Sie sind nicht angemeldet! Dieses Tagebuch ist öffentlich einsehbar und wird demnächst zurückgesetzt.

| |||||||

| |||||||

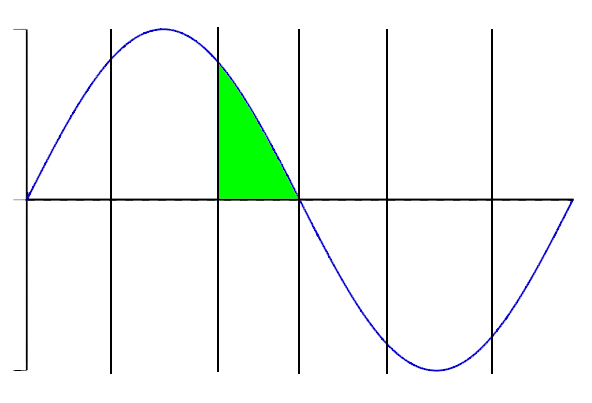

| © tratabu.de

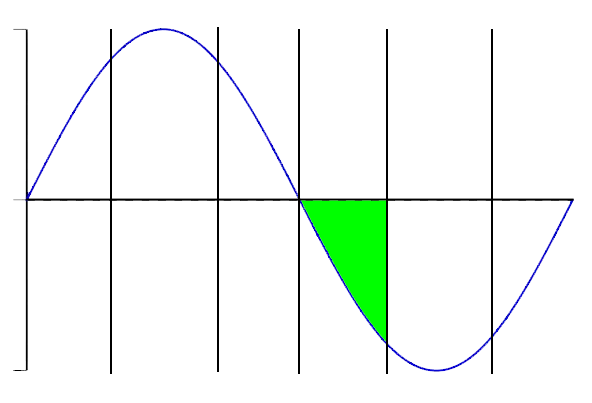

© tratabu.de

|

Dividendenzahlungen |

|||

| Titel | Ex-Datum | Zahldatum | Bruttobetrag |

PUMA SE |

22.05.25 |

26.05.25 |

0.6100 € |

PUMA SE |

23.05.24 |

27.05.24 |

0.8200 € |

PUMA SE |

26.05.23 |

0.8200 € |

|

PUMA SE |

25.05.23 |

30.05.23 |

0.8200 € |

PUMA SE |

13.05.22 |

0.7200 € |

|

PUMA SE |

12.05.22 |

16.05.22 |

0.7200 € |

PUMA SE |

07.05.21 |

0.1600 € |

|

PUMA SE |

06.05.21 |

10.05.21 |

0.1600 € |

PUMA SE |

08.05.20 |

0.5000 € |

|

Nachrichten |

||

| Datum / Uhrzeit | Titel | Bewertung |

| 29.07.25 11:10:31 | Französisch Sportartikel Verkäufer Decathlon zu verdoppeln Indien Beschaffung auf $3 Milliarden in 5 Jahren |  |

| (Reuters) - France's Decathlon zielt darauf ab, den Anteil der Waren aus Indien auf 3 Milliarden US-Dollar in den nächsten fünf Jahren zu verdoppeln, sagte der Sportartikel-Händler am Dienstag, seinen Fußabdruck im weltberühmten Land zu erweitern. Bis Ende 2030 wird das Unternehmen 15% seiner Waren aus der asiatischen Nation, mit dem Wachstum angetrieben durch "hochpotenzielle" Kategorien wie Schuhe, Fitnessgeräte und technische Textilien, um den wachsenden Anforderungen sowohl indischer als auch globaler Märkte gerecht zu werden, sagte der Händler. Decathlon, der 2009 in Indien eintrat, verkauft eine Vielzahl von Sport-Accessoires, von Fußballen und Yoga-Matten bis zu Fahrrädern und Übungsausrüstungen im Land, Cashing auf das wachsende Interesse an Fitness und einen aktiven Lebensstil. Es konkurrieren mit Nike, Adidas, Puma und lokalen Marken in Indiens Sportartikelmarkt, der voraussichtlich 69% auf 6,6 Milliarden US-Dollar von 2020 bis 2027 wachsen wird, nach Industrieschätzungen. Das Unternehmen sagte, dass es in den nächsten fünf Jahren mehr als 300.000 direkte und indirekte Arbeitsplätze in Indien schaffen wird. (Bericht von Kashish Tandon in Bengaluru; Hrsg. Dhaniwala) |

