Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

Smith & Nephew PLC |

27.03.25 |

28.05.25 |

0.0018 |

Smith & Nephew PLC |

03.10.24 |

08.11.24 |

0.1440 |

Smith & Nephew PLC |

28.03.24 |

22.05.24 |

0.2310 |

Smith & Nephew PLC |

05.10.23 |

01.11.23 |

0.1440 |

Smith & Nephew PLC |

30.03.23 |

17.05.23 |

0.2310 |

Smith & Nephew PLC |

29.09.22 |

26.10.22 |

0.1440 |

Smith & Nephew PLC |

31.03.22 |

11.05.22 |

0.2310 |

Smith & Nephew PLC |

30.09.21 |

27.10.21 |

0.1440 |

Smith & Nephew PLC |

01.04.21 |

12.05.21 |

0.2310 |

Smith & Nephew PLC |

01.10.20 |

28.10.20 |

0.1440 |

Smith & Nephew PLC |

02.04.20 |

06.05.20 |

0.2310 |

Smith & Nephew PLC |

03.10.19 |

30.10.19 |

0.1440 |

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 08.04.25 13:21:04 | Are Poor Financial Prospects Dragging Down Smith & Nephew plc (LON:SN. Stock? |  |

| With its stock down 15% over the past month, it is easy to disregard Smith & Nephew (LON:SN.). Given that stock prices are usually driven by a company’s fundamentals over the long term, which in this case look pretty weak, we decided to study the company's key financial indicators. Particularly, we will be paying attention to Smith & Nephew's ROE today. Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity. This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality. How Is ROE Calculated? The formula for ROE is: Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity So, based on the above formula, the ROE for Smith & Nephew is: 7.8% = US$412m ÷ US$5.3b (Based on the trailing twelve months to December 2024). The 'return' is the profit over the last twelve months. Another way to think of that is that for every £1 worth of equity, the company was able to earn £0.08 in profit. Check out our latest analysis for Smith & Nephew Why Is ROE Important For Earnings Growth? Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features. Smith & Nephew's Earnings Growth And 7.8% ROE When you first look at it, Smith & Nephew's ROE doesn't look that attractive. Yet, a closer study shows that the company's ROE is similar to the industry average of 6.8%. But Smith & Nephew saw a five year net income decline of 13% over the past five years. Bear in mind, the company does have a slightly low ROE. So that's what might be causing earnings growth to shrink. That being said, we compared Smith & Nephew's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 3.8% in the same 5-year period.LSE:SN. Past Earnings Growth April 8th 2025 Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is SN. fairly valued? This infographic on the company's intrinsic value has everything you need to know. Story Continues Is Smith & Nephew Making Efficient Use Of Its Profits? Smith & Nephew's high three-year median payout ratio of 107% suggests that the company is depleting its resources to keep up its dividend payments, and this shows in its shrinking earnings. Paying a dividend higher than reported profits is not a sustainable move. Our risks dashboard should have the 2 risks we have identified for Smith & Nephew. In addition, Smith & Nephew has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 40% over the next three years. Accordingly, the expected drop in the payout ratio explains the expected increase in the company's ROE to 17%, over the same period. Conclusion On the whole, Smith & Nephew's performance is quite a big let-down. Particularly, its ROE is a huge disappointment, not to mention its lack of proper reinvestment into the business. As a result its earnings growth has also been quite disappointing. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the company's future earnings growth forecasts take a look at this freereport on analyst forecasts for the company to find out more. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 01.04.25 14:02:06 | Is Smith & Nephew plc (SNN) the Most Undervalued Healthcare Stock to Buy According to Analysts? |  |

