alongside the updated QIAcube Connect and EZ2 Connect systems, offering automation options for even smaller-scale workflows. Story Continues "These new sample preparation systems underscore our commitment to helping labs operate more efficiently, sustainably and flexibly," said Nitin Sood, Senior Vice President and Head of Product Portfolio & Innovation at QIAGEN. "With QIAmini, QIAsprint Connect and QIAsymphony Connect, we are supporting customers with new ways to tackle complex challenges – from liquid biopsy to high-throughput screening – with smart, scalable solutions." These upcoming launches build on recent enhancements across QIAGEN’s automation portfolio, including the upgraded QIAcube Connect and EZ2 Connect systems. Together, they reflect QIAGEN’s strategy to provide modular, scalable solutions in sample preparation that match evolving lab needs from small research settings to high-volume testing labs. To learn more about QIAGEN’s portfolio of instruments for automated sample preparation, please visit: https://www.qiagen.com/de-de/product-categories/instruments-and-automation/nucleic-acid-purification About QIAGEN QIAGEN N.V., a Netherlands-based holding company, is the leading global provider of Sample to Insight solutions that enable customers to gain valuable molecular insights from samples containing the building blocks of life. Our sample technologies isolate and process DNA, RNA and proteins from blood, tissue and other materials. Assay technologies make these biomolecules visible and ready for analysis. Bioinformatics software and knowledge bases interpret data to report relevant, actionable insights. Automation solutions tie these together in seamless and cost-effective workflows. QIAGEN provides solutions to more than 500,000 customers around the world in Molecular Diagnostics (human healthcare) and Life Sciences (academia, pharma R&D and industrial applications, primarily forensics). As of December 31, 2024, QIAGEN employed more than 5,700 people in over 35 locations worldwide. Further information can be found at https://www.qiagen.com. Forward-Looking Statement Certain statements contained in this press release may be considered forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. To the extent that any of the statements contained herein relating to QIAGEN's products, timing for launch and development, marketing and/or regulatory approvals, financial and operational outlook, growth and expansion, collaborations, markets, strategy or operating results, including without limitation its expected adjusted net sales and adjusted diluted earnings results, are forward-looking, such statements are based on current expectations and assumptions that involve a number of uncertainties and risks. Such uncertainties and risks include, but are not limited to, risks associated with management of growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN's products (including fluctuations due to general economic conditions, the level and timing of customers' funding, budgets and other factors); our ability to obtain regulatory approval of our products; difficulties in successfully adapting QIAGEN's products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitors' products; market acceptance of QIAGEN's new products and the integration of acquired technologies and businesses; actions of governments, global or regional economic developments, weather or transportation delays, natural disasters, political or public health crises, and its impact on the demand for our products and other aspects of our business, or other force majeure events; as well as the possibility that expected benefits related to recent or pending acquisitions may not materialize as expected; and the other factors discussed under the heading "Risk Factors in our most recent Annual Report on Form 20-F. For further information, please refer to the discussions in reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission. Source: QIAGEN N.V. Category: Life Sciences View source version on businesswire.com: https://www.businesswire.com/news/home/20250414679841/en/ Contacts QIAGEN Investor Relations John Gilardi, +49 2103 29 11711 Domenica Martorana, +49 2103 29 11244 e-mail: ir@QIAGEN.com Public Relations Thomas Theuringer, +49 2103 29 11826 Lisa Specht, +49 2103 29 14181 e-mail: pr@QIAGEN.com View Comments |

||

| 10.04.25 13:53:00 | Biogen (BIIB) Soars 5.7%: Is Further Upside Left in the Stock? |  |