||

| 28.07.25 19:05:10 | Warum LVMH Aktien heute verschoben wurden |  |

| **Key Points über LVMH Stock* * ### Aktuelle Leistung * Der Bestand von LVMH Moët Hennessy - Louis Vuitton (OTC: LVMUY) lag um 2 % ab 1:45 Uhr. ET, nach dem enttäuschenden Ergebnisbericht des Unternehmens und dem neuen Tarifvertrag zwischen den USA und der EU. * Auch andere hochkarätige europäische Bestände wie Heineken, Puma und AB/InBev fielen auf den heutigen Markt. ### Market Impact * Die EU und die USA vereinbarten einen 15%-Zoll für europäische Güter, den Frankreich am Montag als "Einreichung" bezeichnete. * Diese Bewegung wird eine große Kosten für Luxusgüter hinzufügen, die aufgrund der anhaltenden Handelsspannungen bereits kämpfen. ### Challenges Ahead for LVMH * Die LVMH hat in den letzten Quartalen mit einem Umsatzrückgang von 4% und einem Rückgang des Betriebsgewinns im ersten Halbjahr 2023 zu kämpfen. * Die Schwäche in Asien, vor allem im Bereich Mode und Lederwaren, wird erwartet, dass die Nachfrage nach Luxusgütern weiter beeinflusst. ### Potential Opportunities * Trotz der aktuellen Marktvolatilität hoffen einige Investoren, dass ein Handelsabkommen mit China bekannt gegeben werden kann, was für LVMH aufgrund seines bedeutenden Anteils am Luxusmarkt der Welt von Vorteil sein könnte. * Das Analystenteam von The Motley Fool hat 10 Bestände identifiziert, die Monsterrinnen in den kommenden Jahren produzieren könnten, darunter LVMH Moët Hennessy - Louis Vuitton. ### Investment Empfehlung * Vor der Investition in LVMH Moët Hennessy - Louis Vuitton sollten Investoren ihre individuellen finanziellen Situationen und Ziele sowie die potenziellen Risiken und Belohnungen im Zusammenhang mit der Investition in Luxusgüter berücksichtigen. ### Schlüsselanhänger * LVMH hat in den letzten Quartalen aufgrund von Handelsspannungen und rückläufiger Nachfrage in Schlüsselmärkten gekämpft. * Der Bestand des Unternehmens wurde durch das neue Tarifabkommen zwischen den USA und der EU beeinflusst. * Einige Investoren hoffen jedoch, dass ein Handelsabkommen mit China angekündigt wird, was für LVMH von Vorteil sein könnte. * Das Analystenteam von The Motley Fool hat 10 Bestände identifiziert, die Monster-Retouren in den kommenden Jahren produzieren könnten. |

||

| 25.07.25 11:44:58 | Puma Nasenmesser, LVMH Ergebnisse, Intel Ergebnis: Trending Tickers |  |

