Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

HOCHTIEF Aktiengesellschaft |

30.04.25 |

07.07.25 |

5.2300 € |

HOCHTIEF Aktiengesellschaft |

26.04.24 |

05.07.24 |

4.4000 € |

HOCHTIEF Aktiengesellschaft |

28.04.23 |

4.0000 € |

|

HOCHTIEF Aktiengesellschaft |

27.04.23 |

07.07.23 |

4.0000 € |

HOCHTIEF Aktiengesellschaft |

29.04.22 |

1.9100 € |

|

HOCHTIEF Aktiengesellschaft |

28.04.22 |

07.07.22 |

1.9100 € |

HOCHTIEF Aktiengesellschaft |

07.05.21 |

07.07.21 |

3.9300 € |

HOCHTIEF Aktiengesellschaft |

30.04.20 |

5.8000 € |

|

HOCHTIEF Aktiengesellschaft |

29.04.20 |

5.8000 € |

|

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 26.07.25 07:47:30 | HOCHTIEF Zweites Quartal 2025 Ergebnis: EPS: 2,30 € (vs 4,03 € in 2Q 2024) |  |

| **HOCHTIEF (ETR:HOT) Zweites Quartal 2025 Ergebnisse Zusammenfassung** ### Wichtigste Finanzergebnisse * Umsatz: 9,45 Mrd. € (plus 20 % ab 2Q 2024) * Nettoeinkommen: 173,2 Mio. € (ab 2Q 2024 43%) * Gewinnmarge: 1,8% (ab 3.8% in 2Q 2024) * EPS: 2,30 € (ab € 4,03 in 2Q 2024) ### Ergebnis und Umsatzwachstum * Umsatzwachstumsprognose für die nächsten 3 Jahre: 2,8% p.a. * Umsatzwachstumsprognose in Europa: 3,9% (im Vergleich zur Bauindustrie in Deutschland) ### Market Performance * Unternehmen teilt sich vor einer Woche um 4,6% * HOCHTIEF Earnings Insights: In den nächsten 3 Jahren durchschnittlich auf 2,8% p.a. ### Risikoanalyse * 3 Warnzeichen: - Ergebnisbericht aktualisieren - Marktvolatilität - Wettbewerb in der Bauindustrie ### Disclaimer * Dieser Artikel ist allgemein in der Natur und nicht als finanzielle Beratung gedacht * Keine Empfehlung zum Kauf oder Verkauf von Aktien * Analyse basierend auf historischen Daten und Analyseprognosen mit einer unvoreingenommenen Methodik |

||

| 21.07.25 13:51:38 | HOCHTIEF's (ETR:HOT) three-year earnings growth trails the 60% YoY shareholder returns |  |

| The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance the HOCHTIEF Aktiengesellschaft (ETR:HOT) share price is 264% higher than it was three years ago. That sort of return is as solid as granite. And in the last month, the share price has gained 19%. On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns. We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free. To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement. During three years of share price growth, HOCHTIEF achieved compound earnings per share growth of 55% per year. Notably, the 54% average annual share price gain matches up nicely with the EPS growth rate. This observation indicates that the market's attitude to the business hasn't changed all that much. Au contraire, the share price change has arguably mimicked the EPS growth. The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).XTRA:HOT Earnings Per Share Growth July 21st 2025 We know that HOCHTIEF has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on HOCHTIEF's balance sheet strength is a great place to start, if you want to investigate the stock further. What About Dividends? As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of HOCHTIEF, it has a TSR of 313% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence! A Different Perspective It's good to see that HOCHTIEF has rewarded shareholders with a total shareholder return of 76% in the last twelve months. And that does include the dividend. That's better than the annualised return of 24% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand HOCHTIEF better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for HOCHTIEF you should be aware of, and 1 of them doesn't sit too well with us. Story Continues But note: HOCHTIEF may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast). Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 04.07.25 15:32:31 | GelreGroen JV signs contract with Rijkswaterstaat for Dutch highway project |  |