| Biogen Inc. (BIIB) shares rallied 5.7% in the last trading session to close at $120.49. This move can be attributable to notable volume with a higher number of shares being traded than in a typical session. This compares to the stock's 20.6% loss over the past four weeks. The stock surged in response to the broader market rally after President Trump announced a 90-day pause on the sweeping tariffs against non-retaliating countries. This company is expected to post quarterly earnings of $3.59 per share in its upcoming report, which represents a year-over-year change of -2.2%. Revenues are expected to be $2.24 billion, down 2.2% from the year-ago quarter. Earnings and revenue growth expectations certainly give a good sense of the potential strength in a stock, but empirical research shows that trends in earnings estimate revisions are strongly correlated with near-term stock price movements. For Biogen, the consensus EPS estimate for the quarter has remained unchanged over the last 30 days. And a stock's price usually doesn't keep moving higher in the absence of any trend in earnings estimate revisions. So, make sure to keep an eye on BIIB going forward to see if this recent jump can turn into more strength down the road. The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here >>>> Biogen belongs to the Zacks Medical - Biomedical and Genetics industry. Another stock from the same industry, Qiagen (QGEN), closed the last trading session 6.8% higher at $41.43. Over the past month, QGEN has returned -1.1%. Qiagen's consensus EPS estimate for the upcoming report has remained unchanged over the past month at $0.49. Compared to the company's year-ago EPS, this represents a change of +4.3%. Qiagen currently boasts a Zacks Rank of #3 (Hold). Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Biogen Inc. (BIIB) : Free Stock Analysis Report QIAGEN N.V. (QGEN) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 08.04.25 15:22:00 | QIAGEN N.V. to Release Results for Q1 2025 and Hold Webcast |  |

| VENLO, The Netherlands, April 08, 2025--(BUSINESS WIRE)--QIAGEN N.V. (NYSE: QGEN) (Frankfurt Stock Exchange: QIA) announced plans to release results for the first quarter 2025. Press release date / time: Wednesday, May 7, shortly after 22:05Frankfurt time / 21:05 London time / 16:05 New York time. Conference call date / time: Thursday, May 8, at15:00 Frankfurt time / 14:00 London time / 09:00 New York time. Three options for joining the conference call Register for call back connection - Click here: Connect me Service is available 15 minutes before the call starts Dial-in by phone U.S.: +1 646 828 8193 UK: +44 (0)330 165 3655 GER: +49 (0)69 6610 2480 Conference ID: 5803222 To avoid waiting time, please join the event conference 5-10 minutes prior to the start time. Access the audio webcast - Click here: Access Webcast A conference call replay will be available by using the following link: https://event.webcasts.com/starthere.jsp?ei=1684140&tp_key=ac10da14a0 Contact: IR@qiagen.com About QIAGEN QIAGEN N.V., a Netherlands-based holding company, is the leading global provider of Sample to Insight solutions, enabling customers to extract and gain valuable molecular insights from samples containing the building blocks of life. Our Sample technologies isolate and process DNA, RNA and proteins from blood, tissue and other materials. Assay technologies prepare these biomolecules for analysis while bioinformatics software and knowledge bases can be used to interpret data to find actionable insights. Automation solutions bring these processes together into seamless and cost-effective workflows. QIAGEN serves over 500,000 customers globally in Life Sciences (academia, pharma R&D and industrial applications, primarily forensics) and Molecular Diagnostics for clinical healthcare. As of December 31, 2024, QIAGEN employed more than 5,700 people in over 35 locations worldwide. Further information can be found at https://www.qiagen.com. source: QIAGEN N.V. category: Financial View source version on businesswire.com: https://www.businesswire.com/news/home/20250408330643/en/ Contacts John Gilardi Vice President Head of Corporate Communications +49 2103 29 11711 +49 152 018 11711 +1 240 686 2222 Email: ir@qiagen.com Domenica Martorana Associate Director Investor Relations +49 2103 29 11244 +49 152 018 11244 Email: ir@qiagen.com View Comments |

||

| 06.04.25 18:28:00 | QIAGEN Delivers Strong Preliminary Q1 2025 Results Exceeding Outlook and Raises Full-Year 2025 Adjusted EPS Outlook |  |