| Puma (PUM.DE)-Aktien gingen nach Freigabe des zweiten Quartals-Ergebnisses zurück, die ein sinkendes Wachstum zeigten und seine Gesamtjahresaussichten verringerten. LVMH (MC.PA) Aktiengewinne nach der Meldung besserer Ergebnisergebnisse. Intel (INTC)-Aktien fallen nach der Meldung enttäuschender Gewinne unter den laufenden Turnaround-Bemühungen. Um mehr erfahrene Einblicke und Analysen zu den neuesten Marktaktionen zu sehen, schauen Sie sich mehr Morning Brief: Market Sunrise hier an. Video Transkript 00:00 Lautsprecher A Willkommen zurück für unsere trendigen Tickers. Wir fangen mit Puma an. Der Bestand der Sportswear-Marke ist heute Morgen sehr aktiv, aber nicht auf gute Weise. Aktien sanken heute Morgen mehr als 18%, nachdem Puma im zweiten Quartal einen Umsatzrückgang von 2% auf 2,27 Milliarden Dollar verzeichnete. Für das Jahr sagt Puma, dass es jetzt einen niedrigen zweistelligen Rückgang des währungsbereinigten Umsatzes und einen Verlust erwartet, während seine vorherige Führung bei mehr als 500 Millionen Dollar lag. Das Unternehmen zitierte weichere Top-Line-Entwicklung, erhöhte Währungs-Headwinds und natürlich die Auswirkungen der US-Tarife. Puma, dessen Produktion vor allem in Asien ist, ist die neueste Bekleidungsmarke, um die negativen Auswirkungen von Zöllen zu warnen, die Nike und Lululemon. Okay, unser zweites Ticket zum Ticket heute ist ein weiterer kämpfender europäischer Riese, LVMH. Der Besitzer von Tiffany und Co sprang heute Morgen um 5.1%. Jetzt handelt es sich bei rund +3,3%, nachdem die Analysten sagten, das Schlimmste ist wahrscheinlich hinter ihm für die Luxusgruppe. Nun, HSBC-Analysten sagten, dass, obwohl LVMH einen Rückgang des Umsatzes in der ersten Hälfte von, erste Hälfte auf 39,8 Milliarden Euro, das ist etwa $47 Milliarden. Das Unternehmen implementiert Effizienzen und es gibt einen Hoffnungsschimmer, dass der Umsatzrückgang verlangsamt ist. Die Deutsche Bank sagte, die erste Jahreshälfte sei "besser als gefürchtet". Dennoch ist es eine schreckliche Zeit für LVMH, die von seinem Erz-Rivalen, Hermes, übertroffen wurde, und hat fast 35% in den letzten sechs Monaten getrunken. Und jetzt von europäischer Mode bis zu KI-Chips. Die Anteile von Intel sanken mehr als 8% im Vormarkthandel, nachdem es gestern Abend gemischte Ergebnisse des zweiten Quartals gemeldet hatte. Es ist jetzt nur unter 7 und ein halbes Prozent dort. Jetzt. Intel lieferte einen Umsatz von $12,8 Milliarden schlagen Schätzungen von $11,8 Milliarden. Der Chipmaker kündigte jedoch einen Verlust von 10 Cent pro Aktie an, anstatt ein erwartetes Ergebnis von 1 Cent pro Aktie. Lip Butan, der im März zum CEO ernannt wurde, ist auf der Mission, den Chiphersteller umzudrehen. Er sagt, das Unternehmen ist Laser konzentriert auf seine AI-Roadmap, sowie den Aufbau mehr finanziell disziplinierte Operationen. Intel hat gesagt, dass es seine Kopfzahl um 15% reduziert. Verwandte Videos 05:12 Citadel's Ubide sagt 'Now or Never' für Eurobonds Bloomberg • vor 42 Minuten 04:26 Cyclische vs. Verteidigungsbestände: Hier ist, wie man investiert Yahoo Finance Video • Vor 1 Stunde 06:15 Valeo CEO auf Ergebnis, Auswirkungen der US-Autotarife Bloomberg • Vor 4 Stunden 10:54 VW-CFO für US-Autotarife, Elektrofahrzeuge, Ergebnis Bloomberg • Vor 5 Stunden Kommentare anzeigen |

||

| 14.07.25 14:05:00 | Codere Online reinforces its commitment to Mexican sport with Rayadas partnership |  |