| Rijkswaterstaat, the operational arm of the Dutch Ministry of Infrastructure and Water Management, has sealed a significant contract with the GelreGroen joint venture (JV) for a highway project in the Netherlands. The GelreGroen JV, comprising HOCHTIEF (40%), John Laing (40%), Dura Vermeer (10%), and BESIX (10%), will undertake the project's planning, construction, and subsequent maintenance. The consortium executing the work will comprise HOCHTIEF, Dura Vermeer, BESIX, and Van Oord, each holding a 25% stake. Set in the Arnhem area, the project will see the extension of the A15 highway by 12km and the widening of the A12 and A15 roads with additional lanes over a 23km stretch. The contract also encompasses the financing, operation, and maintenance of the highway until 2051. The project, awarded to the JV in 2020, faced delays due to appeals before the domestic Supreme Administrative Court, preventing the commencement of work. The project is now scheduled to start in January 2026, with the new section of the A15 highway and the additional lanes on the A12/A15 expected to open by the end of 2031. As construction moves forward, the project will include the erection of 45 bridge structures, ten traffic junctions, and additional noise barriers. A new bridge over the Pannerdensch Canal, approximately 2.5km in length, will serve as the project's centrepiece. Sustainability is a key focus of the project, influencing the planning, construction, and operation phases. The GelreGroen name reflects an environmentally focused design, and the development will include the reuse of materials and green construction methods. Last month, HOCHTIEF announced that in partnership with cloud solutions provider IONOS Group, it submitted an expression of interest to the European Commission for its interest in constructing and operating an AI 'Gigafactory' in Europe. "GelreGroen JV signs contract with Rijkswaterstaat for Dutch highway project" was originally created and published by World Construction Network, a GlobalData owned brand. The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. View Comments |

||

| 26.06.25 08:43:39 | HOCHTIEF to expand UK data network with sustainable centres |  |

| HOCHTIEF PPP Solutions is set to establish the HOCHTIEF Data Center Partner in the UK to build a comprehensive network of sustainable centres. The company’s latest move comes as it aims to advance the rollout of its European data centre strategy and will now transfer its German model to the Irish and UK markets. This is aimed at addressing the increasing demand for cloud services and computing capacity. HOCHTIEF’s new entity will be led by real-estate and technology expert Warren Taylor. As part of its broader strategy, the company will establish a pan-European network of EDGE data centres. In collaboration with Thomas-Krenn, HOCHTIEF has founded the joint venture (JV) Yorizon, which improves the company’s YEXIO centres with hardware and the latest cloud computing solutions that support digital sovereignty. In 2025, the initial data centre is set to open in Heiligenhaus near Essen, Germany, with sites for four additional centres already secured. The YEXIO data centres focus on sustainable construction, energy efficiency, and local integration. They utilise liquid cooling systems, local renewable energy, and integrate into municipal heating networks. HOCHTIEF PPP Solutions management board member Bernd Holtwick said: “These projects make a significant contribution to the digital transformation of small and medium-sized enterprises, to strengthening regional data processing capabilities, and to achieving modern urban development and climate goals.” The company and Palladio Partners have signed a land purchase agreement for a YEXIO data centre in Dorfen, near Munich. The facility, covering around 7,500m², will provide computing capacity for regional companies and focus on sustainable operations. Construction is scheduled to begin in early 2026, with commissioning expected by mid-2027. Prior to this development, HOCHTIEF, in partnership with cloud solutions provider IONOS Group, expressed interest in constructing and operating an AI ‘Gigafactory’ in Europe. "HOCHTIEF to expand UK data network with sustainable centres" was originally created and published by World Construction Network, a GlobalData owned brand. The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. View Comments |

||

| 23.06.25 09:49:10 | HOCHTIEF and IONOS submit EoI for building AI Gigafactory in Europe |  |