| Q1 2025 preliminary net sales rise 7% CER and adjusted diluted EPS results of at least $0.55 CER both above outlook despite challenging macro environment Full-year 2025 adjusted diluted EPS outlook raised to about $2.35 CER (prior outlook about $2.28 CER) On track to exceed 31% CER adjusted operating income margin ahead of 2028 mid-term target VENLO, Netherlands, April 06, 2025--(BUSINESS WIRE)--QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) today announced preliminary Q1 2025 results that exceeded its outlook for both net sales and adjusted earnings per share (EPS), reflecting strong performances across many growth drivers. Net sales grew approximately 5% (+7% at constant exchange rates, CER) to about $483 million in Q1 2025, surpassing the previously communicated outlook for about 3% CER growth (4% CER core business excluding discontinued products such as NeuMoDx and Dialunox). Adjusted diluted EPS are expected to be at least $0.55 CER compared to the previously communicated outlook for about $0.50 CER. Sales of the QuantiFERON latent TB test grew about 15% CER as global adoption continues to shift from the skin test to this proven, modern blood-based test. The QIAstat-Dx syndromic testing system advanced above 35% CER on continued demand for respiratory panels along with growth in gastrointestinal and meningitis testing. The QIAcuity digital PCR system and QIAGEN Digital Insights bioinformatics business both delivered high-single-digit CER gains, reflecting solid adoption across research and clinical applications. Additional growth contributions also came from higher sales of PCR consumables and from OEM products. Sample technologies sales declined 1% CER, reflecting the cautious instrument spending environment among some Life Sciences customers. Given the positive start to 2025, QIAGEN is raising its adjusted diluted EPS outlook for full-year 2025 in light of the strong sales growth in Q1 and the overall current business trends, which includes expected headwinds from the recently announced U.S. import tariffs and a better-than-expected tax environment. Full-year 2025, adjusted diluted EPS are now expected to be about $2.35 CER, up from the prior full-year outlook for about $2.28 CER, while reaffirming the goal to improve the adjusted operating income margin to above 30% for the year. QIAGEN will provide additional perspectives on the outlook for full-year 2025 with the publication of full Q1 2025 results on May 7, 2025. Additionally, QIAGEN now expects to reach the mid-term adjusted operating income margin goal of at least 31% well ahead of the original 2028 timeline, reflecting the stronger-than-anticipated improvements delivered during 2024 and 2025. Story Continues About QIAGEN QIAGEN N.V., a Netherlands-based holding company, is the leading global provider of Sample to Insight solutions, enabling customers to extract and gain valuable molecular insights from samples containing the building blocks of life. Our Sample technologies isolate and process DNA, RNA and proteins from blood, tissue and other materials. Assay technologies prepare these biomolecules for analysis while bioinformatics software and knowledge bases can be used to interpret data to find actionable insights. Automation solutions bring these processes together into seamless and cost-effective workflows. QIAGEN serves over 500,000 customers globally in Life Sciences (academia, pharma R&D and industrial applications, primarily forensics) and Molecular Diagnostics for clinical healthcare. As of December 31, 2024, QIAGEN employed more than 5,700 people in over 35 locations worldwide. For more information, visit www.qiagen.com. Forward-Looking Statement Certain statements in this press release may constitute forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These statements, including those regarding QIAGEN's financial and operational outlook, including its expected Q1 25 and full year net sales, adjusted diluted EPS and adjusted operating income margin, products, development timelines, marketing and / or regulatory approvals, growth strategies, collaborations and operating results are based on current expectations and assumptions. However, they involve uncertainties and risks. These risks include, but are not limited to, challenges in managing growth and international operations (including the effects of currency fluctuations, tariffs, regulatory processes and logistical dependencies), variability in operating results and allocations between customer classes, commercial development for our products to customers in the Life Sciences and clinical healthcare, changes in relationships with customers, suppliers or strategic partners; competition and rapid technological advancements; fluctuating demand for QIAGEN's products due to factors such as economic conditions, customer budgets and funding cycles; obtaining and maintaining regulatory approvals for our products; difficulties in successfully adapting QIAGEN's products into integrated solutions and producing these products; and protecting product differentiation from competitors. Additional uncertainties may arise from market acceptance of new products, integration of acquisitions, governmental actions, global or regional economic developments, natural disasters, political or public health crises, and other "force majeure" events. There is also no guarantee that anticipated financial and operational results will materialize as expected. For a comprehensive overview of risks, please refer to the "Risk Factors" contained in our most recent Annual Report on Form 20-F and other reports filed with or furnished to the U.S. Securities and Exchange Commission. Source: QIAGEN Category: Corporate View source version on businesswire.com: https://www.businesswire.com/news/home/20250406144830/en/ Contacts Contacts QIAGEN: Investor Relations John Gilardi, +49 2103 29 11711 Domenica Martorana, +49 2103 29 11244 e-mail: ir@QIAGEN.com Public Relations Thomas Theuringer, +49 2103 29 11826 e-mail: pr@QIAGEN.com View Comments |