| We recently published a list of 8 Most Undervalued Healthcare Stocks to Buy According to Analysts. In this article, we are going to take a look at where Smith & Nephew plc (NYSE:SNN) stands against other most undervalued healthcare stocks to buy according to analysts. Rising Healthcare Costs and the Impact of Tariffs on US-China Trade in the Healthcare Sector Healthcare prices and expenditures have been rising in the United States. Healthcare spending in the United States climbed 7.5% from 2022 to $4.9 trillion in 2023, according to the Centers for Medicare & Medicaid Services. The healthcare sector accounted for 17.6% of the US economy in 2023, up 17.4% from 2022. The two primary drivers of this rise are the expansion of private health insurance and Medicare. As more and more US companies look to China for deals on the next promising chemical, whether in the obesity or cancer area, the effect of tariffs on this ongoing trend has become a major point of dispute in the healthcare business. On February 7, Carlo Rizzuto, managing director of Versant Ventures, discussed how tariffs affect healthcare on CNBC’s “Fast Money.” According to Rizzuto, tariffs could have two effects on the industry. The first would be goods created in China and released into the US or other markets. To understand how tariffs might affect such trade operations, the industry would need to observe how the tariffs are implemented in the market. Second, and more specifically, China serves as a major base for contract production and research in the US healthcare sector. Therefore, anything that increases that cost is likely to make the market more challenging. The management of the healthcare industry, which is already under pressure from investors, will not be improved by cost increases. Impact of China on Healthcare R&D and the Growing Potential of Undervalued Healthcare Stocks The great majority of healthcare organizations use a Chinese CRO or manufacturing partner in some capacity during the research and development phase, according to Rizzuto, who discussed China’s significant influence in the pharmaceutical and healthcare industries. It, therefore, has a significant impact on how pharmaceutical and biotech businesses operate in the country. This pattern is quite frequent across all sizes of enterprises. Simply said, healthcare companies are unable to reshore all of their externalized R&D and production to the United States due to the absence of the infrastructure necessary to manage the transfer. As a result, it is difficult to see how such a massive reshoring might take place. The costs to attain this goal can be calculated linearly with the number of tariffs implemented. Story Continues McKinsey projects that healthcare EBITDA will increase at a 7% CAGR from a baseline of $676 billion in 2023 to $987 billion in 2028. While growth is expected to be faster in some sectors (such as specialty pharmacy and HST), recovery from post-pandemic lows is expected to promote improvement in several categories. Because they enable payers and providers to function more efficiently in a complex environment, software platforms are vital to the healthcare ecosystem. Technological innovation (such as generative AI and machine learning) continues to offer opportunities for stakeholders from all sectors by automating processes, promoting data connectivity, and generating actionable insights. Specialty pharmacy revenue is expected to expand significantly because of higher utilization and pipeline extension (as in cancer), according to McKinsey. The increased usage of specialty drugs is contributing to the continued growth of specialty pharmacy profit pools. Our Methodology For our methodology, we used a screener to filter healthcare stocks with a forward PE ratio of less than 15 and an analyst upside of over 20%. We then ranked the stocks based on the analyst upside as of March 30th, 2025. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).Is Smith & Nephew plc (SNN) the Most Undervalued Healthcare Stock to Buy According to Analysts? A healthcare professional putting the finishing touches on a patient's knee implant in an operating theater. Smith & Nephew Plc (NYSE:SNN) Price Target Upside: 27% Smith & Nephew plc (NYSE:SNN) is a global medical technology company specializing in orthopedic reconstruction, sports medicine, and advanced wound care solutions. The company stands out for its commitment to innovation, investing in research and development to create cutting-edge technologies like robotic-assisted surgical systems, advanced biomaterials, and digital health platforms. Recent innovations, such as the CORI Digital Tensioner for knee procedures and advanced hip systems, enhance surgical precision and improve patient outcomes. Smith & Nephew plc (NYSE:SNN) reported strong Q4 2024 and full-year results, which were fueled by its 12-Point Plan for operational transformation. Its Q4 revenue reached $1.57 billion, reflecting a 7.8% increase, while full-year revenue totaled $5.8 billion, with a 5.3% growth rate. New product launches contributed over 60% to this growth. The company’s profitability saw significant gains, with operating profit surging 54.6% to $657 million. Trading profit rose by 8.2%, reaching over $1 billion, and trading profit margin increased to 18.1%, up from 17.5% in 2023. Cash flow also improved, with operational cash growing 50.2% to $1.24 billion and free cash flow increasing by 327.1% to $551 million. Smith & Nephew plc (NYSE:SNN)’s earnings per share (EPS) jumped 56.3% to 47.2 cents, while adjusted EPS rose slightly to 84.3 cents. The company’s strong performance was driven by operational efficiency, better product availability, and successful commercialization, despite challenges like inflation and issues in China. Looking ahead, the business expects revenue growth of around 5% in 2025, with trading profit margins projected between 19–20%. Continued operational savings are expected to further boost margins beyond 2025. Overall, SNN ranks 6th on our list of most undervalued healthcare stocks to buy according to analysts. While we acknowledge the potential of healthcare companies, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than SNN but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock. READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires. Disclosure: None. This article is originally published at Insider Monkey. View Comments |

||

| 23.03.25 07:28:31 | Here's Why We're Wary Of Buying Smith & Nephew's (LON:SN.) For Its Upcoming Dividend |  |

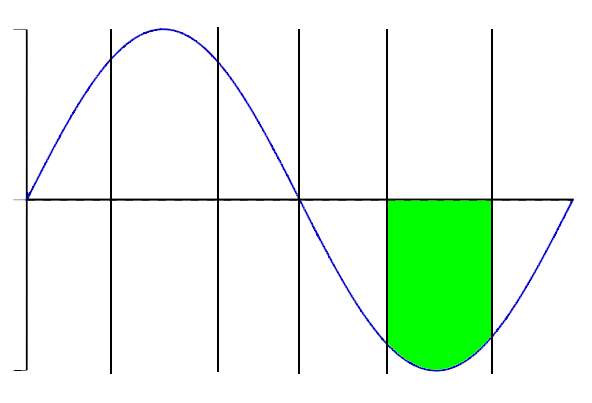

| Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Smith & Nephew plc (LON:SN.) is about to trade ex-dividend in the next 3 days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. In other words, investors can purchase Smith & Nephew's shares before the 27th of March in order to be eligible for the dividend, which will be paid on the 28th of May. The company's next dividend payment will be US$0.231 per share, and in the last 12 months, the company paid a total of US$0.38 per share. Calculating the last year's worth of payments shows that Smith & Nephew has a trailing yield of 2.7% on the current share price of UK£10.85. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Smith & Nephew can afford its dividend, and if the dividend could grow. Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. It paid out 79% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be worried about the risk of a drop in earnings. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out more than half (54%) of its free cash flow in the past year, which is within an average range for most companies. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously. See our latest analysis for Smith & Nephew Click here to see the company's payout ratio, plus analyst estimates of its future dividends.LSE:SN. Historic Dividend March 23rd 2025 Have Earnings And Dividends Been Growing? Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Readers will understand then, why we're concerned to see Smith & Nephew's earnings per share have dropped 7.2% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls. Story Continues Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Smith & Nephew has delivered 2.4% dividend growth per year on average over the past 10 years. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Smith & Nephew is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future. The Bottom Line Is Smith & Nephew an attractive dividend stock, or better left on the shelf? While earnings per share are shrinking, it's encouraging to see that at least Smith & Nephew's dividend appears sustainable, with earnings and cashflow payout ratios that are within reasonable bounds. Bottom line: Smith & Nephew has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors. So if you're still interested in Smith & Nephew despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Every company has risks, and we've spotted 2 warning signs for Smith & Nephew you should know about. If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 17.03.25 07:55:12 | Smith & Nephew's (LON:SN.) Solid Earnings Are Supported By Other Strong Factors |  |