| HOCHTIEF, in partnership with cloud solutions provider IONOS Group, has expressed interest in constructing and operating an AI 'Gigafactory' in Europe. The expression of interest (EoI), submitted to the European Commission (EC), outlines a project that will initially feature over 50,000 graphics processing units (GPUs), with the potential to scale up to over 100,000 GPUs. These facilities will be fully integrated into European standards, with an aim to improve the region's AI capabilities, a statement from HOCHTIEF said. The proposed high-performance data centre infrastructure, utilising the latest GPU technology, is expected to commence operations by 2027. The EU is stated to have plans to invest €20bn ($23bn) in five AI Gigafactories. The EC will detail the next phases of the selection process in the coming months, as the consortium prepares to refine its plans. HOCHTIEF, engaged in data centre development and construction, offers expertise across planning, financing, construction, operation, and digital infrastructure. The company has implemented around 6GW of projects, focusing on sustainable solutions that optimise the entire life cycle of data centres. IONOS Group, meanwhile, with over three decades of experience in digitalisation and cloud infrastructure operation, provides the technological foundation for the General Data Protection Regulation-compliant operation of scalable AI workloads. The consortium also includes specialised technology, utility, security companies, and research and development institutions. The financing for the project will follow a standard industry structure, using equity, partnership models, and debt financing, complemented by targeted EU funding. Last month, the joint venture of construction and real-estate provider Implenia and HOCHTIEF was awarded a contract for the '733 Tunnel Ostbahnhof', a component of the Munich S-Bahn expansion project by Deutsche Bahn, the German state-owned railway company. "HOCHTIEF and IONOS submit EoI for building AI Gigafactory in Europe" was originally created and published by World Construction Network, a GlobalData owned brand. The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site. View Comments |

||

| 18.04.25 12:22:12 | HOCHTIEF (ETR:HOT) Is Increasing Its Dividend To €5.23 |  |

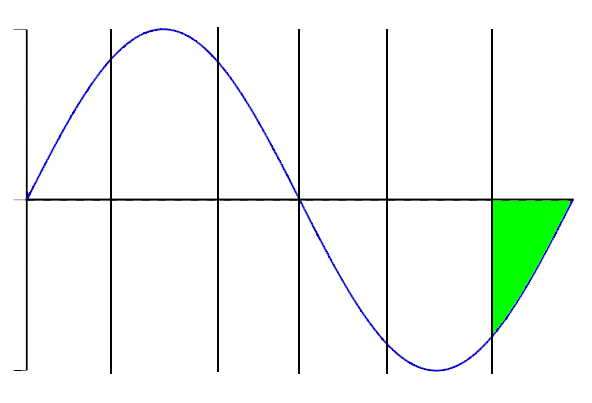

| HOCHTIEF Aktiengesellschaft (ETR:HOT) will increase its dividend from last year's comparable payment on the 5th of May to €5.23. This takes the annual payment to 3.3% of the current stock price, which is about average for the industry. We've discovered 3 warning signs about HOCHTIEF. View them for free. HOCHTIEF's Payment Could Potentially Have Solid Earnings Coverage We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, HOCHTIEF's dividend was comfortably covered by both cash flow and earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth. The next year is set to see EPS grow by 11.2%. Assuming the dividend continues along recent trends, we think the payout ratio could be 49% by next year, which is in a pretty sustainable range.XTRA:HOT Historic Dividend April 18th 2025 View our latest analysis for HOCHTIEF Dividend Volatility While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was €1.70 in 2015, and the most recent fiscal year payment was €5.23. This means that it has been growing its distributions at 12% per annum over that time. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious. The Dividend's Growth Prospects Are Limited Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. In the last five years, HOCHTIEF's earnings per share has shrunk at approximately 3.0% per annum. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are predicted to grow over the next year, but we would remain cautious until a track record of earnings growth is established. Our Thoughts On HOCHTIEF's Dividend Overall, we always like to see the dividend being raised, but we don't think HOCHTIEF will make a great income stock. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment. Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for HOCHTIEF (of which 1 doesn't sit too well with us!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 16.04.25 05:32:01 | At €159, Is It Time To Put HOCHTIEF Aktiengesellschaft (ETR:HOT) On Your Watch List? |  |

