Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

Traton SE |

15.05.25 |

19.05.25 |

1.7000 € |

Traton SE |

14.06.24 |

18.06.24 |

1.5000 € |

Traton SE |

02.06.23 |

06.06.23 |

0.7000 € |

Traton SE |

10.06.22 |

14.06.22 |

0.5000 € |

Traton SE |

01.07.21 |

05.07.21 |

0.2500 € |

Traton SE |

24.09.20 |

1.0000 € |

|

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 27.07.25 07:17:59 | Traton Second Quarter 2025 Earnings: EPS Misses Expectations |  |

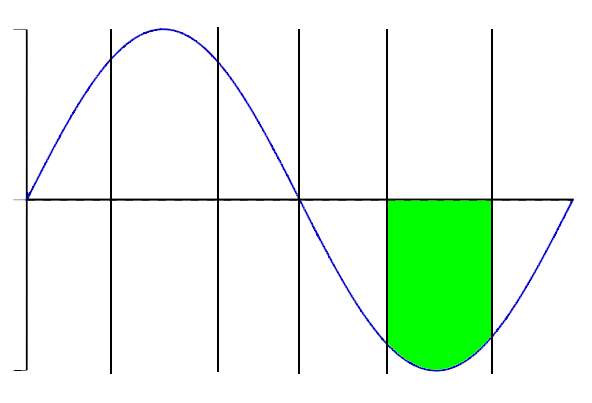

| Traton (ETR:8TRA) Second Quarter 2025 Results Key Financial Results Revenue: €11.3b (down 2.5% from 2Q 2024). Net income: €246.0m (down 58% from 2Q 2024). Profit margin: 2.2% (down from 5.0% in 2Q 2024). EPS: €0.49 (down from €1.17 in 2Q 2024). AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.XTRA:8TRA Earnings and Revenue Growth July 27th 2025 All figures shown in the chart above are for the trailing 12 month (TTM) period Traton EPS Misses Expectations Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 35%. Looking ahead, revenue is forecast to grow 2.7% p.a. on average during the next 3 years, compared to a 5.3% growth forecast for the Machinery industry in Germany. Performance of the German Machinery industry. The company's shares are up 7.4% from a week ago. Risk Analysis It's necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Traton (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 24.07.25 05:54:17 | Boasting A 14% Return On Equity, Is Traton SE (ETR:8TRA) A Top Quality Stock? |  |

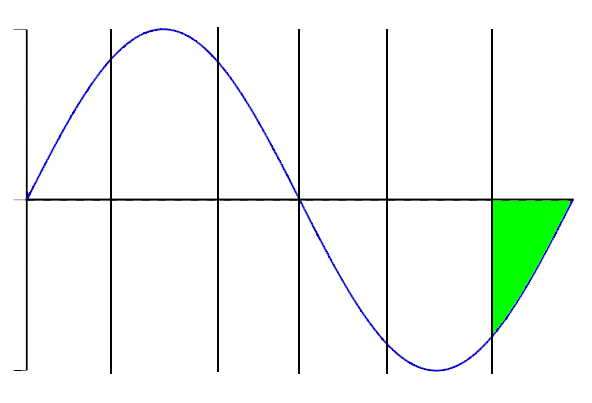

| While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. By way of learning-by-doing, we'll look at ROE to gain a better understanding of Traton SE (ETR:8TRA). Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments. This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality. How To Calculate Return On Equity? The formula for ROE is: Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity So, based on the above formula, the ROE for Traton is: 14% = €2.5b ÷ €19b (Based on the trailing twelve months to March 2025). The 'return' is the profit over the last twelve months. So, this means that for every €1 of its shareholder's investments, the company generates a profit of €0.14. See our latest analysis for Traton Does Traton Have A Good Return On Equity? Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. However, this method is only useful as a rough check, because companies do differ quite a bit within the same industry classification. As is clear from the image below, Traton has a better ROE than the average (10%) in the Machinery industry.XTRA:8TRA Return on Equity July 24th 2025 That's what we like to see. Bear in mind, a high ROE doesn't always mean superior financial performance. A higher proportion of debt in a company's capital structure may also result in a high ROE, where the high debt levels could be a huge risk . You can see the 2 risks we have identified for Traton by visiting our risks dashboard for free on our platform here. How Does Debt Impact Return On Equity? Virtually all companies need money to invest in the business, to grow profits. That cash can come from issuing shares, retained earnings, or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. In this manner the use of debt will boost ROE, even though the core economics of the business stay the same. Traton's Debt And Its 14% ROE Traton clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 1.30. While its ROE is respectable, it is worth keeping in mind that there is usually a limit as to how much debt a company can use. Debt increases risk and reduces options for the company in the future, so you generally want to see some good returns from using it. Story Continues Conclusion Return on equity is a useful indicator of the ability of a business to generate profits and return them to shareholders. In our books, the highest quality companies have high return on equity, despite low debt. All else being equal, a higher ROE is better. But when a business is high quality, the market often bids it up to a price that reflects this. Profit growth rates, versus the expectations reflected in the price of the stock, are a particularly important to consider. So I think it may be worth checking this freereport on analyst forecasts for the company. Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 09.07.25 09:32:07 | Traton posts slight increase in Q2 deliveries but US tariffs weigh |  |

