Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

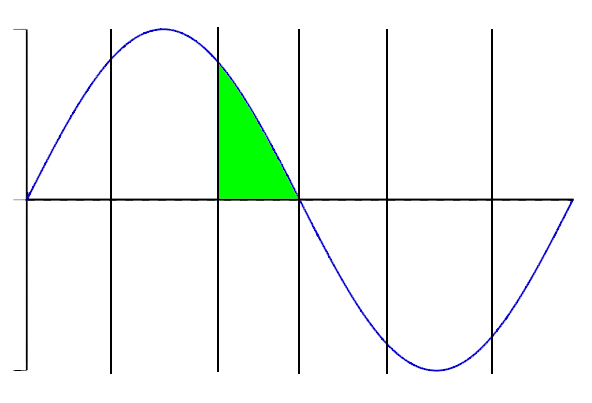

| © tratabu.de

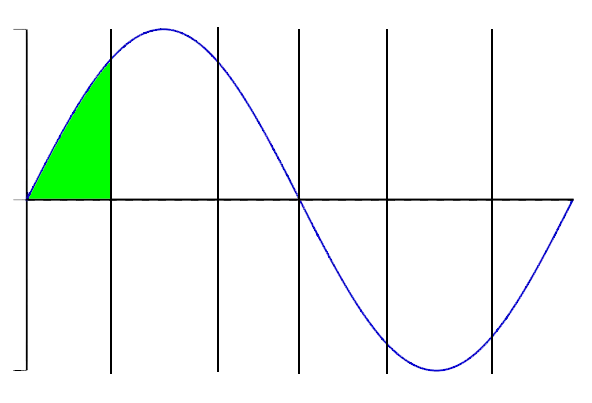

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

Koninklijke Ahold Delhaize NV |

11.04.25 |

24.04.25 |

0.6700 € |

Koninklijke Ahold Delhaize NV |

09.08.24 |

29.08.24 |

0.5000 € |

Koninklijke Ahold Delhaize NV |

12.04.24 |

25.04.24 |

0.6100 € |

Koninklijke Ahold Delhaize NV |

11.08.23 |

31.08.23 |

0.4900 € |

Koninklijke Ahold Delhaize NV |

14.04.23 |

27.04.23 |

0.5900 € |

Koninklijke Ahold Delhaize NV |

12.08.22 |

01.09.22 |

0.4600 € |

Koninklijke Ahold Delhaize NV |

19.04.22 |

28.04.22 |

0.5200 € |

Koninklijke Ahold Delhaize NV |

13.08.21 |

02.09.21 |

0.4300 € |

Koninklijke Ahold Delhaize NV |

16.04.21 |

29.04.21 |

0.4000 € |

Koninklijke Ahold Delhaize NV |

07.08.20 |

27.08.20 |

0.5000 € |

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 14.07.25 09:46:00 | Best Growth Stocks to Buy for July 14th |  |

| Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, July 14th: European Wax Center, Inc. EWCZ: This franchisor and operator of out-of-home waxing services carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 96.8% over the last 60 days. European Wax Center, Inc. Price and ConsensusEuropean Wax Center, Inc. Price and Consensus European Wax Center, Inc. price-consensus-chart | European Wax Center, Inc. Quote European Wax Center has a PEG ratio of 0.47 compared with 3.43 for the industry. The company possesses a Growth Score of B. European Wax Center, Inc. PEG Ratio (TTM)European Wax Center, Inc. PEG Ratio (TTM) European Wax Center, Inc. peg-ratio-ttm | European Wax Center, Inc. Quote Dell Technologies Inc. DELL: This information technology solutions, products and services company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.4% over the last 60 days. Dell Technologies Inc. Price and ConsensusDell Technologies Inc. Price and Consensus Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote Dell has a PEG ratio of 1.06 compared with 1.35 for the industry. The company possesses a Growth Score of B. Dell Technologies Inc. PEG Ratio (TTM)Dell Technologies Inc. PEG Ratio (TTM) Dell Technologies Inc. peg-ratio-ttm | Dell Technologies Inc. Quote Ahold N.V. ADRNY: This retail food stores and e-commerce company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.1% over the last 60 days. Ahold NV Price and ConsensusAhold NV Price and Consensus Ahold NV price-consensus-chart | Ahold NV Quote Ahold has a PEG ratio of 1.66 compared with 2.34 for the industry. The company possesses a Growth Score of A. Ahold NV PEG Ratio (TTM)Ahold NV PEG Ratio (TTM) Ahold NV peg-ratio-ttm | Ahold NV Quote See the full list of top ranked stocks here. Learn more about the Growth score and how it is calculated here. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Dell Technologies Inc. (DELL) : Free Stock Analysis Report Ahold NV (ADRNY) : Free Stock Analysis Report European Wax Center, Inc. (EWCZ) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research |