| Codere Online Luxembourg, S.A. Codere Online to become the main sponsor of Rayadas Rayadas, Puma and Codere have unveiled the new kit for the 2025-2026 season Mexico City / Monterrey, July 14, 2025 (GLOBE NEWSWIRE) – Codere Online Luxembourg, S.A. (Nasdaq: CDRO / CDROW) (the “Company” or “Codere Online”) a leading online gaming operator in Spain and Latin America, is proud to strengthen its partnership with Club de Futbol Monterrey as the main sponsor of Rayadas, the multi-champion women’s team in Liga MX Femenil. Starting on July 13th, the Codere Online logo featured on the front of the Rayadas match-day jersey, debuting in its opening fixture against Pumas in matchday one of the Apertura 25 tournament. The branding will also be present when Rayadas compete for the “Campeón de Campeonas” trophy against Pachuca in San Antonio, Texas, on July 16th and will continue to be featured throughout the remainder of the season. Codere Online and Rayadas will collaborate on a series of campaigns, activations and fan experiences designed to elevate the profile of women’s football in the country. By combining digital engagement with in-stadium initiatives, the partnership reflects shared values of equity, excellence and the ongoing growth of the game. This new sponsorship builds on last years’ renewal of Codere Online’s partnership with Rayados, which saw Codere named Official Betting Partner of the men’s team, while maintaining its front of shirt sponsorship. Extending support to Rayadas demonstrates Codere Online’s institutional commitment to the development and professionalisation of women’s sport in Mexico. Carlos Sabanza, Director of Sponsorships and Public Relations at Codere Online, said: “Becoming Main Sponsor of Rayadas was a clear priority for Codere Online since we started our partnership with the broader club. “It is an honour to support one of the strongest teams in Liga MX Femenil and to help drive greater visibility for women’s football.” Alberto Telias, Chief Marketing Officer at Codere Online, added: “This partnership underlines our continued growth in Mexico, where codere.mx remains one of the foremost online gaming platforms.” Pedro Esquivel, Executive President of Club de Futbol Monterrey, commented: “We are delighted to extend our relationship with Codere Online. This collaboration promises exciting developments ahead, and we look forward to achieving them together.” About Codere Online Codere Online refers, collectively, to Codere Online Luxembourg, S.A. and its subsidiaries. Codere Online launched in 2014 as part of the renowned casino operator Codere Group. Codere Online offers online sports betting and online casino through its state-of-the art website and mobile applications. Codere currently operates in its core markets of Spain, Mexico, Colombia, Panama and the City of Buenos Aires (Argentina). Codere Online’s online business is complemented by Codere Group’s physical presence in Spain and throughout Latin America, forming the foundation of the leading omnichannel gaming and casino presence. Story Continues About Codere Group Codere Group is a multinational group devoted to entertainment and leisure. It is a leading player in the private gaming industry, with four decades of experience and with presence in seven countries in Europe (Spain and Italy) and Latin America (Argentina, Colombia, Mexico, Panama, and Uruguay). Contacts: Investors and Media Guillermo Lancha Director, Investor Relations and Communications Guillermo.Lancha@codereonline.com (+34) 628.928.152 View Comments |

||

| 14.07.25 13:40:04 | Are Investors Undervaluing Puma Biotechnology (PBYI) Right Now? |  |

| Here at Zacks, we focus on our proven ranking system, which places an emphasis on earnings estimates and estimate revisions, to find winning stocks. But we also understand that investors develop their own strategies, so we are constantly looking at the latest trends in value, growth, and momentum to find strong companies for our readers. Considering these trends, value investing is clearly one of the most preferred ways to find strong stocks in any type of market. Value investors use a variety of methods, including tried-and-true valuation metrics, to find these stocks. In addition to the Zacks Rank, investors looking for stocks with specific traits can utilize our Style Scores system. Of course, value investors will be most interested in the system's "Value" category. Stocks with "A" grades for Value and high Zacks Ranks are among the best value stocks available at any given moment. Puma Biotechnology (PBYI) is a stock many investors are watching right now. PBYI is currently sporting a Zacks Rank #2 (Buy) and an A for Value. Investors will also notice that PBYI has a PEG ratio of 1.38. This popular figure is similar to the widely-used P/E ratio, but the PEG ratio also considers a company's expected EPS growth rate. PBYI's industry has an average PEG of 2.72 right now. Over the past 52 weeks, PBYI's PEG has been as high as 0.00 and as low as 0.00, with a median of 0.00. We should also highlight that PBYI has a P/B ratio of 1.8. The P/B ratio is used to compare a stock's market value with its book value, which is defined as total assets minus total liabilities. This stock's P/B looks attractive against its industry's average P/B of 3.11. Over the past year, PBYI's P/B has been as high as 4.07 and as low as 1.40, with a median of 1.84. Finally, our model also underscores that PBYI has a P/CF ratio of 3.55. This metric focuses on a firm's operating cash flow and is often used to find stocks that are undervalued based on the strength of their cash outlook. This company's current P/CF looks solid when compared to its industry's average P/CF of 8.30. Over the past year, PBYI's P/CF has been as high as 9.59 and as low as 2.76, with a median of 3.91. Value investors will likely look at more than just these metrics, but the above data helps show that Puma Biotechnology is likely undervalued currently. And when considering the strength of its earnings outlook, PBYI sticks out as one of the market's strongest value stocks. Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report Story Continues Puma Biotechnology, Inc. (PBYI) : Free Stock Analysis Report This article originally published on Zacks Investment Research (zacks.com). Zacks Investment Research View Comments |