| (Reuters) -German truck maker Traton reported on Wednesday a 1% increase in second-quarter deliveries year on year despite ongoing uncertainty over U.S. import tariffs. The Volkswagen subsidiary said its international motors division saw a 10% increase in sales following a fire at a supplier's plant in the prior-year quarter. "However, the U.S. market faces ongoing uncertainty regarding the impact of import tariffs and the economic outlook," a statement said, adding that half-year sales in that unit had fallen by 2%. (Reporting by Amir Orusov, editing by Rachel More) View Comments |

||

| 30.06.25 08:02:00 | 2025 Medium & Heavy Truck Manufacturers Strategy Playbook: Strategy Focus, Key Strategies & Plans, SWOT, Trends & Growth Opportunities |  |

| Company Logo Unlock pivotal industry insights with the 2025 Strategy Playbook Bundle, detailing strategic focuses, trends, and future plans of leading truck manufacturers Daimler, Volvo, Traton, PACCAR, and Iveco. Essential for decision-makers, it navigates sustainability shifts and macroeconomic challenges in the global truck market. Dublin, June 30, 2025 (GLOBE NEWSWIRE) -- The "2025 Medium & Heavy Truck Manufacturers Strategy Playbook: Daimler, Volvo, Traton, PACCAR, Iveco - Strategy Focus, Key Strategies & Plans, SWOT, Trends & Growth Opportunities, Business and Market Outlook" company profile has been added to ResearchAndMarkets.com's offering. This report provides a comprehensive analysis of leading industry manufacturers in the global Medium & Heavy Truck market, offering in-depth insights into their strategic focus, key initiatives, and future plans. The reports assess the evolving market landscape amid geopolitical uncertainties, macroeconomic challenges, and the industry's transition towards sustainability and electrification. With a detailed SWOT analysis, financial performance review, and evaluation of key market and technology trends, this bundle serves as an essential resource for decision-makers across the industry value chain. The report also incorporates analysis & assessment of key market, technology & industry trends, along with issues & challenges, which are likely to impact and shape industry's future over near to medium term while providing insights & inputs to be incorporated into the broader strategic planning & decision making processes, thereby, making it relevant, useful and essential from a competitive analysis standpoint. The report also identifies key driving & restraining forces for the industry & assesses their potential degree of impact through a force field analysis. The report concludes by providing a comprehensive outlook & demand forecast on the Global Medium & Heavy Truck market for the medium term. The leading medium & heavy trucks market manufacturers analyzed are: Daimler Truck AG Volvo AB Traton SE PACCAR Inc. Iveco S.p.A. Global Medium & Heavy Truck Market in Normalization Mode while Gearing-Up for a more Sustainable Future amid Global Macroeconomic Complexities & Uncertainties The Global Medium & Heavy Truck market has been in the normalization mode since 2024 after being in the high growth zone and having experienced tailwinds over the last couple of years marked by extraordinary growth, driven by post-pandemic pent-up demand amid easing out of supply chain disruptions & constraints, which enabled the industry OEMs to effectively ramp-up production rates to meet surging demand levels. The market tailwinds drove steady order intake, slight contraction in delivery volumes and strong book-to-bill ratios across most industry OEMs in 2024 and even turbocharged the in-service fleet utilization levels across fleet owners & operators and even revitalized the used trucks market. Story Continues The global medium & heavy truck market is likely to register a slight, up to 10% decrease in year-on-year deliveries for 2025 with sustained demand for new & used trucks likely, led by replacement demand and recent launch of new, sustainable truck models by the industry. In the North American market, the vocational trucks segment continues to drive market demand while the upcoming EPA 2027 emission guidelines are likely to drive pre-buys in the later part of 2025. Going forward, favorable trends, like the introduction of CO2 price loading on conventional, Diesel & Petrol trucks, from 2025 and significant reduction in CO2 emission limits is likely to create a level playing field and facilitate faster adoption of Electric & other sustainable fuels-powered Trucks. The industry, too, continues to work towards rapid development of charging infrastructure and electric mobility ecosystem which is likely to accelerate the ongoing transition towards sustainability across traditional markets. The full