||

| 10.07.25 15:33:15 | Ahold Delhaize appoints auto industry veteran as CTO |  |

| This story was originally published on CIO Dive. To receive daily news and insights, subscribe to our free daily CIO Dive newsletter. Dive Brief: Grocery giant Ahold Delhaize appointed Jan Brecht as CTO and member of its executive committee, effective Sept. 26, the company said Thursday. Brecht will replace departing CTO Ben Wishart, who first joined the company in 2013. Brecht comes to the company after an extensive career in the auto industry, most recently serving as chief digital information officer at Nissan. Previously, Brecht served as CIO of the Mercedes-Benz and as CIO and head of global supply chain at Adidas. At Ahold Delhaize, Brecht will lead the company's technology function, overseeing enterprise tech strategy, digital innovation and cybersecurity, according to the announcement. Dive Insight: Ahold Delhaize's CTO appointment comes amid a broader tech adoption push at the food retailer, the parent company of Giant, Stop & Shop and other grocers. "Identifying innovation solutions and leveraging the power of AI and data are both critical components that enable us to innovate for growth and efficiency," said CEO Frans Muller, during an earnings call in May. "We have made good progress on this front during the quarter, with several initiatives we believe can scale over time." In February, Ann Dozier joined Ahold Delhaize's U.S. division as its CIO. Previously the chief information and technology officer at Southern Glazer’s Wine and Spirits, Dozier was brought in to lead IT operations with a focus on omnichannel for Ahold Delhaize's U.S. grocery brands. Ahold Delhaize has also been braving the effects of a November 2024 cybersecurity breach that disrupted e-commerce systems for several days and exposed the data of more than 2 million current and former employees. Other food retailers have also been sharpening technology strategies to support productivity and cost-consciousness. U.S.-based grocery chain Giant Eagle announced in June it rolled out a cloud-based warehouse management system to optimize operations. To support its membership growth plans, Walmart-owned Sam's Club is working to improve digital shopping for customers, including the migration of its app to the same platform Walmart uses. In the aftermath of a failed merger with rival grocery chain Kroger, Albertsons said it is working to bolster its data science capabilities amid a productivity and AI adoption push. Technology improvements, including a real-time comprehensive data platform, are part of a three-year cost-cutting initiative announced in January, CEO Susan Morris said in an April earnings call. Story continues Recommended Reading Geopolitics invades technology decision making View comments |

||

| 10.07.25 13:40:03 | Should Value Investors Buy Ahold (ADRNY) Stock? |  |

| Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. Of these, perhaps no stock market trend is more popular than value investing, which is a strategy that has proven to be successful in all sorts of market environments. Value investors use a variety of methods, including tried-and-true valuation metrics, to find these stocks. Luckily, Zacks has developed its own Style Scores system in an effort to find stocks with specific traits. Value investors will be interested in the system's "Value" category. Stocks with both "A" grades in the Value category and high Zacks Ranks are among the strongest value stocks on the market right now. One stock to keep an eye on is Ahold (ADRNY). ADRNY is currently sporting a Zacks Rank #1 (Strong Buy) and an A for Value. The stock has a Forward P/E ratio of 12.83. This compares to its industry's average Forward P/E of 20.12. ADRNY's Forward P/E has been as high as 14.34 and as low as 10.85, with a median of 12.13, all within the past year. ADRNY is also sporting a PEG ratio of 1.51. This metric is used similarly to the famous P/E ratio, but the PEG ratio also takes into account the stock's expected earnings growth rate. ADRNY's industry currently sports an average PEG of 3.26. Over the last 12 months, ADRNY's PEG has been as high as 2.68 and as low as 1.51, with a median of 1.92. Another valuation metric that we should highlight is ADRNY's P/B ratio of 2.3. The P/B is a method of comparing a stock's market value to its book value, which is defined as total assets minus total liabilities. This stock's P/B looks solid versus its industry's average P/B of 6.09. Over the past 12 months, ADRNY's P/B has been as high as 2.40 and as low as 1.74, with a median of 1.98. Value investors also use the P/S ratio. The P/S ratio is calculated as price divided by sales. This is a popular metric because sales are harder to manipulate on an income statement, so they are often considered a better performance indicator. ADRNY has a P/S ratio of 0.39. This compares to its industry's average P/S of 0.89. Finally, investors should note that ADRNY has a P/CF ratio of 6.28. This figure highlights a company's operating cash flow and can be used to find firms that are undervalued when considering their impressive cash outlook. ADRNY's current P/CF looks attractive when compared to its industry's average P/CF of 14.25. Over the past 52 weeks, ADRNY's P/CF has been as high as 6.54 and as low as 4.75, with a median of 5.37. Story Continues These are just a handful of the figures considered in Ahold's great Value grade. Still, they help show that the stock is likely being undervalued at the moment. Add this to the strength of its earnings outlook, and we can clearly see that ADRNY is an impressive value stock right now. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Ahold NV (ADRNY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 09.07.25 16:45:02 | 3 Reasons Why Growth Investors Shouldn't Overlook Ahold (ADRNY) |  |