||

| 02.04.25 10:06:32 | Qiagen Full Year 2024 Earnings: EPS Misses Expectations |  |

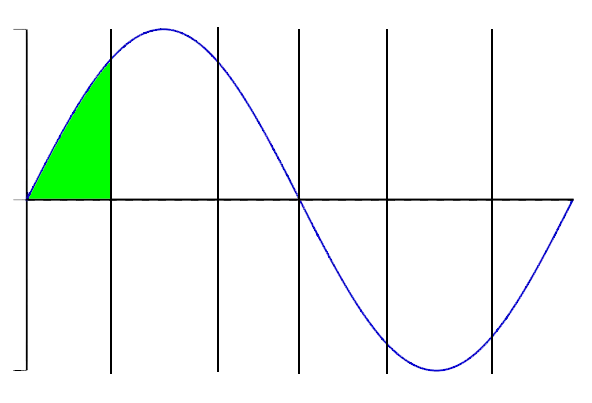

| Qiagen (NYSE:QGEN) Full Year 2024 Results Key Financial Results Revenue: US$1.98b (flat on FY 2023). Net income: US$83.6m (down 76% from FY 2023). Profit margin: 4.2% (down from 17% in FY 2023). EPS: US$0.39 (down from US$1.59 in FY 2023). We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.NYSE:QGEN Earnings and Revenue Growth April 2nd 2025 All figures shown in the chart above are for the trailing 12 month (TTM) period Qiagen EPS Misses Expectations Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 51%. Looking ahead, revenue is forecast to grow 6.8% p.a. on average during the next 3 years, compared to a 5.8% growth forecast for the Life Sciences industry in the US. Performance of the American Life Sciences industry. The company's share price is broadly unchanged from a week ago. Risk Analysis We should say that we've discovered 2 warning signs for Qiagen that you should be aware of before investing here. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 01.04.25 05:30:00 | QIAGEN Launches QIAprep& Plasmodium Kit to Strengthen Malaria Research and Surveillance Efforts |  |