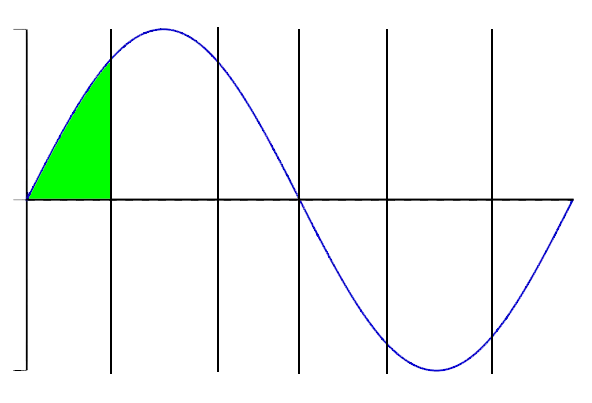

| Today we're going to take a look at the well-established HOCHTIEF Aktiengesellschaft (ETR:HOT). The company's stock saw a significant share price rise of 23% in the past couple of months on the XTRA. While good news for shareholders, the company has traded much higher in the past year. As a large-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. However, what if the stock is still a bargain? Let’s examine HOCHTIEF’s valuation and outlook in more detail to determine if there’s still a bargain opportunity. We've discovered 3 warning signs about HOCHTIEF. View them for free. Is HOCHTIEF Still Cheap? According to our price multiple model, which makes a comparison between the company's price-to-earnings ratio and the industry average, the stock price seems to be justfied. In this instance, we’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. We find that HOCHTIEF’s ratio of 15.46x is trading slightly above its industry peers’ ratio of 13.33x, which means if you buy HOCHTIEF today, you’d be paying a relatively reasonable price for it. And if you believe that HOCHTIEF should be trading at this level in the long run, then there should only be a fairly immaterial downside vs other industry peers. Furthermore, it seems like HOCHTIEF’s share price is quite stable, which means there may be less chances to buy low in the future now that it’s priced similarly to industry peers. This is because the stock is less volatile than the wider market given its low beta. Check out our latest analysis for HOCHTIEF What does the future of HOCHTIEF look like?XTRA:HOT Earnings and Revenue Growth April 16th 2025 Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at the company's future expectations. HOCHTIEF's earnings growth are expected to be in the teens in the upcoming years, indicating a solid future ahead. This should lead to robust cash flows, feeding into a higher share value. What This Means For You Are you a shareholder? HOT’s optimistic future growth appears to have been factored into the current share price, with shares trading around industry price multiples. However, there are also other important factors which we haven’t considered today, such as the financial strength of the company. Have these factors changed since the last time you looked at HOT? Will you have enough confidence to invest in the company should the price drop below the industry PE ratio? Story Continues Are you a potential investor? If you’ve been keeping tabs on HOT, now may not be the most advantageous time to buy, given it is trading around industry price multiples. However, the optimistic forecast is encouraging for HOT, which means it’s worth further examining other factors such as the strength of its balance sheet, in order to take advantage of the next price drop. If you want to dive deeper into HOCHTIEF, you'd also look into what risks it is currently facing. For instance, we've identified 3 warning signs for HOCHTIEF (1 is concerning) you should be familiar with. If you are no longer interested in HOCHTIEF, you can use our free platform to see our list of over 50 other stocks with a high growth potential. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 01.04.25 13:26:43 | Why HOCHTIEF Aktiengesellschaft (ETR:HOT) Looks Like A Quality Company |  |

| While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. To keep the lesson grounded in practicality, we'll use ROE to better understand HOCHTIEF Aktiengesellschaft (ETR:HOT). Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital. How Is ROE Calculated? The formula for ROE is: Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity So, based on the above formula, the ROE for HOCHTIEF is: 73% = €867m ÷ €1.2b (Based on the trailing twelve months to December 2024). The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each €1 of shareholders' capital it has, the company made €0.73 in profit. View our latest analysis for HOCHTIEF Does HOCHTIEF Have A Good Return On Equity? Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. However, this method is only useful as a rough check, because companies do differ quite a bit within the same industry classification. As is clear from the image below, HOCHTIEF has a better ROE than the average (13%) in the Construction industry.XTRA:HOT Return on Equity April 1st 2025 That is a good sign. However, bear in mind that a high ROE doesn’t necessarily indicate efficient profit generation. Aside from changes in net income, a high ROE can also be the outcome of high debt relative to equity, which indicates risk. To know the 3 risks we have identified for HOCHTIEF visit our risks dashboard for free. The Importance Of Debt To Return On Equity Virtually all companies need money to invest in the business, to grow profits. That cash can come from retained earnings, issuing new shares (equity), or debt. In the case of the first and second options, the ROE will reflect this use of cash, for growth. In the latter case, the debt required for growth will boost returns, but will not impact the shareholders' equity. Thus the use of debt can improve ROE, albeit along with extra risk in the case of stormy weather, metaphorically speaking. Combining HOCHTIEF's Debt And Its 73% Return On Equity It seems that HOCHTIEF uses a huge volume of debt to fund the business, since it has an extremely high debt to equity ratio of 6.21. Its ROE is clearly quite good, but it seems to be boosted by the significant use of debt by the company. Story Continues Summary Return on equity is useful for comparing the quality of different businesses. In our books, the highest quality companies have high return on equity, despite low debt. If two companies have around the same level of debt to equity, and one has a higher ROE, I'd generally prefer the one with higher ROE. But when a business is high quality, the market often bids it up to a price that reflects this. The rate at which profits are likely to grow, relative to the expectations of profit growth reflected in the current price, must be considered, too. So you might want to take a peek at this data-rich interactive graph of forecasts for the company. Of course HOCHTIEF may not be the best stock to buy. So you may wish to see this free collection of other companies that have high ROE and low debt. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 18.03.25 12:46:12 | HOCHTIEF's (ETR:HOT) Dividend Will Be Increased To €5.23 |  |

