Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

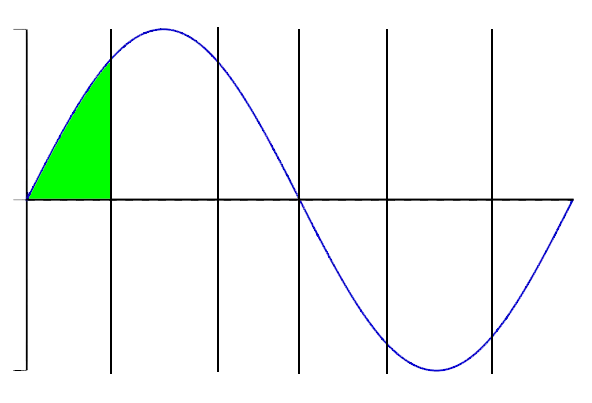

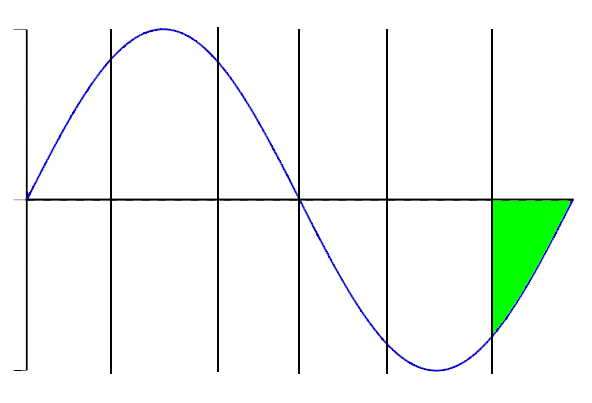

| |||||||

| |||||||

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

Aroundtown SA |

30.06.22 |

19.07.22 |

0.2300 € |

Aroundtown SA |

01.07.21 |

20.07.21 |

0.2200 € |

Aroundtown SA |

16.12.20 |

15.01.21 |

0.0210 € |

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 23.07.25 04:25:04 | Aroundtown SA (ETR:AT1) Shares Could Be 49% Below Their Intrinsic Value Estimate |  |

| Key Insights The projected fair value for Aroundtown is €6.25 based on 2 Stage Free Cash Flow to Equity Current share price of €3.20 suggests Aroundtown is potentially 49% undervalued The €2.90 analyst price target for AT1 is 54% less than our estimate of fair value Today we'll do a simple run through of a valuation method used to estimate the attractiveness of Aroundtown SA (ETR:AT1) as an investment opportunity by taking the expected future cash flows and discounting them to their present value. This will be done using the Discounted Cash Flow (DCF) model. It may sound complicated, but actually it is quite simple! We generally believe that a company's value is the present value of all of the cash it will generate in the future. However, a DCF is just one valuation metric among many, and it is not without flaws. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you. This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality. Step By Step Through The Calculation We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To start off with, we need to estimate the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years. A DCF is all about the idea that a dollar in the future is less valuable than a dollar today, so we discount the value of these future cash flows to their estimated value in today's dollars: 10-year free cash flow (FCF) forecast 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Levered FCF (€, Millions) €533.4m €653.5m €588.0m €605.0m €617.9m €629.5m €640.2m €650.2m €659.8m €669.2m Growth Rate Estimate Source Analyst x3 Analyst x3 Analyst x1 Analyst x1 Est @ 2.14% Est @ 1.88% Est @ 1.69% Est @ 1.57% Est @ 1.48% Est @ 1.42% Present Value (€, Millions) Discounted @ 9.9% €485 €541 €443 €414 €385 €357 €330 €305 €281 €260 ("Est" = FCF growth rate estimated by Simply Wall St) Present Value of 10-year Cash Flow (PVCF) = €3.8b Story Continues We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (1.3%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 9.9%. Terminal Value (TV)= FCF2035 × (1 + g) ÷ (r – g) = €669m× (1 + 1.3%) ÷ (9.9%– 1.3%) = €7.8b Present Value of Terminal Value (PVTV)= TV / (1 + r)10= €7.8b÷ ( 1 + 9.9%)10= €3.0b The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is €6.8b. In the final step we divide the equity value by the number of shares outstanding. Compared to the current share price of €3.2, the company appears quite good value at a 49% discount to where the stock price trades currently. The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent.XTRA:AT1 Discounted Cash Flow July 23rd 2025 Important Assumptions The calculation above is very dependent on two assumptions. The first is the discount rate and the other is the cash flows. You don't have to agree with these inputs, I recommend redoing the calculations yourself and playing with them. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Aroundtown as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 9.9%, which is based on a levered beta of 2.000. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business. View our latest analysis for Aroundtown SWOT Analysis for Aroundtown Strength Debt is well covered by earnings. Weakness No major weaknesses identified for AT1. Opportunity Annual earnings are forecast to grow faster than the German market. Good value based on P/E ratio and estimated fair value. Threat Debt is not well covered by operating cash flow. Annual revenue is forecast to grow slower than the German market. Next Steps: Whilst important, the DCF calculation shouldn't be the only metric you look at when researching a company. The DCF model is not a perfect stock valuation tool. Rather it should be seen as a guide to "what assumptions need to be true for this stock to be under/overvalued?" If a company grows at a different rate, or if its cost of equity or risk free rate changes sharply, the output can look very different. Why is the intrinsic value higher than the current share price? For Aroundtown, we've put together three important elements you should consider: Risks: You should be aware of the 1 warning sign for Aroundtown we've uncovered before considering an investment in the company. Future Earnings: How does AT1's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart. Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing! PS. Simply Wall St updates its DCF calculation for every German stock every day, so if you want to find the intrinsic value of any other stock just search here. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 02.07.25 05:59:36 | Aroundtown SA's (ETR:AT1) largest shareholders are individual investors with 35% ownership, private companies own 21% |  |