| Smith & Nephew plc's (LON:SN.) strong earnings report was rewarded with a positive stock price move. We did some digging and found some further encouraging factors that investors will like. See our latest analysis for Smith & Nephew LSE:SN. Earnings and Revenue History March 17th 2025 How Do Unusual Items Influence Profit? For anyone who wants to understand Smith & Nephew's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by US$233m due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. If Smith & Nephew doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates. Our Take On Smith & Nephew's Profit Performance Unusual items (expenses) detracted from Smith & Nephew's earnings over the last year, but we might see an improvement next year. Based on this observation, we consider it likely that Smith & Nephew's statutory profit actually understates its earnings potential! And the EPS is up 56% over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about Smith & Nephew as a business, it's important to be aware of any risks it's facing. Case in point: We've spotted 2 warning signs for Smith & Nephew you should be aware of. This note has only looked at a single factor that sheds light on the nature of Smith & Nephew's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 12.03.25 05:06:51 | Smith & Nephew Full Year 2024 Earnings: EPS Misses Expectations |  |

| Smith & Nephew (LON:SN.) Full Year 2024 Results Key Financial Results Revenue: US$5.81b (up 4.7% from FY 2023). Net income: US$412.0m (up 57% from FY 2023). Profit margin: 7.1% (up from 4.7% in FY 2023). EPS: US$0.47 (up from US$0.30 in FY 2023).LSE:SN. Revenue and Expenses Breakdown March 12th 2025 All figures shown in the chart above are for the trailing 12 month (TTM) period Smith & Nephew EPS Misses Expectations Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 1.7%. The primary driver behind last 12 months revenue was the Orthopaedics segment contributing a total revenue of US$2.31b (40% of total revenue). The largest operating expense was General & Administrative costs, amounting to US$2.90b (79% of total expenses). Explore how SN.'s revenue and expenses shape its earnings. Looking ahead, revenue is forecast to grow 4.8% p.a. on average during the next 3 years, compared to a 5.8% growth forecast for the Medical Equipment industry in the United Kingdom. Performance of the British Medical Equipment industry. The company's shares are down 3.1% from a week ago. Risk Analysis What about risks? Every company has them, and we've spotted 2 warning signs for Smith & Nephew you should know about. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 11.03.25 15:00:00 | Smith+Nephew to showcase advanced Orthopaedic Reconstruction technologies for Robotics, Knees, Hips, and Shoulders at AAOS 2025 |  |