| Growth stocks are attractive to many investors, as above-average financial growth helps these stocks easily grab the market's attention and produce exceptional returns. But finding a growth stock that can live up to its true potential can be a tough task. By their very nature, these stocks carry above-average risk and volatility. Moreover, if a company's growth story is over or nearing its end, betting on it could lead to significant loss. However, it's pretty easy to find cutting-edge growth stocks with the help of the Zacks Growth Style Score (part of the Zacks Style Scores system), which looks beyond the traditional growth attributes to analyze a company's real growth prospects. Our proprietary system currently recommends Ahold NV (ADRNY) as one such stock. This company not only has a favorable Growth Score, but also carries a top Zacks Rank. Studies have shown that stocks with the best growth features consistently outperform the market. And for stocks that have a combination of a Growth Score of A or B and a Zacks Rank #1 (Strong Buy) or 2 (Buy), returns are even better. While there are numerous reasons why the stock of this company is a great growth pick right now, we have highlighted three of the most important factors below: Earnings Growth Arguably nothing is more important than earnings growth, as surging profit levels is what most investors are after. And for growth investors, double-digit earnings growth is definitely preferable, and often an indication of strong prospects (and stock price gains) for the company under consideration. While the historical EPS growth rate for Ahold is 2.7%, investors should actually focus on the projected growth. The company's EPS is expected to grow 11.2% this year, crushing the industry average, which calls for EPS growth of 4.5%. Impressive Asset Utilization Ratio Asset utilization ratio -- also known as sales-to-total-assets (S/TA) ratio -- is often overlooked by investors, but it is an important indicator in growth investing. This metric exhibits how efficiently a firm is utilizing its assets to generate sales. Right now, Ahold has an S/TA ratio of 1.8, which means that the company gets $1.8 in sales for each dollar in assets. Comparing this to the industry average of 1.19, it can be said that the company is more efficient. In addition to efficiency in generating sales, sales growth plays an important role. And Ahold is well positioned from a sales growth perspective too. The company's sales are expected to grow 11.9% this year versus the industry average of 0%. Story Continues Promising Earnings Estimate Revisions Beyond the metrics outlined above, investors should consider the trend in earnings estimate revisions. A positive trend is a plus here. Empirical research shows that there is a strong correlation between trends in earnings estimate revisions and near-term stock price movements. There have been upward revisions in current-year earnings estimates for Ahold. The Zacks Consensus Estimate for the current year has surged 4.4% over the past month. Bottom Line Ahold has not only earned a Growth Score of B based on a number of factors, including the ones discussed above, but it also carries a Zacks Rank #1 because of the positive earnings estimate revisions. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here. This combination indicates that Ahold is a potential outperformer and a solid choice for growth investors. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Ahold NV (ADRNY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 08.07.25 09:18:00 | The Zacks Analyst Blog Highlights Ahold, Veolia Environment and Japan Airlines |  |