| Key Insights Significant control over Aroundtown by individual investors implies that the general public has more power to influence management and governance-related decisions A total of 4 investors have a majority stake in the company with 52% ownership 14% of Aroundtown is held by insiders We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free. If you want to know who really controls Aroundtown SA (ETR:AT1), then you'll have to look at the makeup of its share registry. We can see that individual investors own the lion's share in the company with 35% ownership. Put another way, the group faces the maximum upside potential (or downside risk). And private companies on the other hand have a 21% ownership in the company. Let's take a closer look to see what the different types of shareholders can tell us about Aroundtown. See our latest analysis for Aroundtown XTRA:AT1 Ownership Breakdown July 2nd 2025 What Does The Institutional Ownership Tell Us About Aroundtown? Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing. As you can see, institutional investors have a fair amount of stake in Aroundtown. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Aroundtown, (below). Of course, keep in mind that there are other factors to consider, too.XTRA:AT1 Earnings and Revenue Growth July 2nd 2025 Hedge funds don't have many shares in Aroundtown. Looking at our data, we can see that the largest shareholder is TLG Immobilien AG with 17% of shares outstanding. In comparison, the second and third largest shareholders hold about 14% and 14% of the stock. On looking further, we found that 52% of the shares are owned by the top 4 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company. Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too. Story Continues Insider Ownership Of Aroundtown While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it. Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances. It seems insiders own a significant proportion of Aroundtown SA. It is very interesting to see that insiders have a meaningful €481m stake in this €3.4b business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently. General Public Ownership With a 35% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Aroundtown. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run. Private Company Ownership Our data indicates that Private Companies hold 21%, of the company's shares. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company. Public Company Ownership Public companies currently own 17% of Aroundtown stock. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further. Next Steps: It's always worth thinking about the different groups who own shares in a company. But to understand Aroundtown better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Aroundtown you should be aware of. If you would prefer discover what analysts are predicting in terms of future growth, do not miss this freereport on analyst forecasts. NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 30.03.25 07:23:02 | Aroundtown Full Year 2024 Earnings: EPS Beats Expectations, Revenues Lag |  |