| The board of HOCHTIEF Aktiengesellschaft (ETR:HOT) has announced that it will be paying its dividend of €5.23 on the 5th of May, an increased payment from last year's comparable dividend. The payment will take the dividend yield to 3.0%, which is in line with the average for the industry. While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that HOCHTIEF's stock price has increased by 40% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield. View our latest analysis for HOCHTIEF HOCHTIEF's Future Dividend Projections Appear Well Covered By Earnings We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Prior to this announcement, HOCHTIEF's dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business. Over the next year, EPS is forecast to expand by 0.9%. If the dividend continues along recent trends, we estimate the payout ratio will be 54%, which is in the range that makes us comfortable with the sustainability of the dividend.XTRA:HOT Historic Dividend March 18th 2025 Dividend Volatility Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of €1.70 in 2015 to the most recent total annual payment of €5.23. This implies that the company grew its distributions at a yearly rate of about 12% over that duration. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious. The Dividend's Growth Prospects Are Limited Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. HOCHTIEF has seen earnings per share falling at 3.0% per year over the last five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. Earnings are predicted to grow over the next year, but we would remain cautious until a track record of earnings growth is established. Our Thoughts On HOCHTIEF's Dividend Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks. Story Continues Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, HOCHTIEF has 3 warning signs (and 1 which is a bit concerning) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 13.03.25 04:43:56 | Public companies among HOCHTIEF Aktiengesellschaft's (ETR:HOT) largest stockholders and were hit after last week's 4.1% price drop |  |

| Key Insights The considerable ownership by public companies in HOCHTIEF indicates that they collectively have a greater say in management and business strategy ACS, Actividades de Construcción y Servicios, S.A. owns 76% of the company Analyst forecasts along with ownership data serve to give a strong idea about prospects for a business Every investor in HOCHTIEF Aktiengesellschaft (ETR:HOT) should be aware of the most powerful shareholder groups. The group holding the most number of shares in the company, around 76% to be precise, is public companies. Put another way, the group faces the maximum upside potential (or downside risk). As a result, public companies as a group endured the highest losses last week after market cap fell by €542m. In the chart below, we zoom in on the different ownership groups of HOCHTIEF. Check out our latest analysis for HOCHTIEF XTRA:HOT Ownership Breakdown March 13th 2025 What Does The Institutional Ownership Tell Us About HOCHTIEF? Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices. As you can see, institutional investors have a fair amount of stake in HOCHTIEF. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at HOCHTIEF's earnings history below. Of course, the future is what really matters.XTRA:HOT Earnings and Revenue Growth March 13th 2025 Hedge funds don't have many shares in HOCHTIEF. ACS, Actividades de Construcción y Servicios, S.A. is currently the largest shareholder, with 76% of shares outstanding. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. In comparison, the second and third largest shareholders hold about 1.0% and 0.9% of the stock. While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too. Insider Ownership Of HOCHTIEF The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it. Story Continues Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances. Our data cannot confirm that board members are holding shares personally. It is unusual not to have at least some personal holdings by board members, so our data might be flawed. A good next step would be to check how much the CEO is paid. General Public Ownership The general public, who are usually individual investors, hold a 18% stake in HOCHTIEF. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies. Public Company Ownership It appears to us that public companies own 76% of HOCHTIEF. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further. Next Steps: I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that HOCHTIEF is showing 3 warning signs in our investment analysis, and 1 of those doesn't sit too well with us... If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future. NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||