| Smith & Nephew UK Ltd Smith+Nephew (LSE:SN, NYSE:SNN), the global medical technology company, today announces it will feature the latest advancements in Orthopaedic Reconstruction at the American Academy of Orthopaedic Surgeons Annual Meeting in San Diego this week. Some of the highlighted technologies will include: Robotics: Optimizing and personalizing surgery With CORIOGRAPH◊ Pre-Op Planning and Modeling Services advanced technology and the CORI Surgical System's image-agnostic solution for robotic-assisted knee and computer-guided hip replacement procedures, Smith+Nephew offers a highly personalized approach for both surgeons and their patients. CORIOGRAPH’s recent addition of support for hip procedures expands the platform’s reach to provide advanced planning and simulation technology for THA. A defining feature of the technology is the ability to simulate a patient’s functional activities of daily living (ADLs) specific to their anatomy.1 Alongside these advancements, the CORI◊ Digital Tensioner enhances the level of personalization in knee procedures by providing objective gap data for planning and execution of the procedure.2-4 Now available for UKA, TKA, and Revision TKA, the CORI Digital Tensioner is designed to deliver accurate gap balance measurements with the CORI Surgical System for optimizing the surgical plan to align with each patient’s unique soft tissue anatomy. These cutting-edge technologies enable a highly personalized and tailored surgical approach with the CORI Surgical System, ensuring that patient-specific needs are met. Learn more by visiting the CORIOGRAPH webpage here. Hips: Best-in-class just got better Smith+Nephew’s new CATALYSTEM◊ Primary Hip System is designed to address the evolving demands of primary hip surgery - including the increased adoption of anterior approach procedures. It features a triple-taper stem design with uniform proximal loading,5 and the reduced distal stem geometry and shorter lengths are ideal for anterior approach - and suitable for all approaches.6 Smith+Nephew’s total hip arthroplasty (THA) portfolio was recently recognized in the latest annual report from the Australian Orthopaedic Association National Joint Replacement Registry. It highlighted the exceptional performance of proprietary OXINIUM◊ (Oxidized Zirconium) on highly cross-linked polyethylene where the data indicated the combination has the highest survivorship rate (>94.1%) among all bearing combinations over a 20-year period for THA.7 Read the press release here. Story Continues Knees: Raising the bar in revisions Smith+Nephew recently launched proprietary OXINIUM implant technology on the LEGION◊ Hinged Knee (HK) System that delivers the durability of metals, the wear resistance of ceramics, and corrosion resistance better than both metal and ceramic.8-14 Part of the LEGION Total Knee (TK) System, the LEGION HK System is designed to provide a natural range of motion with medial pivot, lateral roll back, and screw home. Since 2011, the LEGION HK System has enabled surgeons to transition intraoperatively from a constrained revision knee implant to a CoCr-hinged assembly. Learn more by visiting the LEGION HK webpage here. AETOS◊ Shoulder System: Elegant design. Elevated experience. Smith+Nephew recently received 510(k) clearance from the FDA for a stemless anatomic total shoulder for the AETOS Shoulder System (AETOS Stemless). AETOS Stemless addresses the growing demand for anatomic total shoulder replacement with a small operating room footprint allowing for an efficient procedure.15 It is designed to maximize metaphyseal fixation and stability with an inlay collar, cruciate fins, and porous titanium coating to encourage biological fixation.16,17 Learn more by visiting the AETOS webpage here. To learn more about Smith+Nephew’s advanced solutions for Orthopaedic Reconstruction, please visit our booth (#3729) at the American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting in San Diego March 11-13, 2025 or visit wwww.smith-nephew.com. - ends – Media Enquiries Dave Snyder +1 (978) 749-1440 Smith+Nephew david.snyder@smith-nephew.com References Smith+Nephew 2020. Internal Report. EA/RECON/VISIONAIRE/001/v6. Smith+Nephew 2022. Optimus TKA Tensioner Gap Assessment Verification Report. Internal Report. 10059269. Smith+Nephew 2022. Tensioner KPC: Tensioner Calibration Check. Internal Report. TR100116, REV B. Smith+Nephew 2022. CORI TENSIONER. 2020.04 Study Cases. Preliminary Analysis Report REV B. Smith + Nephew 2024. Finite Element Analysis of the CATALYSTEM Hip Stem Design. Internal Report. OR-24-025 Smith + Nephew 2024. Surgeon Feedback on the CATALYSTEM Total Hip System. Internal Report. CSD.REC.24.001 Australian Orthopaedic Association National Joint Replacement Registry (AOANJRR) Hip, Knee & Shoulder Arthroplasty: 2024 Annual Report Adelaide; AOA, 2024:1–629. Available at: https://aoanjrr.sahmri.com/annual-reports-2024. Accessed December 11, 2024. Sheth NP, Lementowski P, Hunter G, Garino JP. Clinical applications of oxidized zirconium. J Surg Orthop Adv. 2008;17(1):17-26. Davidson JA, Mishra AK, Poggie RA. Friction and UHMWPE wear of cobalt alloy, zirconia, titanium nitride, and amorphous diamond-like carbon implant bearing surfaces. Poster presented at: 4th World Biomaterials Con1992; Berlin, FRG. Hobbs L, Rozen V, Mangin S, Treska M. Oxidation Microstructures and Interfaces in the Oxidized Zirconium Knee. Int J Appl Ceram Technol. 2005. Long M, Riester L, Hunter G. Nano-Hardness Measurements of Oxidized Zr.2.5Nb and Various Orthopaedic Materials. 1998. Smith+Nephew 2010. Hip Simulator Wear Testing of XLPE Liners Against Oxidized Zr-2.5Nb and BIOLOX Delta Heads. Interal Report. OR-10-155 Smith+Nephew 2010. OR-10-155. Smith+Nephew 2016. OR-16-127 Smith+Nephew 2023. AETOS Instruments & Trays. Internal Report. ER-04-0990-0020 REV B Pilliar RM. Cementless implant fixation—toward improved reliability. Orthopedic Clinics of North America. 2005;36(1):113-119 About Smith+Nephew Smith+Nephew is a portfolio medical technology business focused on the repair, regeneration and replacement of soft and hard tissue. We exist to restore people’s bodies and their self-belief by using technology to take the limits off living. We call this purpose ‘Life Unlimited’. Our 17,000 employees deliver this mission every day, making a difference to patients’ lives through the excellence of our product portfolio, and the invention and application of new technologies across our three global business units of Orthopaedics, Sports Medicine & ENT and Advanced Wound Management. Founded in Hull, UK, in 1856, we now operate in around 100 countries, and generated annual sales of $5.8 billion in 2024. Smith+Nephew is a constituent of the FTSE100 (LSE:SN, NYSE:SNN). The terms ‘Group’ and ‘Smith+Nephew’ are used to refer to Smith & Nephew plc and its consolidated subsidiaries, unless the context requires otherwise. For more information about Smith+Nephew, please visit www.smith-nephew.com and follow us on X, LinkedIn, Instagram or Facebook. Forward-looking Statements This document may contain forward-looking statements that may or may not prove accurate. For example, statements regarding expected revenue growth and trading profit margins, market trends and our product pipeline are forward-looking statements. Phrases such as "aim", "plan", "intend", "anticipate", "well-placed", "believe", "estimate", "expect", "target", "consider" and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from what is expressed or implied by the statements. For Smith+Nephew, these factors include: conflicts in Europe and the Middle East, economic and financial conditions in the markets we serve, especially those affecting healthcare providers, payers and customers; price levels for established and innovative medical devices; developments in medical technology; regulatory approvals, reimbursement decisions or other government actions; product defects or recalls or other problems with quality management systems or failure to comply with related regulations; litigation relating to patent or other claims; legal and financial compliance risks and related investigative, remedial or enforcement actions; disruption to our supply chain or operations or those of our suppliers; competition for qualified personnel; strategic actions, including acquisitions and disposals, our success in performing due diligence, valuing and integrating acquired businesses; disruption that may result from transactions or other changes we make in our business plans or organisation to adapt to market developments; relationships with healthcare professionals; reliance on information technology and cybersecurity; disruptions due to natural disasters, weather and climate change related events; changes in customer and other stakeholder sustainability expectations; changes in taxation regulations; effects of foreign exchange volatility; and numerous other matters that affect us or our markets, including those of a political, economic, business, competitive or reputational nature. Please refer to the documents that Smith+Nephew has filed with the U.S. Securities and Exchange Commission under the U.S. Securities Exchange Act of 1934, as amended, including Smith+Nephew's most recent annual report on Form 20-F, which is available on the SEC’s website at www. sec.gov, for a discussion of certain of these factors. Any forward-looking statement is based on information available to Smith+Nephew as of the date of the statement. All written or oral forward-looking statements attributable to Smith+Nephew are qualified by this caution. Smith+Nephew does not undertake any obligation to update or revise any forward-looking statement to reflect any change in circumstances or in Smith+Nephew's expectations. ◊ Trademark of Smith+Nephew. Certain marks registered in US Patent and Trademark Office. . View Comments |