| Aroundtown (ETR:AT1) Full Year 2024 Results Key Financial Results Revenue: €1.50b (up 3.2% from FY 2023). Net income: €52.9m (up from €1.99b loss in FY 2023). Profit margin: 3.5% (up from net loss in FY 2023). EPS: €0.048 (up from €1.82 loss in FY 2023). This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.XTRA:AT1 Revenue and Expenses Breakdown March 30th 2025 All figures shown in the chart above are for the trailing 12 month (TTM) period Aroundtown EPS Beats Expectations, Revenues Fall Short Revenue missed analyst estimates by 1.6%. Earnings per share (EPS) exceeded analyst estimates. The primary driver behind last 12 months revenue was the Commercial Portfolio segment contributing a total revenue of €946.9m (63% of total revenue). The most substantial expense, totaling €831.0m were related to Non-Operating costs. This indicates that a significant portion of the company's costs is related to non-core activities. Explore how AT1's revenue and expenses shape its earnings. Looking ahead, revenue is forecast to grow 2.5% p.a. on average during the next 3 years, compared to a 17% decline forecast for the Real Estate industry in Germany. Performance of the German Real Estate industry. The company's shares are up 5.3% from a week ago. Risk Analysis It's necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Aroundtown (at least 1 which shouldn't be ignored), and understanding them should be part of your investment process. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 29.03.25 06:01:33 | Aroundtown SA Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next |  |

| Investors in Aroundtown SA (ETR:AT1) had a good week, as its shares rose 5.3% to close at €2.55 following the release of its full-year results. Revenues of €1.5b reported a marginal miss, falling short of forecasts by 4.3%, but earnings were better than expected - statutory profits came in at €0.05 per share, a nice change from the loss the analysts expected. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results. The end of cancer? These 15 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.XTRA:AT1 Earnings and Revenue Growth March 29th 2025 Taking into account the latest results, Aroundtown's eight analysts currently expect revenues in 2025 to be €1.53b, approximately in line with the last 12 months. Per-share earnings are expected to bounce 611% to €0.34. In the lead-up to this report, the analysts had been modelling revenues of €1.58b and earnings per share (EPS) of €0.32 in 2025. So it's pretty clear that while sentiment around revenues has declined following the latest results, the analysts are now more bullish on the company's earnings power. See our latest analysis for Aroundtown The consensus has made no major changes to the price target of €2.92, suggesting the forecast improvement in earnings is expected to offset the decline in revenues next year. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Aroundtown at €4.20 per share, while the most bearish prices it at €1.70. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business. One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Aroundtown's revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 1.8% growth on an annualised basis. This is compared to a historical growth rate of 3.7% over the past five years. Compare this with other companies in the same industry, which are forecast to see a revenue decline of 17% annually. Factoring in the forecast slowdown in growth, it's pretty clear that Aroundtown is still expected to grow faster than the wider industry. Story Continues The Bottom Line The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Aroundtown's earnings potential next year. Sadly they also cut their revenue estimates, although at least the company is expected to perform a bit better than the wider industry. Still, earnings are more important to the intrinsic value of the business. The consensus price target held steady at €2.92, with the latest estimates not enough to have an impact on their price targets. With that in mind, we wouldn't be too quick to come to a conclusion on Aroundtown. Long-term earnings power is much more important than next year's profits. We have forecasts for Aroundtown going out to 2027, and you can see them free on our platform here. However, before you get too enthused, we've discovered 2 warning signs for Aroundtown (1 makes us a bit uncomfortable!) that you should be aware of. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 26.03.25 07:57:00 | Aroundtown (ETR:AT1 shareholders incur further losses as stock declines 4.3% this week, taking three-year losses to 54% |  |

| The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term Aroundtown SA (ETR:AT1) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 57% share price collapse, in that time. The falls have accelerated recently, with the share price down 18% in the last three months. With the stock having lost 4.3% in the past week, it's worth taking a look at business performance and seeing if there's any red flags. Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit. While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS). Aroundtown has made a profit in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time. Arguably the revenue decline of 3.1% per year has people thinking Aroundtown is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future. You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).XTRA:AT1 Earnings and Revenue Growth March 26th 2025 Aroundtown is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this freechart depicting consensus estimates. What About The Total Shareholder Return (TSR)? We've already covered Aroundtown's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Aroundtown's TSR of was a loss of 54% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends. A Different Perspective It's good to see that Aroundtown has rewarded shareholders with a total shareholder return of 37% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 7% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Aroundtown . Story Continues If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: many of them are unnoticed AND have attractive valuation). Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 21.01.25 12:25:54 | Aroundtown SA's (ETR:AT1) biggest owners are individual investors who got richer after stock soared 9.3% last week |  |