| For Immediate Release Chicago, IL – July 8, 2025 – Zacks.com announces the list of stocks featured in the Analyst Blog. Every day the Zacks Equity Research analysts discuss the latest news and events impacting stocks and the financial markets. Stocks recently featured in the blog include: Ahold ADRNY, Veolia Environment VEOEY and Japan Airlines JAPSY. Here are highlights from Monday’s Analyst Blog: New U.S. Trade Deals, or Not? Global Week Ahead What is going on in the Global Week Ahead? Investors await U.S. President Donald Trump's July 9th deadline for trade partners to strike deals on tariffs with a degree of equanimity. What happens beyond that has the power to stir up more volatility and uncertainty. The macro data docket for the coming week is light, leaving the focus squarely on tariffs. Invest in Gold Thor Metals Group: Best Overall Gold IRA Learn More Priority Gold: Up to $15k in Free Silver + Zero Account Fees on Qualifying Purchase Learn More American Hartford Gold: #1 Precious Metals Dealer in the Nation Learn More Powered by Money.com - Yahoo may earn commission from the links above. So far, the U.S. administration has a limited deal with Britain and an in-principle agreement with Vietnam. Two down. Just roughly 180 to go, including the penguin-populated Heard Island. Next are Reuters' five world market themes, re-ordered for equity traders— (1) By July 9th, will there be new U.S. trade deals, with other countries? Or not? With just days to go until the deadline, investors are on edge to see if the United States forges any agreements with trading partners as they seek to avoid higher levies. Investors have circled this date for months. Trump paused many of the harshest U.S. tariffs for 90 days after his April 2 "Liberation Day" announcement roiled global markets. The coming days could bring a number of scenarios. Some investors have speculated about more delays to allow for talks to continue, but Trump has said he is not thinking of extending the deadline. He even suggested he could impose a tariff of 30% or 35% on imports from Japan - well above the 24% rate he announced in April. (2) A strong 2025 rally, in major Euro Area stocks, is in focus. 2025 was meant to be European markets' year, as erratic U.S. policymaking and a once-in-a-generation fiscal shift in Germany prompted investors to shift their money into Europe. That's still the case for the euro, but in equities-land, Wall Street is catching up fast. The STOXX 600 benchmark is up +6.9% in 2025, just one percentage point above the S&P 500, a narrowing from around a 10-percentage point gap in March. A storming few months for Big Tech — where Europe cannot compete — is driving much of U.S. performance. Poster child Nvidia (NVDA) hit a market value of $3.92 trillion on Thursday. U.S.-friendly, or Europe-unfriendly, tariff developments in the coming days could see Wall Street overtake Europe on a year-to-date basis. 繼續閱讀 Barring one day in April's tariff sell-off, that's not happened since early January. (3) A crypto stablecoin bill move towards U.S. Congressional passage. With the "One Big Beautiful Bill" done, House Republicans will start working on getting the Senate's landmark stablecoin legislation — known as the GENIUS Act — passed and on to Trump's desk. Stablecoins are a type of cryptocurrency designed to maintain a constant value. The act could see stablecoins explode from being worth around $250 billion now, to anywhere between $500 billion and $2 trillion in the next few years, depending on who you ask, but it is getting plenty of central bankers — and China — hot under the collar. One fear, especially in emerging markets, is it will trigger the "dollarization" of their economies, whereas many in the industrialized world warn stablecoins give too much control over money to private firms that experience shows can become very unstable very quickly. (4) A U.S. trade deal with Japan? Stuck in limbo. It may be a sign you're not "winning" in trade talks with the Trump administration when you start attracting verbal broadsides like "spoiled" and “recalcitrant.” That's the position of Japan, facing the July 9th deadline before hefty tariffs take effect on its export-dependent economy. Trump hinted at a "potential" deal in late April, but after multiple rounds of talks, none has emerged. He said last week he could set a tariff of "30% or 35% or whatever" on Japanese imports, far higher than the rate he announced on April 2nd. Cars and rice are sticking points. Japan has vowed not to "sacrifice" its critical agriculture sector. And with autos being Japan's biggest employer and export to the U.S., at nearly 30% of the total, Tokyo may feel it has no choice but to fight for a better deal. (5) U.K. fiscal managers face a possible U.K. bond crisis. British bondholders are no strangers to crisis. The British government's decision to scale back an unpopular reform of the welfare system, thereby blowing a 5-billion-pound hole in its budget plans and the visible upset of Finance Minister Rachel Reeves in parliament was all traders needed to unleash a blast of selling that revived memories of 2022. Benchmark 10-year gilt yields shot up 21 basis points at one point and sterling fell as investors fretted Reeves' job might be on the line, but reversed course after Prime Minister Keir Starmer publicly backed her. Reeves is running out of wiggle-room and may be forced into tax hikes later this year. British consumers are already under pressure. The coming week's data on house prices, car sales and economic growth may show more of those cracks. Zacks #1 Rank (STRONG BUY) Stocks Let’s take a look at Zacks large-cap Value stocks this week. The following are #1 Rank short-term picks, with long-term Zacks Value scores of A. (1) Ahold: This is a $42 a share stock with a market cap of $38.2B. It is found in the Consumer Products-Staples industry. I see a Zacks Value score of A, a Zacks Growth score of B, and a Zacks Momentum score of B. Koninklijke Ahold Delhaize N.V. provides retail stores which offer food and non-food products primarily in the United States and Europe. The company operates supermarkets, convenience stores, compact hypers, pick-up points and gasoline stations as well as specialty stores. Koninklijke Ahold Delhaize N.V., formerly known as Ahold N.V., is based in Zaandam, Netherlands. (2) Veolia Environment: This is a $18 a share stock with a market cap of $26.1B. It is found in the Utility-Water Supply industry. I see a Zacks Value score of A, a Zacks Growth score of F, and a Zacks Momentum score of D. Veolia Environnement is the only global company to offer the entire range of environmental services in the water, waste management, energy and transportation sectors. Veolia has been creating global and integrated solutions for public and private sector clients over the world. The quality of its research, the expertise and synergies developed between its teams, its mastery of the public-private partnership model and our commitment to sustainable development have made us a benchmark player in major environmental matters. (3) Japan Airlines: This is a $10 a share stock with a market cap of $8.8B. It is found in the Transportation-Airline industry. I see a Zacks Value score of A, a Zacks Growth score of B, and a Zacks Momentum score of B. Japan Airlines Co., Ltd. provides scheduled and non-scheduled air transport, aerial work, and aircraft maintenance services. The company's operating segment consists of Air Transport and Others. · The Air Transport segment engages in scheduled and non-scheduled transport operations for cargo and international and domestic passengers · The Others segmentencompasses airline-related business like ticket reservation system, baggage delivery and travel planning services Japan Airlines Co. is headquartered in Tokyo. Why Haven't You Looked at Zacks' Top Stocks? Since 2000, our top stock-picking strategies have blown away the S&P's +7.7% average gain per year. Amazingly, they soared with average gains of +48.4%, +50.2% and +56.7% per year. Today you can access their live picks without cost or obligation. See Stocks Free >> Zacks Investment Research 800-767-3771 ext. 9339 support@zacks.com https://www.zacks.com Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Zacks Investment Research does not engage in investment banking, market making or asset management activities of any securities. These returns are from hypothetical portfolios consisting of stocks with Zacks Rank = 1 that were rebalanced monthly with zero transaction costs. These are not the returns of actual portfolios of stocks. The S&P 500 is an unmanaged index. Visit https://www.zacks.com/performance for information about the performance numbers displayed in this press release. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Veolia Environnement SA (VEOEY) : Free Stock Analysis Report Ahold NV (ADRNY) : Free Stock Analysis Report Japan Airlines Ltd (JAPSY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research 查看留言 |