||

| 10.03.25 15:00:00 | Smith+Nephew to highlight breakthrough Sports Medicine technologies for joint repair at AAOS 2025 |  |

| Smith & Nephew UK Ltd Smith+Nephew (LSE:SN, NYSE:SNN), the global medical technology company, today announces it will showcase the latest advancements in Sports Medicine for joint repair at the American Academy of Orthopaedic Surgeons Annual Meeting in San Diego this week. Some of the highlighted technologies will include: Spatial Surgery Smith+Nephew continues to pioneer in Sports Medicine and is excited to introduce a new category called Spatial Surgery - a revolutionary new frontier in arthroscopic surgical innovation. This 510(k)-pending technology called the TESSA◊ Spatial Surgery System (Tracking Enabled Spatial Surgery Assistant) plans to combine personalized operative planning with a real-time, tracking enabled device using advanced imaging and augmented reality guidance to assist a surgeon in decision making. Learn more at www.spatialsurgery.com CARTIHEAL◊ AGILI-C◊ Cartilage Repair Implant Smith+Nephew’s CARTIHEAL AGILI-C Cartilage Repair Implant is an FDA approved device that was previously granted breakthrough designation and is now evolving the cartilage repair landscape. The unique properties of the implant enable physicians to surgically treat patients that previously had no access to cartilage repair procedures.1-3 In a large randomized controlled trial, when compared to the surgical standard of care,* the CARTIHEAL AGILI-C implant demonstrated: Proven clinical superiority: Patients treated with the CARTIHEAL AGILI-C Implant reported significantly better knee function, pain relief, and mobility improvements over a 4-year period.1,4 ** Significantly lower risk of TKA or osteotomy: Patients’ risk of additional knee reconstruction/realignment surgery at 4 years.4 Different patient profiles – same great results: The scaffold treats a broad group of patients across age, lesion size, and presence of osteoarthritis while delivering clinically meaningful results.1,4, ** The use of the CARTIHEAL AGILI-C Implant in the presence of osteoarthritis will be featured during OrthoDome at AAOS on Wednesday, March 12, from 11:16-11:31 am PST. You can learn more by visiting the CARTIHEAL AGILI-C webpage here. REGENETEN◊ Bioinductive Implant The REGENETEN Bioinductive Implant is a scaffold made from highly purified type I collagen fibers and has changed the way surgeons treat tendon injuries for more than ten years.5-8 Clinical studies in rotator cuff repair have demonstrated results that surpass the current standard of care: 3x reduction in the risk of re-tear in a randomized controlled trial versus standard repair alone augmenting repair of medium-to-large full-thickness tears (at 1-year).9*** Accelerated recovery and return to activity when used as an isolated treatment (compared with takedown and suture anchor repair),10,11 while leading to consistent tendon healing for partial-thickness tears.9,12 Well established technique used in >150,000 patients, with a proprietary delivery and fixation system resulting in a 15-minute procedure.9 Story Continues In addition to continued value in rotator cuff repair, usage of the REGENETEN Implant continues to increase in tendons around the body, including those in the hip, knee, and foot & ankle, where surgeons recognize its potential to improve tendon healing. You can learn more by visiting the REGENETEN webpage here. To learn more about Smith+Nephew’s Sports Medicine joint repair solutions and enabling technologies, please visit our booth (#3729) at the American Academy of Orthopaedic Surgeons Annual Meeting in San Diego March 11-13, 2025, or visit www.smith-nephew.com. - ends – Media Enquiries Dave Snyder +1 (978) 749-1440 Smith+Nephew david.snyder@smith-nephew.com * Debridement or microfracture ** Over a 2- and 4-year follow-up *** Re-tear: 8.3% vs 25.8%; Relative risk=0.32 [95% Confidence Interval 0.13- 0.83]; p=0.0106. References Altschuler N, Zaslav KR, Di Matteo B, et al. Aragonite-Based Scaffold Versus Microfracture and Debridement for the Treatment of Knee Chondral and Osteochondral Lesions: Results of a Multicenter Randomized Controlled Trial. Am J Sports Med. 2023;51(4):957-967 Kon E, Di Matteo B, Verdonk P, et al. Aragonite-Based Scaffold for the Treatment of Joint Surface Lesions in Mild to Moderate Osteoarthritic Knees: Results of a 2-Year Multicenter Prospective Study. Am J Sports Med. 2021;49(3):588-598 Kon E, Filardo G, Shani J, et al. Osteochondral regeneration with a novel aragonite-hyaluronate biphasic scaffold: up to 12-month follow-up study in a goat model. J Orthop Surg Res. 2015;10:81 Conte P, Anzillotti G, Crawford DC, et al. Differential analysis of the impact of lesions' location on clinical and radiological outcomes after the implantation of a novel aragonite-based scaffold to treat knee cartilage defects. Int Orthop. 2024;48(12):3117-3126 Bokor DJ, et al. Muscles Ligaments Tendons J. 2016;6(1):16-25. Warren JR, et al. J Shoulder Elbow Surg. 2024;33(11):2515-2529 Bokor DJ, et al. Muscles Ligaments Tendons J. 2015;5(3):144-150. Smith+Nephew 2020 REGENETEN Collagen Implant Physical Characteristics. Internal Report Internal Report. 15009769 Ruiz Ibán MÁ, et al. Arthroscopy. 2024;40(6):1760-1773. Camacho Chacón JA, et al. J Shoulder Elbow Surg. 2024;33(9):1894-1904. Bushnell BD, et al. Orthop J Sports Med. 2021;9(8):23259671211027850. Schlegel TF, Abrams JS, Bushnell BD, Brock JL, Ho CP. Radiologic and clinical evaluation of a bioabsorbable collagen implant to treat partial-thickness tears: a prospective multicenter study. J Shoulder Elbow Surg. 2018 27(2):242-251 About Smith+Nephew Smith+Nephew is a portfolio medical technology business focused on the repair, regeneration and replacement of soft and hard tissue. We exist to restore people’s bodies and their self-belief by using technology to take the limits off living. We call this purpose ‘Life Unlimited’. Our 17,000 employees deliver this mission every day, making a difference to patients’ lives through the excellence of our product portfolio, and the invention and application of new technologies across our three global business units of Orthopaedics, Sports Medicine & ENT and Advanced Wound Management. Founded in Hull, UK, in 1856, we now operate in around 100 countries, and generated annual sales of $5.8 billion in 2024. Smith+Nephew is a constituent of the FTSE100 (LSE:SN, NYSE:SNN). The terms ‘Group’ and ‘Smith+Nephew’ are used to refer to Smith & Nephew plc and its consolidated subsidiaries, unless the context requires otherwise. For more information about Smith+Nephew, please visit www.smith-nephew.com and follow us on X, LinkedIn, Instagram or Facebook. Forward-looking Statements This document may contain forward-looking statements that may or may not prove accurate. For example, statements regarding expected revenue growth and trading profit margins, market trends and our product pipeline are forward-looking statements. Phrases such as "aim", "plan", "intend", "anticipate", "well-placed", "believe", "estimate", "expect", "target", "consider" and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from what is expressed or implied by the statements. For Smith+Nephew, these factors include: conflicts in Europe and the Middle East, economic and financial conditions in the markets we serve, especially those affecting healthcare providers, payers and customers; price levels for established and innovative medical devices; developments in medical technology; regulatory approvals, reimbursement decisions or other government actions; product defects or recalls or other problems with quality management systems or failure to comply with related regulations; litigation relating to patent or other claims; legal and financial compliance risks and related investigative, remedial or enforcement actions; disruption to our supply chain or operations or those of our suppliers; competition for qualified personnel; strategic actions, including acquisitions and disposals, our success in performing due diligence, valuing and integrating acquired businesses; disruption that may result from transactions or other changes we make in our business plans or organisation to adapt to market developments; relationships with healthcare professionals; reliance on information technology and cybersecurity; disruptions due to natural disasters, weather and climate change related events; changes in customer and other stakeholder sustainability expectations; changes in taxation regulations; effects of foreign exchange volatility; and numerous other matters that affect us or our markets, including those of a political, economic, business, competitive or reputational nature. Please refer to the documents that Smith+Nephew has filed with the U.S. Securities and Exchange Commission under the U.S. Securities Exchange Act of 1934, as amended, including Smith+Nephew's most recent annual report on Form 20-F, which is available on the SEC’s website at www. sec.gov, for a discussion of certain of these factors. Any forward-looking statement is based on information available to Smith+Nephew as of the date of the statement. All written or oral forward-looking statements attributable to Smith+Nephew are qualified by this caution. Smith+Nephew does not undertake any obligation to update or revise any forward-looking statement to reflect any change in circumstances or in Smith+Nephew's expectations. ◊ Trademark of Smith+Nephew. Certain marks registered in US Patent and Trademark Office. View Comments |