| Key Insights Aroundtown's significant individual investors ownership suggests that the key decisions are influenced by shareholders from the larger public A total of 4 investors have a majority stake in the company with 52% ownership Insider ownership in Aroundtown is 14% To get a sense of who is truly in control of Aroundtown SA (ETR:AT1), it is important to understand the ownership structure of the business. And the group that holds the biggest piece of the pie are individual investors with 31% ownership. Put another way, the group faces the maximum upside potential (or downside risk). As a result, individual investors were the biggest beneficiaries of last week’s 9.3% gain. Let's delve deeper into each type of owner of Aroundtown, beginning with the chart below. See our latest analysis for Aroundtown XTRA:AT1 Ownership Breakdown January 21st 2025 What Does The Institutional Ownership Tell Us About Aroundtown? Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index. Aroundtown already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Aroundtown, (below). Of course, keep in mind that there are other factors to consider, too.XTRA:AT1 Earnings and Revenue Growth January 21st 2025 We note that hedge funds don't have a meaningful investment in Aroundtown. Looking at our data, we can see that the largest shareholder is TLG Immobilien AG with 17% of shares outstanding. In comparison, the second and third largest shareholders hold about 14% and 14% of the stock. Our research also brought to light the fact that roughly 52% of the company is controlled by the top 4 shareholders suggesting that these owners wield significant influence on the business. While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future. Insider Ownership Of Aroundtown The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO. Story Continues I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions. It seems insiders own a significant proportion of Aroundtown SA. It has a market capitalization of just €3.0b, and insiders have €419m worth of shares in their own names. That's quite significant. It is good to see this level of investment. You can check here to see if those insiders have been buying recently. General Public Ownership The general public, who are usually individual investors, hold a 31% stake in Aroundtown. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies. Private Company Ownership It seems that Private Companies own 21%, of the Aroundtown stock. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research. Public Company Ownership Public companies currently own 17% of Aroundtown stock. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership. Next Steps: It's always worth thinking about the different groups who own shares in a company. But to understand Aroundtown better, we need to consider many other factors. Take risks for example - Aroundtown has 1 warning sign we think you should be aware of. If you would prefer discover what analysts are predicting in terms of future growth, do not miss this freereport on analyst forecasts. NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 17.10.24 05:57:19 | Aroundtown (ETR:AT1) shareholders are up 6.4% this past week, but still in the red over the last five years |  |

| It is doubtless a positive to see that the Aroundtown SA (ETR:AT1) share price has gained some 43% in the last three months. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. The share price has failed to impress anyone , down a sizable 59% during that time. So we're not so sure if the recent bounce should be celebrated. However, in the best case scenario (far from fait accompli), this improved performance might be sustained. While the stock has risen 6.4% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us. Check out our latest analysis for Aroundtown While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time. We know that Aroundtown has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move. In contrast to the share price, revenue has actually increased by 5.5% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity. The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail). earnings-and-revenue-growth Aroundtown is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Aroundtown will earn in the future (free analyst consensus estimates) What About The Total Shareholder Return (TSR)? We've already covered Aroundtown's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Aroundtown shareholders, and that cash payout explains why its total shareholder loss of 53%, over the last 5 years, isn't as bad as the share price return. A Different Perspective It's nice to see that Aroundtown shareholders have received a total shareholder return of 31% over the last year. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Aroundtown better, we need to consider many other factors. For instance, we've identified 2 warning signs for Aroundtown (1 doesn't sit too well with us) that you should be aware of. Story continues Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings. Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View comments |