||

| 07.07.25 13:40:02 | Are Consumer Staples Stocks Lagging Ahold (ADRNY) This Year? |  |

| Investors interested in Consumer Staples stocks should always be looking to find the best-performing companies in the group. Is Ahold NV (ADRNY) one of those stocks right now? A quick glance at the company's year-to-date performance in comparison to the rest of the Consumer Staples sector should help us answer this question. Invest in Gold Thor Metals Group: Best Overall Gold IRA Learn More Priority Gold: Up to $15k in Free Silver + Zero Account Fees on Qualifying Purchase Learn More American Hartford Gold: #1 Precious Metals Dealer in the Nation Learn More Powered by Money.com - Yahoo may earn commission from the links above. Ahold NV is a member of the Consumer Staples sector. This group includes 178 individual stocks and currently holds a Zacks Sector Rank of #14. The Zacks Sector Rank includes 16 different groups and is listed in order from best to worst in terms of the average Zacks Rank of the individual companies within each of these sectors. The Zacks Rank is a proven system that emphasizes earnings estimates and estimate revisions, highlighting a variety of stocks that are displaying the right characteristics to beat the market over the next one to three months. Ahold NV is currently sporting a Zacks Rank of #1 (Strong Buy). Over the past 90 days, the Zacks Consensus Estimate for ADRNY's full-year earnings has moved 7.5% higher. This shows that analyst sentiment has improved and the company's earnings outlook is stronger. According to our latest data, ADRNY has moved about 28.5% on a year-to-date basis. Meanwhile, stocks in the Consumer Staples group have gained about 7% on average. As we can see, Ahold NV is performing better than its sector in the calendar year. One other Consumer Staples stock that has outperformed the sector so far this year is Cervecerias Unidas (CCU). The stock is up 19% year-to-date. For Cervecerias Unidas, the consensus EPS estimate for the current year has increased 12.9% over the past three months. The stock currently has a Zacks Rank #2 (Buy). To break things down more, Ahold NV belongs to the Consumer Products - Staples industry, a group that includes 35 individual companies and currently sits at #172 in the Zacks Industry Rank. This group has lost an average of 1.5% so far this year, so ADRNY is performing better in this area. On the other hand, Cervecerias Unidas belongs to the Beverages - Alcohol industry. This 15-stock industry is currently ranked #73. The industry has moved +3.7% year to date. Going forward, investors interested in Consumer Staples stocks should continue to pay close attention to Ahold NV and Cervecerias Unidas as they could maintain their solid performance. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Ahold NV (ADRNY) : Free Stock Analysis Report Story Continues Compania Cervecerias Unidas, S.A. (CCU) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 02.07.25 09:28:00 | Best Growth Stocks to Buy for July 2nd |  |

| Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, July 2nd: Strattec Security Corporation STRT: This automotive security, access control, and user interface controls products and solutions company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 19.9% over the last 60 days. Strattec Security Corporation Price and ConsensusStrattec Security Corporation Price and Consensus Strattec Security Corporation price-consensus-chart | Strattec Security Corporation Quote Strattec has a PEG ratio of 1.41 compared with 4.76 for the industry. The company possesses a Growth Score of A. Strattec Security Corporation PEG Ratio (TTM)Strattec Security Corporation PEG Ratio (TTM) Strattec Security Corporation peg-ratio-ttm | Strattec Security Corporation Quote Ahold N.V. ADRNY: This retail food stores and e-commerce company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.5% over the last 60 days. Ahold NV Price and ConsensusAhold NV Price and Consensus Ahold NV price-consensus-chart | Ahold NV Quote Ahold has a PEG ratio of 1.61 compared with 2.38 for the industry. The company possesses a Growth Score of B. Ahold NV PEG Ratio (TTM)Ahold NV PEG Ratio (TTM) Ahold NV peg-ratio-ttm | Ahold NV Quote Nova Ltd. NVMI: This process control systems company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.1% over the last 60 days. Nova Ltd. Price and ConsensusNova Ltd. Price and Consensus Nova Ltd. price-consensus-chart | Nova Ltd. Quote Nova has a PEG ratio of 2.23 compared with 9.50 for the industry. The company possesses a Growth Score of B. Nova Ltd. PEG Ratio (TTM)Nova Ltd. PEG Ratio (TTM) Nova Ltd. peg-ratio-ttm | Nova Ltd. Quote See the full list of top ranked stocks here. Learn more about the Growth score and how it is calculated here. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Strattec Security Corporation (STRT) : Free Stock Analysis Report Nova Ltd. (NVMI) : Free Stock Analysis Report Ahold NV (ADRNY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 30.06.25 09:56:00 | Best Growth Stocks to Buy for June 30th |  |

| Here are three stocks with buy ranks and strong growth characteristics for investors to consider today, June 30th: BAE Systems plc BAESY: This company that provides defense, aerospace, and security solutionscarries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.2% over the last 60 days. Bae Systems PLC Price and ConsensusBae Systems PLC Price and Consensus Bae Systems PLC price-consensus-chart | Bae Systems PLC Quote BAE has a PEG ratio of 1.92 compared with 3.73 for the industry. The company possesses a Growth Score of B. Bae Systems PLC PEG Ratio (TTM)Bae Systems PLC PEG Ratio (TTM) Bae Systems PLC peg-ratio-ttm | Bae Systems PLC Quote Ahold N.V. ADRNY: This retail food stores and e-commerce company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.5% over the last 60 days. Ahold NV Price and ConsensusAhold NV Price and Consensus Ahold NV price-consensus-chart | Ahold NV Quote Ahold has a PEG ratio of 1.60 compared with 2.38 for the industry. The company possesses a Growth Score of B. Ahold NV PEG Ratio (TTM)Ahold NV PEG Ratio (TTM) Ahold NV peg-ratio-ttm | Ahold NV Quote Nova Ltd. NVMI: This process control systems company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.1% over the last 60 days. Nova Ltd. Price and ConsensusNova Ltd. Price and Consensus Nova Ltd. price-consensus-chart | Nova Ltd. Quote Nova has a PEG ratio of 2.17 compared with 9.56 for the industry. The company possesses a Growth Score of B. Nova Ltd. PEG Ratio (TTM)Nova Ltd. PEG Ratio (TTM) Nova Ltd. peg-ratio-ttm | Nova Ltd. Quote See the full list of top ranked stocks here. Learn more about the Growth score and how it is calculated here. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Bae Systems PLC (BAESY) : Free Stock Analysis Report Nova Ltd. (NVMI) : Free Stock Analysis Report Ahold NV (ADRNY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 26.06.25 13:33:00 | Best Growth Stocks to Buy for June 26th |  |