||

| 06.03.25 15:00:00 | New report confirms Smith+Nephew’s OXINIUM™ Technology is the best performing bearing surface at 20 years for total hip arthroplasty |  |

| Smith & Nephew UK Ltd Smith+Nephew (LSE:SN, NYSE:SNN), the global medical technology company, is pleased to announce that the latest annual report from the Australian Orthopaedic Association National Joint Replacement Registry (AOANJRR) highlights the exceptional performance of Smith+Nephew’s proprietary OXINIUM on highly cross-linked polyethylene. The data indicates that this combination has the highest survivorship rate (94.1%) among all bearing combinations over a 20-year period for total hip arthroplasty (THA).1 The report on 20-year outcomes corroborates similar findings and peer-reviewed publications from the National Joint Registry for England, Wales, Northern Ireland and the Isle of Man (NJR).2 Whitehouse et al. found that hip implants combining delta ceramic or OXINIUM (Oxidized Zirconium) heads with XLPE (highly cross-linked polyethylene) liners or cups had the lowest risk of needing revision surgery over a 15-year period.3 Four registries in total - including the Italian Registry (RIPO; Register of Orthopaedic Prosthetic Implants) and the Dutch Arthroplasty Register (LROI) - have now demonstrated that OXINIUM/XLPE had a 35% lower risk of revision at 10-years versus other modular acetabular implants1-5 These findings offer valuable guidance for surgeons and patients in selecting the most reliable implant materials for long-term outcomes. “When I started in practice more than 20 years ago bearing wear was the leading cause of failure of hip replacements,” said Prof. Bill Walter of The University of Sydney and Royal North Shore Hospital. “We used to see osteolysis as the main reason for revision. The AOANJRR now shows that bearing wear has been virtually eliminated as a cause of failure. The bearing combination of OXINIUM on highly cross-linked polyethylene leads the pack with revision rates at 20 years significantly lower than even metal on XLPE.” Through a unique manufacturing process, the OXINIUM alloy becomes a ceramicised metal - a true material transformation - rather than an applied coating.6 It is this material transformation that provides OXINIUM with its ground-breaking performance benefits which include: Unrivalled Material Science: The durability of metal, the wear resistance of ceramic and corrosion resistance better than both metal and ceramic.6-16 Differentiated Composition: Virtually no nickel, cobalt and chromium,16 with a 30x reduction in pro-inflammatory markers for OXINIUM.*17 As such, OXINIUM implants do not require declaration of the presence of CMR (carcinogenic, mutagenic, reprotoxic) substances on the labeling. Story Continues “Registries throughout the world have highlighted the performance of OXINIUM for total hip arthroplasty. The AOANJRR report showing 20-year outcomes provides powerful evidence for payers, hospitals, surgeons, and patients of our truly differentiated and proven technology,” said Craig Gaffin, President of Global Orthopaedics at Smith+Nephew. “OXINIUM/XLPE continues to demonstrate superior revision rates across multiple global joint replacement registries.” To learn more about Smith+Nephew’s OXINIUM Technology and hip reconstruction portfolio, please visit our booth (#3729) at the American Academy of Orthopaedic Surgeons Annual Meeting in San Diego March 11-13, 2025 or visit https://www.smith-nephew.com/en-us/health-care-professionals/products/orthopaedics/oxinium. - ends – Media Enquiries Dave Snyder +1 (978) 749-1440 Smith+Nephew david.snyder@smith-nephew.com * ASTM International Standard Specification for Wrought Zirconium-2.5 Niobium Alloy for Surgical Implant Applications (UNS R60901) Designation: F 2384 – 10. References Australian Orthopaedic Association National Joint Replacement Registry (AOANJRR) Hip, Knee & Shoulder Arthroplasty: 2024 Annual Report Adelaide; AOA, 2024:1–629. Available at: https://aoanjrr.sahmri.com/annual-reports-2024. Accessed December 11, 2024 National Joint Registry for England, Wales and Northern Ireland: 21st Annual Report. 2024. Available at: NJR 21st Annual Report 2024_Hips.pdf. Accessed January 06, 2025. Whitehouse MR, Patel R, French JMR, et al. The association of bearing surface materials with the risk of revision following primary total hip replacement: A cohort analysis of 1,026,481 hip replacements from the National Joint Registry. PLoS Med 2024;21(11): e1004478. Peters RM, Van Steenbergen LN, Stevens M, Rijk PC, Bulstra SK, Zijlstra WP. The effect of bearing type on the outcome of total hip arthroplasty. Acta Orthop. 2018:89;163–169. Available at: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5901513/. Accessed November 9, 2023. Atrey A, Ancarani C, Fitch D, Bordini B. Impact of bearing couple on long-term component survivorship for primary cementless total hip replacement in a large arthroplasty registry. Poster presented at: Canadian Orthopedic Association; June 20–23, 2018; Victoria, British Columbia, Canada. Hunter G, Dickinson J, Herb B, et al. Creation of oxidized zirconium orthopaedic implants. Journal of ASTM International. 