||

| 08.10.24 09:14:28 | How to Invest in Europe’s Biggest Economy |  |

| Looking to invest in Europe’s biggest economy? Aroundtown SA (AANNF) is a real estate company with a focus on income-generating quality properties. The company has multiple commercial and residential holdings in Germany, which is Europe’s biggest economy. In addition, it holds properties with value-add potential in central locations in top-tier European cities in the Netherlands and London. AANNF stock gives investors an opportunity to dip into the European real estate market and take part in a business with strong fundamentals and growth prospects. TipRanks recently had the opportunity to discuss the company’s workings with Oschrie Massatschi, Chief Capital Markets Officer at Aroundtown. Read on to learn all about this company’s prospects. TipRanks: What makes this company attractive to investors? Oschrie Massatschi: Aroundtown is an attractive investment due to several key factors that set it apart in the European real estate market: 1. Market Position Third Largest Publicly With a €25 billion asset base: Aroundtown is the third-largest publicly listed real estate company in Europe. Its scale and market position provide significant advantages in terms of operational efficiency, market access, and deal flow. Aroundtown is a well-known and trusted player in transaction markets, providing it with a wide network comprising leading market participants and thereby strong access to acquisition and disposal opportunities. 2. High Level of Diversification Diverse Asset Types and Locations: Aroundtown’s portfolio is highly diversified, both in terms of asset types and geographic locations. The company focuses on prime properties in Germany and the Netherlands, with a mix of residential properties in Germany and London, hotels across Europe, and offices in key cities in Germany and the Netherlands. This diversification ensures multiple earnings drivers and reduces risk, as the company is not dependent on any single location, asset type, or tenant base. While at the same time the Company’s large scale still allows it to benefit from a strong local position and depth of experience in its specific asset locations and asset types, resulting in a competitive advantage on a local level. 3. Strong Financial Position Credit Rating and Market Access: Aroundtown enjoys a strong credit rating of BBB+ from S&P (highest for German commercial & residential real estate). This reflects the company’s solid financial management and provides superb access to capital markets and bank financing, ensuring liquidity and financial flexibility. This was reflected in recent bond issuances which were 7x oversubscribed, with strong demand from leading global bond investors, allowing it to raise funds on short notice to capitalize on attractive opportunities if these arise. Story continues Stable Cash Flows: The company generates stable rental income from its diversified and high-quality tenant base, further strengthening its financial position. 4. Attractive Valuation High Discount to NAV: Due to the current weak market sentiment driven by interest rate fluctuations and market volatility, Aroundtown is trading at a significant discount to its net asset value (NAV). Despite this, the company continues to deliver a high earnings yield, indicating that its market price is disconnected from its actual earnings power and the quality of its assets. This presents a compelling value opportunity for investors. 5. Macroeconomic Positioning Poised for Growth: Aroundtown is well-positioned to benefit from improved macroeconomic conditions and potential interest rate cuts. As the market sentiment improves, the company’s strong asset base and pro-active financial management will allow it to capitalize on these changes, driving potential capital appreciation and enhanced investor returns. To summarize: Aroundtown’s scale, diversification, strong credit rating, and attractive valuation make it an appealing investment, especially in the context of current market conditions. The company’s ability to generate stable earnings while trading at a discount to its NAV offers significant upside potential, particularly as macroeconomic conditions improve and interest rates further reduce. TipRanks:From your extensive experience in the real estate industry, what types of assets do you believe will hold the greatest value for investors in the coming years? Oschrie Massatschi: Residential Properties are now showing the greatest value for investors. This is the case as a result of the current environment, but the drivers are very sustainable and are expected to generate high value also in the long-term. Residential real estate will continue to be a top-performing asset class due to a substantial demand-supply gap. In key markets like Germany and London, housing demand far outstrips supply, with urbanization and population growth driving the need for more residential units. For instance, Germany alone faces a shortfall of hundreds of thousands of housing units annually. This imbalance is likely to sustain high occupancy rates and rental growth, making residential properties a strong investment. Hotels are benefiting from a positive momentum post-pandemic. Hotels, particularly in the leisure segment, are seeing a robust recovery post-pandemic. Leisure travel has bounced back strongly, driven by pent-up demand and the return of large-scale events across Europe, such as the recent European football tournament in Germany. This resurgence in tourism is boosting occupancy rates and revenues for hotels, making them a very attractive asset class. Looking more into the mid-term, the office sector, particularly in Germany and the Netherlands, is poised for a rebound. Market vacancy rates are currently low, sitting below historic levels, and new supply is limited as many development projects have been halted or cancelled. Once the economy starts growing again, which is expected to coincide with interest rate reductions, demand for office space is anticipated to pick up. This combination of low supply and growing demand positions offices in these markets as valuable assets for investors