Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

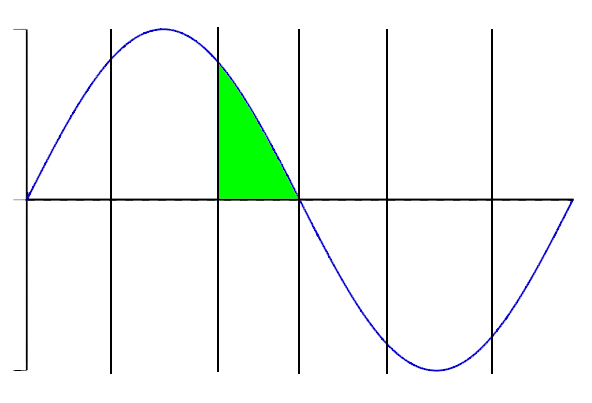

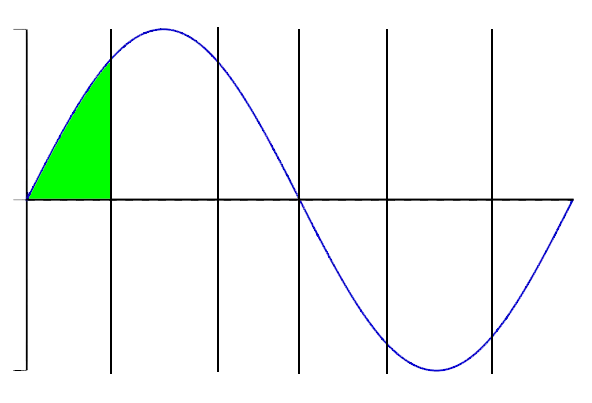

| © tratabu.de

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

Jungheinrich AG O.N.VZO |

21.05.25 |

23.05.25 |

0.8000 € |

Jungheinrich AG O.N.VZO |

16.05.24 |

20.05.24 |

0.7500 € |

Jungheinrich AG O.N.VZO |

12.05.23 |

16.05.23 |

0.6800 € |

Jungheinrich AG O.N.VZO |

23.05.22 |

0.6800 € |

|

Jungheinrich AG O.N.VZO |

13.05.22 |

0.6800 € |

|

Jungheinrich AG O.N.VZO |

11.05.22 |

13.05.22 |

0.6800 € |

Jungheinrich AG O.N.VZO |

14.05.21 |

0.4300 € |

|

Jungheinrich AG O.N.VZO |

12.05.21 |

14.05.21 |

0.4300 € |

Jungheinrich AG O.N.VZO |

28.08.20 |

01.09.20 |

0.4800 € |

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 17.07.25 14:12:23 | Jungheinrich stock tumbles after guidance cut |  |

| Investing.com -- The Jungheinrich share price plunged more than 15% on Thursday after the German warehouse equipment maker cut its 2025 guidance and unveiled a restructuring plan aimed at shoring up competitiveness in a weakening European market. Jefferies analysts noted that order intake, revenue, and EBIT were all revised lower. “The new guidance for 2025 leads to cuts at order intake of 3%, at revenues of 2% and at reported EBIT of 32% at midpoint,” they wrote, adding that adjusted EBIT excluding restructuring implies a 13% reduction, around 10% below consensus expectations. The company now targets a 2025 order intake of €5.3–5.9 billion and EBIT of €280–350 million, or €370–440 million excluding €90 million in restructuring costs. That compares with previous EBIT guidance of €430–500 million and consensus at €448 million, Jefferies noted. Free cash flow is now expected to exceed €250 million, down from over €300 million previously. Jefferies said the €100 million cost-saving programme, which involves personnel and location changes, is “likely the right strategic move” amid “further market weakness in the forklift business in Europe/Germany and continued competitive pressure.” The firm added that management had not indicated that major restructuring was coming during its Q1 strategy update. “The change likely comes from further market weakness,” Jefferies wrote, adding that cost and payback estimates are broadly in line with sector peer KION. Two-thirds of the €90 million in one-off charges will be recognised in Q3, with the remainder in Q4. Jungheinrich also said it may revise its forecast further if it reaches a binding agreement to sell its Russian subsidiary. Related articles Jungheinrich stock tumbles after guidance cut These Under-the-Radar Stocks Offer Better Risk-Reward Ratio Than Nvidia After soaring 149%, this stock is back in our AI’s favor - & already +25% in July View Comments |

||