2005;2:1-14. Long M, Riester L, Hunter G. Nano-hardness Measurements of Oxidized Zr-2.5Nb and Various Orthopaedic Materials. Abstract presented at: 24th Annual Meeting of the Society for Biomaterials. April 22-26, 1998, San Diego, California. Parikh A, Hill P, Hines G, Pawar V. Wear of conventional and highly crosslinked polyethylene liners during simulated fast walking/jogging. Poster presented at: Orthopaedic Research Society Annual Meeting; 2009; Las Vegas; NV. Parikh A, Hill P, Pawar V, Sprague J. Long-term Simulator Wear Performance of an Advanced Bearing Technology for THA. Poster presented at: 2013 Annual Meeting of the Orthopaedic Research Society. Poster no. 1028. Papannagari R, Hines G, Sprague J, Morrison M. Long-term wear performance of an advanced bearing technology for TKA. Poster presented at: Orthopaedic Research Society Annual Meeting; 2011; Long Beach, CA. Smith+Nephew 2010. OR-10-155. Aldinger P, Williams T, Woodard E. Accelerated fretting corrosion testing of zirconia toughened alumina composite ceramic and a new composition of ceramicised metal femoral heads. Poster presented at: Orthopaedic Research Society Annual Meeting; 2017; San Diego, CA. Smith+Nephew 2016. OR-16-127. 2005 ASM International Engineering Materials Achievement Award. Dalal A, Pawar V, McAllister K, Weaver C, Hallab NJ. Orthopedic implant cobalt-alloy particles produce greater toxicity and inflammatory cytokines than titanium alloy and zirconium alloy-based particles in vitro, in human osteoblasts, fibroblasts, and macrophages. J Biomed Mater Res Part A. 2012;100A:2147-2158. ASTM F2384-24 (May 2024). Standard specification for wrought zirconium-2.5niobium alloy for surgical implant applications (UNS R60901). Available at: https://www.astm.org/f2384-10r16.html. Accessed February 27, 2025 Hallab NJ, McAllister K, Jacobs JJ, and Pawar, V. Zirconium-Alloy and Zirconium-Oxide Particles Produce less Toxicity and Inflammatory Cytokines than Cobalt-Alloy and Titanium-Alloy Particles In Vitro, in Human Osteoblasts, Fibroblasts and Macrophages. 2012 Annual Meeting of the Orthopaedic Research Society. Poster no. 0971. About Smith+Nephew Smith+Nephew is a portfolio medical technology business focused on the repair, regeneration and replacement of soft and hard tissue. We exist to restore people’s bodies and their self-belief by using technology to take the limits off living. We call this purpose ‘Life Unlimited’. Our 17,000 employees deliver this mission every day, making a difference to patients’ lives through the excellence of our product portfolio, and the invention and application of new technologies across our three global business units of Orthopaedics, Sports Medicine & ENT and Advanced Wound Management. Founded in Hull, UK, in 1856, we now operate in around 100 countries, and generated annual sales of $5.8 billion in 2024. Smith+Nephew is a constituent of the FTSE100 (LSE:SN, NYSE:SNN). The terms ‘Group’ and ‘Smith+Nephew’ are used to refer to Smith & Nephew plc and its consolidated subsidiaries, unless the context requires otherwise. For more information about Smith+Nephew, please visit www.smith-nephew.com and follow us on X, LinkedIn, Instagram or Facebook. Forward-looking Statements This document may contain forward-looking statements that may or may not prove accurate. For example, statements regarding expected revenue growth and trading profit margins, market trends and our product pipeline are forward-looking statements. Phrases such as "aim", "plan", "intend", "anticipate", "well-placed", "believe", "estimate", "expect", "target", "consider" and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from what is expressed or implied by the statements. For Smith+Nephew, these factors include: conflicts in Europe and the Middle East, economic and financial conditions in the markets we serve, especially those affecting healthcare providers, payers and customers; price levels for established and innovative medical devices; developments in medical technology; regulatory approvals, reimbursement decisions or other government actions; product defects or recalls or other problems with quality management systems or failure to comply with related regulations; litigation relating to patent or other claims; legal and financial compliance risks and related investigative, remedial or enforcement actions; disruption to our supply chain or operations or those of our suppliers; competition for qualified personnel; strategic actions, including acquisitions and disposals, our success in performing due diligence, valuing and integrating acquired businesses; disruption that may result from transactions or other changes we make in our business plans or organisation to adapt to market developments; relationships with healthcare professionals; reliance on information technology and cybersecurity; disruptions due to natural disasters, weather and climate change related events; changes in customer and other stakeholder sustainability expectations; changes in taxation regulations; effects of foreign exchange volatility; and numerous other matters that affect us or our markets, including those of a political, economic, business, competitive or reputational nature. Please refer to the documents that Smith+Nephew has filed with the U.S. Securities and Exchange Commission under the U.S. Securities Exchange Act of 1934, as amended, including Smith+Nephew's most recent annual report on Form 20-F, which is available on the SEC’s website at www. sec.gov, for a discussion of certain of these factors. Any forward-looking statement is based on information available to Smith+Nephew as of the date of the statement. All written or oral forward-looking statements attributable to Smith+Nephew are qualified by this caution. Smith+Nephew does not undertake any obligation to update or revise any forward-looking statement to reflect any change in circumstances or in Smith+Nephew's expectations. ◊ Trademark of Smith+Nephew. Certain marks registered in US Patent and Trademark Office. View Comments |