in the coming years. TipRanks: In July, Aroundtown announced the successful launch of a €650 million unsecured bond, with plans to use the proceeds to buy back shorter-term debt. How will that bond affect the company’s financials? Oschrie Massatschi: We have robust access to capital markets, and the recent bond issuance has further diversified our liquidity sources, lowered refinancing risk, and extended our average debt maturity by enabling the buyback of shorter-dated bonds at a discount. The bond issuance was seven times oversubscribed, reflecting strong investor demand and attracting high-quality investors. In addition, our residential subsidiary Grand City Properties also issued a bond, with similar high demand as Aroundtown’s issuance. The proceeds are being used to optimize the Company’s financial profile, thereby reducing refinancing risk and allowing the Company to focus on the execution of its long-term value creation strategy. TipRanks: What are the most prominent risks Aroundtown faces, and what steps are you taking to minimize those risks? Oschrie Massatschi: Rising interest rates negatively affect our valuations, thereby increasing leverage. We’ve managed to keep leverage conservative by disposing of assets and buying back debt at a discount. With interest rates peaking and beginning to decline, the pace of value reduction has slowed, suggesting we may be nearing the bottom. However, higher interest rates also impact our refinancing costs, which could negatively affect future earnings. To counter this, we’re repurchasing variable debt, hedging it at lower fixed rates, and enhancing our portfolio’s reversionary potential, which exceeds 20%. The current demand for office space is subdued due to the weak economic environment. To mitigate this risk, we maintain long average lease terms with no significant maturities in any single year, avoid dependence on single tenants—our top 10 tenants account for less than 20% of total rent—ensure strong tenant quality with approximately 75% of tenants being public sector entities, multinationals, or large domestic corporations, and explore conversion options, such as turning office spaces into hotels or residential units. TipRanks: What strategies is Aroundtown using to promote its growth in the German and NL real estate markets? Oschrie Massatschi: Our portfolio currently has a reversionary potential of over 20%, meaning that there is a significant gap between current rent and market rent. We aim to capture this potential through re-letting opportunities as leases mature, either by extending existing leases or securing new tenants, with the success of this strategy largely influenced by market conditions. This approach has already shown positive results, as evidenced by our consistent like-for-like rent growth of 2.8% over the last 12 months as of March. Additionally, our value-add strategy plays a crucial role in driving growth. By leveraging our expertise across all asset types, we identify and implement the best use for our properties, ensuring we maximize their potential and enhance overall portfolio performance. TipRanks:How does Aroundtown maintain its substantial pipeline of new real estate deals? Oschrie Massatschi: Since 2004, we have developed a robust deal-sourcing network, bolstered by our strong reputation as a reliable counterparty that executes transactions efficiently and with certainty, given our position as cash buyers. This network has historically been a key resource for acquisitions, but since 2020, we have increasingly leveraged it for disposals as well. Our ability to maintain a substantial pipeline of new real estate deals is driven by the strength of these long-established relationships, which continue to provide us with high-quality opportunities in both acquisition and disposition markets. Furthermore, the Company’s ability to quickly pivot from acquisitions to disposals, as shown when we started disposing in 2020, and ability to shift back to acquisitions, when attractive opportunities arise, is a clear strength of the Company’s platform. TipRanks:According to Statista, German real estate is expected to grow annually (CAGR 2024-2029) by 2.77%, led by residential real estate. Currently, residential housing comprises 33% of Aroundtown’s assets. Do you have plans to shift your asset balance and increase your residential real estate segment? Oschrie Massatschi: AT’s residential assets are held through GCP. GCP holds around 81% in Germany and 19% in London. We are happy with our position in residential, but may also increase our position through targeted conversion of commercial assets into residential. Both residential markets are characterized by a systemic supply-demand imbalance which results in consistent strong operations for the mid- to long-term. Germany has rent regulation, which limits the amount of rent increase and thus provides more stable cash flows with long-term upside potential as demand outpaces supply significantly. The London rental market has no regulation, thus capturing the potential to market rent is faster. The reversionary rent potential of GCP is 24%. TipRanks:Do you expect interest rates in Germany and the Netherlands to rise or fall through the end of 2024? How will the rates affect Aroundtown’s revenues? Oschrie Massatschi: Interest rates peaked in Q4 2023, and by June, the ECB had begun lowering them again. With inflation continuing to ease, we anticipate that interest rates will decrease further, as indicated by trends in mid-swap rates. Given this outlook, we expect interest rates in Germany and the Netherlands to continue declining through the end of 2024, in-line with market expectations. Lower interest rates should positively impact Aroundtown’s revenues by reducing financing costs and creating a more favorable environment for refinancing existing debt. This decrease in borrowing costs could also stimulate market activity, further supporting our revenue growth. However, Aroundtown follows a pro-active management approach, also regarding its financing structure, and is prepared to deal with scenarios in which rates do not decrease at the pace markets expect. View comments |