commercialization of autonomous trucks now is likely to disrupt the truck market over near term with the emergence of new business & service models configured around them. However, rising defense levels are likely to provide a significant growth opportunity to truck makers, especially in the specialty vehicles segment, over near to medium term with demand skyrocketing for trucks-based missile defense and strike systems globally amid a continued surge in global defense spending which touched the record and all-time high level of $2.7 trillion for 2024 growing at record 9.4% year-on-year, as per SIPRI. The taming of inflation, monetary policy easing and the relative easing of supply chain woes globally have come as welcome news for the world economy in 2025, however, policy instabilities, macroeconomic uncertainties & trade tensions created by Trump's protectionism & tariff wars and continuing military conflicts across Ukraine & the Middle East exacerbated by a deteriorating world order and rising defense spending levels amid slowing economic growth & rising debt levels pose a serious challenge to it over near term. Overall, the world economic growth is forecasted to grow merely by 2.8% for 2025 (and 3% for 2026), as per IMF, a level which is almost 900 bps below the average pre-pandemic growth rate registered for the world economy through the 2010s decade. Report Excerpts: Analysis of Daimler's strategy of achieving competitive differentiation, based on technologies, aimed at delivering substantial value addition to customers Decryption of Volvo's plans to further deepen market presence and grow its market share in North America with its 3-pronged growth strategies, focus on services business and to leverage its head start in ZEVs effectively across other key, growth markets Analysis of Traton's internal transformation and 'Concentration-of-Capabilities' approach to group-wide operations for enhanced competitiveness, growth focus in North America spearheaded by the 'International' brand strategy, massive R&D spending and active push for deeper inroads in China Strong focus on scaling-up and growing services business to boost profitability and provide structural stability to business portfolio across most trucking OEMs Zero Emission Vehicles (ZEVs) to form a substantial share of truck sales across most industry OEMs by the end of current decade Tightening regulatory emissions, digital transformation, continued push for autonomy and pursuit of measures to create a level playing field for conventional and zero emission vehicles underway across most mature markets Key Topics Covered: Section 1: Business Snapshot & Overview - Global Top 5 Medium & Heavy Truck Manufacturers Founded Headquartered Business Segments Product Portfolio Revenue Base Market Capitalization Key Executives Shareholding/Ownership Structure Section 2: Financial Performance Analysis - Daimler, Volvo, Traton, PACCAR & Iveco Revenue Base & Growth Trend Revenues Split by Key Segments Revenues Split by Key Geographic Markets & Regions Gross Earnings & Margin Trend Operating Earnings & Operating Margin Trend Return on Sales Trend Profitability Growth Trend Cash Flow from Operations R&D Expenditure Trend CAPEX Trend Order Intake & Truck Deliveries Trend Section 3: Overarching Strategy Focus & Strategic Priorities across Top Industry OEMs - Near to Medium Term Daimler Truck AG Volvo AB Traton SE PACCAR Inc. Iveco S.p.A. Section 4: Key Strategies & Plans for the Industry OEMs - Comprehensive Analysis of Strategies & Plans - Analysis Coverage Product Portfolio Strategies & Plans Market Specific Strategies & Plans R&D Strategies & Plans Growth Strategies & Plans Business and Corporate Strategies & Plans Sales & Marketing Strategies & Plans Production/Manufacturing Strategies & Plans Financial Strategies & Plans Acquisitions, Strategic Alliances & JVs Other Strategies & Strategic Initiatives Section 5: SWOT Analysis - On the Top 5 Industry OEMs Section 6: Key Industry Trends Section 7: Key Market Trends Section 8: Key Technology Trends Section 9: Key Issues, Challenges & Risk Factors Section 10: Global Medium & Heavy Truck Market - Force Field Analysis - Analysis of Driving & Restraining Forces and their Overall Dynamics Section 11: Strategic Market Outlook through 2028 Analysis of Emerging Market Scenario for the Global Medium & Heavy Truck Market Demand Outlook - Near to Medium Term Demand Growth Projections for the Global Medium & Heavy Truck Market through 2028 For more information about this company profile visit https://www.researchandmarkets.com/r/4093yz About ResearchAndMarkets.com ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends. CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900 View Comments |