||

| 06.03.25 06:36:06 | Be Wary Of Smith & Nephew (LON:SN.) And Its Returns On Capital |  |

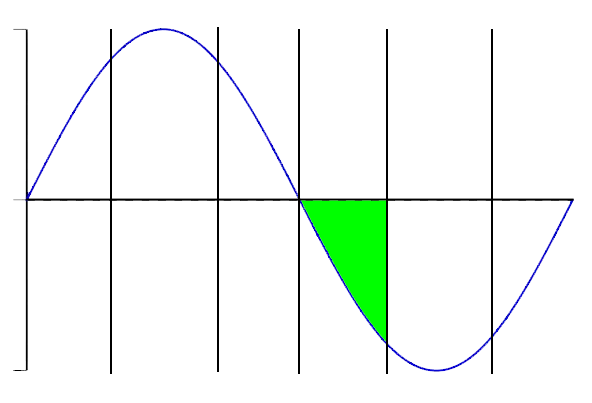

| If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This indicates the company is producing less profit from its investments and its total assets are decreasing. So after glancing at the trends within Smith & Nephew (LON:SN.), we weren't too hopeful. Return On Capital Employed (ROCE): What Is It? Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Smith & Nephew: Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities) 0.074 = US$657m ÷ (US$10b - US$1.5b) (Based on the trailing twelve months to December 2024). Therefore, Smith & Nephew has an ROCE of 7.4%. Even though it's in line with the industry average of 7.3%, it's still a low return by itself. See our latest analysis for Smith & Nephew LSE:SN. Return on Capital Employed March 6th 2025 In the above chart we have measured Smith & Nephew's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Smith & Nephew for free. What Does the ROCE Trend For Smith & Nephew Tell Us? We are a bit worried about the trend of returns on capital at Smith & Nephew. About five years ago, returns on capital were 13%, however they're now substantially lower than that as we saw above. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Smith & Nephew becoming one if things continue as they have. The Bottom Line On Smith & Nephew's ROCE In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. Investors haven't taken kindly to these developments, since the stock has declined 12% from where it was five years ago. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere. Story Continues If you'd like to know about the risks facing Smith & Nephew, we've discovered 1 warning sign that you should be aware of. For those who like to invest in solid companies, check out this freelist of companies with solid balance sheets and high returns on equity. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 05.03.25 16:21:13 | Smith & Nephew opens door to break-up in response to activist, The Times says |  |

| Smith & Nephew has opened up to a possible break-up of the company amid activist pressure to consider a separation of its largest segment, its struggling orthopedics division, marking a shift in the company’s public position, reported The Times’ Alex Ralph. In a meeting with City analysts after Smith & Nephew’s full-year results last week, CFO John Rogers said the group remained committed to the turnaround of the largest of the group’s three units, but could consider options if its growth does not “sustainably improve” or does not result in a re-rating in the shares, The Times noted. Discover the Best Stocks and Maximize Your Portfolio: See what stocks are receiving Strong Buy ratings from top-rated analysts. Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener. Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>> See today’s best-performing stocks on TipRanks >> Read More on SNN: Smith & Nephew announces its efforts to develop technology in Spatial Surgery Smith & Nephew price target raised to 1,300 GBp from 1,250 GBp at Deutsche Bank Smith & Nephew Announces Share Capital Details Positive Outlook for Smith & Nephew: Buy Rating Driven by Strategic Initiatives and Market Growth Potential Smith & Nephew Snats (SNN) Announces Q2 Dividend: Read On for Important Dates View Comments |

||