| Here are three stocks with buy ranks and strong growth characteristics for investors to consider today June 26th: Strattec Security STRT This company which designs, develops, manufactures and markets mechanical locks, electro-mechanical locks and related products for automotive manufacturers with operations in the United States, Canada and Mexico, carries a Zacks Rank #1 (Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 19.9% over the last 60 days. Strattec Security Corporation Price and ConsensusStrattec Security Corporation Price and Consensus Strattec Security Corporation price-consensus-chart | Strattec Security Corporation Quote Strattec Security has a PEG ratio of 1.32 compared with 4.80 for the industry. The company possesses a Growth Score of A. Strattec Security Corporation PEG Ratio (TTM)Strattec Security Corporation PEG Ratio (TTM) Strattec Security Corporation peg-ratio-ttm | Strattec Security Corporation Quote Ahold ADRNY: This company which provides retail stores which offer food and non-food products primarily in the United States and Europe, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.1% over the last 60 days. Ahold NV Price and ConsensusAhold NV Price and Consensus Ahold NV price-consensus-chart | Ahold NV Quote Ahold has a PEG ratio of 1.65 compared with 2.38 for the industry. The company possesses a Growth Score of B. Ahold NV PEG Ratio (TTM)Ahold NV PEG Ratio (TTM) Ahold NV peg-ratio-ttm | Ahold NV Quote Intercorp Financial Services IFS: This company which provides financial products and services, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.6% over the last 60 days. Intercorp Financial Services Inc. Price and ConsensusIntercorp Financial Services Inc. Price and Consensus Intercorp Financial Services Inc. price-consensus-chart | Intercorp Financial Services Inc. Quote Intercorp Financial Services has a PEG ratio of 0.34 compared with 1.43 for the industry. The company possesses a Growth Score of B. Intercorp Financial Services Inc. PEG Ratio (TTM)Intercorp Financial Services Inc. PEG Ratio (TTM) Intercorp Financial Services Inc. peg-ratio-ttm | Intercorp Financial Services Inc. Quote See the full list of top ranked stocks here. Learn more about the Growth score and how it is calculated here. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Strattec Security Corporation (STRT) : Free Stock Analysis Report Ahold NV (ADRNY) : Free Stock Analysis Report Intercorp Financial Services Inc. (IFS) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 25.06.25 07:00:00 | Zacks.com featured highlights Affiliated Managers, Koninklijke Ahold Delhaize, Noah, Plains GP and Gibraltar Industries |  |