||

| 02.04.25 11:35:55 | Should You Investigate Traton SE (ETR:8TRA) At €31.80? |  |

| Today we're going to take a look at the well-established Traton SE (ETR:8TRA). The company's stock led the XTRA gainers with a relatively large price hike in the past couple of weeks. While good news for shareholders, the company has traded much higher in the past year. With many analysts covering the large-cap stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. But what if there is still an opportunity to buy? Let’s take a look at Traton’s outlook and value based on the most recent financial data to see if the opportunity still exists. Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit. What's The Opportunity In Traton? Great news for investors – Traton is still trading at a fairly cheap price according to our price multiple model, where we compare the company's price-to-earnings ratio to the industry average. We’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 5.67x is currently well-below the industry average of 16.78x, meaning that it is trading at a cheaper price relative to its peers. What’s more interesting is that, Traton’s share price is quite volatile, which gives us more chances to buy since the share price could sink lower (or rise higher) in the future. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market. See our latest analysis for Traton Can we expect growth from Traton?XTRA:8TRA Earnings and Revenue Growth April 2nd 2025 Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. Traton's earnings growth are expected to be in the teens in the upcoming years, indicating a solid future ahead. This should lead to robust cash flows, feeding into a higher share value. What This Means For You Are you a shareholder? Since 8TRA is currently below the industry PE ratio, it may be a great time to accumulate more of your holdings in the stock. With an optimistic outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as capital structure to consider, which could explain the current price multiple. Story Continues Are you a potential investor? If you’ve been keeping an eye on 8TRA for a while, now might be the time to enter the stock. Its buoyant future profit outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy 8TRA. But before you make any investment decisions, consider other factors such as the strength of its balance sheet, in order to make a well-informed assessment. If you want to dive deeper into Traton, you'd also look into what risks it is currently facing. Be aware that Traton is showing 2 warning signs in our investment analysis and 1 of those is a bit unpleasant... If you are no longer interested in Traton, you can use our free platform to see our list of over 50 other stocks with a high growth potential. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 13.03.25 04:30:10 | Analysts Are Updating Their Traton SE (ETR:8TRA) Estimates After Its Annual Results |  |

| Traton SE (ETR:8TRA) shareholders are probably feeling a little disappointed, since its shares fell 6.8% to €34.40 in the week after its latest full-year results. The result was positive overall - although revenues of €47b were in line with what the analysts predicted, Traton surprised by delivering a statutory profit of €5.61 per share, modestly greater than expected. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Traton after the latest results. Check out our latest analysis for Traton XTRA:8TRA Earnings and Revenue Growth March 13th 2025 Taking into account the latest results, Traton's 14 analysts currently expect revenues in 2025 to be €47.6b, approximately in line with the last 12 months. Statutory earnings per share are forecast to decrease 5.6% to €5.29 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of €47.3b and earnings per share (EPS) of €5.54 in 2025. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a small dip in their earnings per share forecasts. It might be a surprise to learn that the consensus price target was broadly unchanged at €37.02, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Traton at €51.00 per share, while the most bearish prices it at €29.00. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Traton shareholders. These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Traton's past performance and to peers in the same industry. It's pretty clear that there is an expectation that Traton's revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 0.2% growth on an annualised basis. This is compared to a historical growth rate of 17% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 4.8% per year. Factoring in the forecast slowdown in growth, it seems obvious that Traton is also expected to grow slower than other industry participants. Story Continues The Bottom Line The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Traton's revenue is expected to perform worse than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates. Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Traton going out to 2027, and you can see them free on our platform here. However, before you get too enthused, we've discovered 2 warning signs for Traton (1 doesn't sit too well with us!) that you should be aware of. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 11.03.25 12:17:41 | Traton Full Year 2024 Earnings: EPS Beats Expectations |  |