||

| 14.08.24 11:30:03 | Aroundtown SA's (ETR:AT1) top owners are individual investors with 30% stake, while 21% is held by private companies |  |

| Key Insights The considerable ownership by individual investors in Aroundtown indicates that they collectively have a greater say in management and business strategy The top 4 shareholders own 52% of the company 14% of Aroundtown is held by insiders A look at the shareholders of Aroundtown SA (ETR:AT1) can tell us which group is most powerful. We can see that individual investors own the lion's share in the company with 30% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn). Private companies, on the other hand, account for 21% of the company's stockholders. Let's delve deeper into each type of owner of Aroundtown, beginning with the chart below. See our latest analysis for Aroundtown ownership-breakdown What Does The Institutional Ownership Tell Us About Aroundtown? Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing. As you can see, institutional investors have a fair amount of stake in Aroundtown. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Aroundtown's earnings history below. Of course, the future is what really matters. earnings-and-revenue-growth Aroundtown is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is TLG Immobilien AG with 17% of shares outstanding. In comparison, the second and third largest shareholders hold about 14% and 14% of the stock. On looking further, we found that 52% of the shares are owned by the top 4 shareholders. In other words, these shareholders have a meaningful say in the decisions of the company. While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future. Insider Ownership Of Aroundtown The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves. Story continues I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions. Our most recent data indicates that insiders own a reasonable proportion of Aroundtown SA. It has a market capitalization of just €2.2b, and insiders have €310m worth of shares in their own names. That's quite significant. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders. General Public Ownership With a 30% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Aroundtown. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies. Private Company Ownership We can see that Private Companies own 21%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research. Public Company Ownership Public companies currently own 17% of Aroundtown stock. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership. Next Steps: I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Aroundtown , and understanding them should be part of your investment process. If you would prefer discover what analysts are predicting in terms of future growth, do not miss this freereport on analyst forecasts. NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View comments |

||

| 31.05.24 04:03:59 | Aroundtown First Quarter 2024 Earnings: EPS Misses Expectations |  |

| Aroundtown (ETR:AT1) First Quarter 2024 Results Key Financial Results Revenue: €390.6m (down 4.2% from 1Q 2023). Net income: €88.4m (up from €43.5m loss in 1Q 2023). Profit margin: 23% (up from net loss in 1Q 2023). EPS: €0.04 (up from €0.04 loss in 1Q 2023). earnings-and-revenue-growth All figures shown in the chart above are for the trailing 12 month (TTM) period Aroundtown EPS Misses Expectations Revenue was in line with analyst estimates. Earnings per share (EPS) missed analyst estimates by 86%. Looking ahead, revenue is forecast to grow 3.8% p.a. on average during the next 3 years, compared to a 17% decline forecast for the Real Estate industry in Germany. Performance of the German Real Estate industry. The company's shares are up 2.6% from a week ago. Risk Analysis Before you take the next step you should know about the 2 warning signs for Aroundtown (1 is a bit unpleasant!) that we have uncovered. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View comments |

||