| Malaria remains a major global health threat, with more than 250 million cases and 600,000 deaths in 2024 – over 90% of them in Africa QIAprep& Plasmodium Kit enables streamlined detection of five malaria-causing parasites for epidemiological research and surveillance Novel QIAGEN assays support mixed-infection tracking, vaccine impact assessment and malaria control strategies in regions with limited healthcare infrastructure VENLO, Netherlands, April 01, 2025--(BUSINESS WIRE)--QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) today announced the launch of the QIAprep& Plasmodium Kit and two companion assays to support malaria research and surveillance efforts. This new solution combines sample preparation and quantitative PCR (qPCR) into a single workflow, providing a rapid and accessible tool for detecting malaria-causing parasites from blood samples. Malaria remains one of the world’s most pressing public health challenges, particularly in tropical and subtropical regions. The disease is caused by five species of Plasmodium parasites, with Plasmodium falciparum responsible for the most severe cases. In 2024 alone, malaria accounted for more than 250 million cases worldwide, with over 90% occurring in Africa. While the integration of vaccines into anti-malaria programs began in 2024, and mark a significant milestone, comprehensive monitoring of parasite prevalence and evolution is essential for disease control. The QIAprep& Plasmodium Kit simplifies malaria research by enabling the detection of all five Plasmodium species in human samples. "Malaria research and surveillance remains critical in the fight against this potentially fatal disease, especially as control efforts evolve," said Swathi Kumar, Head of Global PCR, Enzymes & Oligos at QIAGEN. "Our new QIAprep& Plasmodium Kit and assays allow researchers to monitor disease prevalence through high-frequency screening so they can better track the spread of this disease, study vaccine effectiveness and identify emerging dominant parasite strains that may impact treatment and containment strategies." QIAGEN’s QIAprep& technology – originally developed for COVID-19 research – integrates liquid-based sample preparation with qPCR into a streamlined and cost-efficient workflow. It offers high sensitivity, detecting as little as one parasite per microliter, and is compatible with both liquid and dried blood samples, including QIAcard FTA cards. It is also suitable for use on many qPCR platforms, including QIAGEN’s Rotor-Gene Q. Story Continues The accompanying assays further enhance malaria research detection and differentiation. The QIAGEN Pf/Non-Pf Detection Assay is a single-reaction screen for the most common cause of malaria in humans involving Plasmodium falciparum, while the QIAGEN Pv/Pm/Po/Pk Detection Assay helps distinguish between the remaining four common species that cause malaria – P. vivax, P. malariae, P. ovale, and P. knowlesi – allowing scientists to track mixed infections, study parasite evolution during vaccine rollouts and ensure that comprehensive epidemiological surveillance data is available when designing response measures. For more information about the QIAprep& Plasmodium Kit and assays, visit: https://www.qiagen.com/de/products/discovery-and-translational-research/pcr-qpcr-dpcr/real-time-pcr-enzymes-and-kits/qiaprep-and-amp-plasmodium-kit About QIAGEN QIAGEN N.V., a Netherlands-based holding company, is the leading global provider of Sample to Insight solutions, enabling customers to extract and gain valuable molecular insights from samples containing the building blocks of life. Our Sample technologies isolate and process DNA, RNA and proteins from blood, tissue, and other materials. Assay technologies prepare these biomolecules for analysis while bioinformatics software and knowledge bases can be used to interpret data to find actionable insights. Automation solutions bring these processes together into seamless and cost-effective workflows. QIAGEN serves over 500,000 customers globally in Life Sciences (academia, pharma R&D and industrial applications, primarily forensics) and Molecular Diagnostics for clinical healthcare. As of December 31, 2024, QIAGEN employed more than 5,700 people in over 35 locations worldwide. For more information, visit www.qiagen.com. Forward-Looking Statement Certain statements in this press release may constitute forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. These statements, including those regarding QIAGEN's products, development timelines, marketing and / or regulatory approvals, financial and operational outlook, growth strategies, collaborations and operating results - such as expected adjusted net sales and adjusted diluted earnings - are based on current expectations and assumptions. However, they involve uncertainties and risks. These risks include, but are not limited to, challenges in managing growth and international operations (including the effects of currency fluctuations, regulatory processes and logistical dependencies), variability in operating results and allocations between customer classes, commercial development for our products to customers in the Life Sciences and clinical healthcare, changes in relationships with customers, suppliers or strategic partners; competition and rapid technological advancements; fluctuating demand for QIAGEN's products due to factors such as economic conditions, customer budgets and funding cycles; obtaining and maintaining regulatory approvals for our products; difficulties in successfully adapting QIAGEN's products into integrated solutions and producing these products; and protecting product differentiation from competitors. Additional uncertainties may arise from market acceptance of new products, integration of acquisitions, governmental actions, global or regional economic developments, natural disasters, political or public health crises, and other "force majeure" events. There is also no guarantee that anticipated benefits from acquisitions will materialize as expected. For a comprehensive overview of risks, please refer to the "Risk Factors" contained in our most recent Annual Report on Form 20-F and other reports filed with or furnished to the U.S. Securities and Exchange Commission. Source: QIAGEN N.V. Category: Corporate View source version on businesswire.com: https://www.businesswire.com/news/home/20250331605807/en/ Contacts Contacts QIAGEN: Investor Relations John Gilardi +49 2103 29 11711 Domenica Martorana +49 2103 29 11244 e-mail: ir@QIAGEN.com Public Relations Thomas Theuringer +49 2103 29 11826 Lisa Specht +49 2103 29 14181 e-mail: pr@QIAGEN.com View Comments |

||