| Traton (ETR:8TRA) Full Year 2024 Results Key Financial Results Revenue: €47.5b (up 1.3% from FY 2023). Net income: €2.80b (up 14% from FY 2023). Profit margin: 5.9% (up from 5.2% in FY 2023). EPS: €5.61 (up from €4.90 in FY 2023).XTRA:8TRA Earnings and Revenue Growth March 11th 2025 All figures shown in the chart above are for the trailing 12 month (TTM) period Traton EPS Beats Expectations Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 2.9%. Looking ahead, revenue is forecast to grow 2.6% p.a. on average during the next 3 years, compared to a 4.8% growth forecast for the Machinery industry in Germany. Performance of the German Machinery industry. The company's share price is broadly unchanged from a week ago. Risk Analysis Before we wrap up, we've discovered 2 warning signs for Traton (1 is significant!) that you should be aware of. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 10.03.25 08:59:00 | Traton Shares Fall After Company Guides for Weaker Demand, Profitability |  |

| The stock fell after the company—which houses Scania, MAN, International, and Volkswagen Truck & Bus—said demand for trucks would decline. Continue Reading View Comments |

||

| 25.02.25 10:53:45 | If EPS Growth Is Important To You, Traton (ETR:8TRA) Presents An Opportunity |  |

| The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up. So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Traton (ETR:8TRA). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it. See our latest analysis for Traton How Quickly Is Traton Increasing Earnings Per Share? The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Recognition must be given to the that Traton has grown EPS by 54% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers. It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Traton's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. EBIT margins for Traton remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 4.3% to €48b. That's progress. You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.XTRA:8TRA Earnings and Revenue History February 25th 2025 Fortunately, we've got access to analyst forecasts of Traton's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting. Are Traton Insiders Aligned With All Shareholders? As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to Traton, with market caps over €7.6b, is around €4.7m. The CEO of Traton only received €2.2m in total compensation for the year ending December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally. Story Continues Should You Add Traton To Your Watchlist? Traton's earnings have taken off in quite an impressive fashion. Such fast EPS growth prompts the question: has the business reached an inflection point? Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. It will definitely require further research to be sure, but it does seem that Traton has the hallmarks of a quality business; and that would make it well worth watching. Even so, be aware that Traton is showing 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored... There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of German companies which have demonstrated growth backed by significant insider holdings. Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 30.01.25 04:57:45 | Why Traton SE (ETR:8TRA) Looks Like A Quality Company |  |

| While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. We'll use ROE to examine Traton SE (ETR:8TRA), by way of a worked example. Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments. Check out our latest analysis for Traton How Do You Calculate Return On Equity? Return on equity can be calculated by using the formula: Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity So, based on the above formula, the ROE for Traton is: 15% = €2.6b ÷ €17b (Based on the trailing twelve months to September 2024). The 'return' is the yearly profit. So, this means that for every €1 of its shareholder's investments, the company generates a profit of €0.15. Does Traton Have A Good ROE? One simple way to determine if a company has a good return on equity is to compare it to the average for its industry. Importantly, this is far from a perfect measure, because companies differ significantly within the same industry classification. Pleasingly, Traton has a superior ROE than the average (10%) in the Machinery industry.XTRA:8TRA Return on Equity January 30th 2025 That's clearly a positive. Bear in mind, a high ROE doesn't always mean superior financial performance. Especially when a firm uses high levels of debt to finance its debt which may boost its ROE but the high leverage puts the company at risk. You can see the 2 risks we have identified for Traton by visiting our risks dashboard for free on our platform here. How Does Debt Impact Return On Equity? Most companies need money -- from somewhere -- to grow their profits. The cash for investment can come from prior year profits (retained earnings), issuing new shares, or borrowing. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the debt used for growth will improve returns, but won't affect the total equity. That will make the ROE look better than if no debt was used. Combining Traton's Debt And Its 15% Return On Equity Traton clearly uses a high amount of debt to boost returns, as it has a debt to equity ratio of 1.46. While its ROE is pretty respectable, the amount of debt the company is carrying currently is not ideal. Debt does bring extra risk, so it's only really worthwhile when a company generates some decent returns from it. Story Continues Summary Return on equity is useful for comparing the quality of different businesses. In our books, the highest quality companies have high return on equity, despite low debt. All else being equal, a higher ROE is better. Having said that, while ROE is a useful indicator of business quality, you'll have to look at a whole range of factors to determine the right price to buy a stock. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So you might want to take a peek at this data-rich interactive graph of forecasts for the company. Of course Traton may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||