| For Immediate Release Chicago, IL – June 25, 2025 – The stocks in this week’s article are Affiliated Managers Group, Inc. AMG, Koninklijke Ahold Delhaize N.V. ADRNY, Noah Holdings Ltd. NOAH, Plains GP Holdings, L.P. PAGP and Gibraltar Industries, Inc. ROCK. 5 Value Stocks with Impressive EV-to-EBITDA Ratios to Own Now The price-to-earnings (P/E) multiple enjoys widespread popularity among investors seeking stocks trading at a bargain. In addition to being a widely used tool for screening stocks, P/E is a popular metric for working out the fair market value of a firm. However, even this straightforward, broadly used valuation metric has a few downsides. Although P/E enjoys huge popularity among value investors, a less-used and more complicated metric called EV-to-EBITDA is sometimes viewed as a better alternative. EV-to-EBITDA gives the true picture of a company’s valuation and earnings potential. It has a more comprehensive approach to valuation. Affiliated Managers Group, Inc., Koninklijke Ahold Delhaize N.V., Noah Holdings Ltd., Plains GP Holdings, L.P. and Gibraltar Industries, Inc. are some stocks with attractive EV-to-EBITDA ratios. Is EV-to-EBITDA a Better Substitute to P/E? EV-to-EBITDA is essentially the enterprise value (EV) of a stock divided by its earnings before interest, taxes, depreciation and amortization (EBITDA). EV is the sum of a company’s market capitalization, its debt and preferred stock minus cash and cash equivalents. EBITDA, the other component of the multiple, gives a better idea of a company’s profitability as it removes the impact of non-cash expenses like depreciation and amortization that reduce net earnings. It is also often used as a proxy for cash flows. Just like P/E, the lower the EV-to-EBITDA ratio, the more attractive it is. A low EV-to-EBITDA ratio could signal that a stock is potentially undervalued. EV-to-EBITDA takes into account the debt on a company’s balance sheet that the P/E ratio does not. For this reason, EV-to-EBITDA is generally used to value the potential acquisition targets as it shows the amount of debt the acquirer has to assume. Stocks boasting a low EV-to-EBITDA multiple could be seen as attractive takeover candidates. Another shortcoming of P/E is that it can’t be used to value a loss-making firm. A company’s earnings are also subject to accounting estimates and management manipulation. On the other hand, EV-to-EBITDA is difficult to manipulate and can also be used to value loss-making but EBITDA-positive companies. EV-to-EBITDA is also a useful tool in measuring the value of firms that are highly leveraged and have a high degree of depreciation. Moreover, it can be used to compare companies with different levels of debt. Story Continues But EV-to-EBITDA has its limitations, too. The ratio varies across industries (a high-growth industry typically has a higher multiple and vice versa) and is usually not appropriate when comparing stocks in different industries, given their diverse capital requirements. A strategy solely based on EV-to-EBITDA might not yield the desired results. However, you can club it with the other major ratios in your stock-investing toolbox, such as price-to-book (P/B), P/E and price-to-sales (P/S) to screen value stocks. Here are our five picks out of the 11 stocks that passed the screen: Affiliated Managers Group is a global asset manager with investments in high-quality, independent partner-owned firms or affiliates. This Zacks Rank #1 company has a Value Score of A. Affiliated Managers Group has an expected year-over-year earnings growth rate of 7.7% for 2025. The Zacks Consensus Estimate for AMG’s 2025 earnings has moved up 4.5% over the past 60 days. Ahold Delhaize is one of the world's largest food retail groups. This Zacks Rank #1 company has a Value Score of A. Ahold Delhaize has an expected earnings growth rate of 7.6% for 2025. The consensus estimate for ADRNY’s 2025 earnings has moved up 2.8% over the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here. Noah Holdings is a leading wealth management service provider in China. NOAH, a Zacks Rank #2 stock, has a Value Score of A. Noah Holdings has an expected year-over-year earnings growth rate of 28% for 2025. The consensus estimate for NOAH’s 2025 earnings has been revised 4.6% upward over the past 60 days. Plains GP Holdings, through its subsidiaries, is involved in the transportation, storage, terminalling and marketing of crude oil and refined products. This Zacks Rank #2 stock has a Value Score of A. Plains GP Holdings has an expected year-over-year earnings growth rate of 157.7% for 2025. The consensus estimate for PAGP's 2025 earnings has been stable over the past 60 days. Gibraltar Industries manufactures and distributes products to the industrial and buildings market. This Zacks Rank #2 firm has a Value Score of B. Gibraltar Industries has an expected earnings growth rate of 15.8% for 2025. The Zacks Consensus Estimate for ROCK’s 2025 earnings has been revised 0.2% higher over the past 60 days. You can get the rest of the stocks on this list by signing up now for your 2-week free trial to the Research Wizard and start using this screen in your own trading. Further, you can also create your own strategies and test them first before taking the investment plunge. The Research Wizard is a great place to begin. It's easy to use. Everything is in plain language. And it's very intuitive. Start your Research Wizard trial today. And the next time you read an economic report, open up the Research Wizard, plug your finds in, and see what gems come out. Click here to sign up for a free trial to the Research Wizard today. For the rest of this Screen of the Week article please visit Zacks.com at: https://www.zacks.com/stock/news/2543888/5-value-stocks-with-impressive-ev-to-ebitda-ratios-to-own-now Follow us on Twitter: https://www.twitter.com/zacksresearch Join us on Facebook: https://www.facebook.com/ZacksInvestmentResearch Zacks Investment Research is under common control with affiliated entities (including a broker-dealer and an investment adviser), which may engage in transactions involving the foregoing securities for the clients of such affiliates. Contact: Jim Giaquinto Company: Zacks.com Phone: 312-265-9268 Email: pr@zacks.com Visit: https://www.zacks.com/ Zacks.com provides investment resources and informs you of these resources, which you may choose to use in making your own investment decisions. Zacks is providing information on this resource to you subject to the Zacks "Terms and Conditions of Service" disclaimer. www.zacks.com/disclaimer. Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Zacks Investment Research does not engage in investment banking, market making or asset management activities of any securities. These returns are from hypothetical portfolios consisting of stocks with Zacks Rank = 1 that were rebalanced monthly with zero transaction costs. These are not the returns of actual portfolios of stocks. The S&P 500 is an unmanaged index. Visit https://www.zacks.com/performance for information about the performance numbers displayed in this press release. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Gibraltar Industries, Inc. (ROCK) : Free Stock Analysis Report Affiliated Managers Group, Inc. (AMG) : Free Stock Analysis Report Noah Holdings Ltd. (NOAH) : Free Stock Analysis Report Plains Group Holdings, L.P. (PAGP) : Free Stock Analysis Report Ahold NV (ADRNY) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||