||

| 03.07.25 04:50:27 | PUMA SE's (ETR:PUM) Intrinsic Value Is Potentially 77% Above Its Share Price |  |

| Key Insights The projected fair value for PUMA is €41.70 based on 2 Stage Free Cash Flow to Equity PUMA's €23.59 share price signals that it might be 43% undervalued The €29.65 analyst price target for PUM is 29% less than our estimate of fair value Today we will run through one way of estimating the intrinsic value of PUMA SE (ETR:PUM) by projecting its future cash flows and then discounting them to today's value. One way to achieve this is by employing the Discounted Cash Flow (DCF) model. Models like these may appear beyond the comprehension of a lay person, but they're fairly easy to follow. Companies can be valued in a lot of ways, so we would point out that a DCF is not perfect for every situation. If you want to learn more about discounted cash flow, the rationale behind this calculation can be read in detail in the Simply Wall St analysis model. We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free. Step By Step Through The Calculation We are going to use a two-stage DCF model, which, as the name states, takes into account two stages of growth. The first stage is generally a higher growth period which levels off heading towards the terminal value, captured in the second 'steady growth' period. To begin with, we have to get estimates of the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years. Generally we assume that a dollar today is more valuable than a dollar in the future, so we discount the value of these future cash flows to their estimated value in today's dollars: 10-year free cash flow (FCF) forecast 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 Levered FCF (€, Millions) €473.2m €531.0m €434.0m €431.0m €430.7m €432.2m €434.8m €438.3m €442.5m €447.1m Growth Rate Estimate Source Analyst x6 Analyst x6 Analyst x1 Analyst x1 Est @ -0.07% Est @ 0.33% Est @ 0.62% Est @ 0.81% Est @ 0.95% Est @ 1.05% Present Value (€, Millions) Discounted @ 8.0% €438 €455 €344 €317 €293 €272 €253 €236 €221 €207 ("Est" = FCF growth rate estimated by Simply Wall St) Present Value of 10-year Cash Flow (PVCF) = €3.0b Story Continues We now need to calculate the Terminal Value, which accounts for all the future cash flows after this ten year period. For a number of reasons a very conservative growth rate is used that cannot exceed that of a country's GDP growth. In this case we have used the 5-year average of the 10-year government bond yield (1.3%) to estimate future growth. In the same way as with the 10-year 'growth' period, we discount future cash flows to today's value, using a cost of equity of 8.0%. Terminal Value (TV)= FCF2035 × (1 + g) ÷ (r – g) = €447m× (1 + 1.3%) ÷ (8.0%– 1.3%) = €6.7b Present Value of Terminal Value (PVTV)= TV / (1 + r)10= €6.7b÷ ( 1 + 8.0%)10= €3.1b The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is €6.1b. To get the intrinsic value per share, we divide this by the total number of shares outstanding. Compared to the current share price of €23.6, the company appears quite undervalued at a 43% discount to where the stock price trades currently. Valuations are imprecise instruments though, rather like a telescope - move a few degrees and end up in a different galaxy. Do keep this in mind.XTRA:PUM Discounted Cash Flow July 3rd 2025 The Assumptions The calculation above is very dependent on two assumptions. The first is the discount rate and the other is the cash flows. You don't have to agree with these inputs, I recommend redoing the calculations yourself and playing with them. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at PUMA as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 8.0%, which is based on a levered beta of 1.559. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business. View our latest analysis for PUMA SWOT Analysis for PUMA Strength Debt is not viewed as a risk. Dividends are covered by earnings and cash flows. Weakness Earnings declined over the past year. Dividend is low compared to the top 25% of dividend payers in the Luxury market. Opportunity Annual earnings are forecast to grow faster than the German market. Good value based on P/E ratio and estimated fair value. Threat Annual revenue is forecast to grow slower than the German market. Moving On: Valuation is only one side of the coin in terms of building your investment thesis, and it shouldn't be the only metric you look at when researching a company. The DCF model is not a perfect stock valuation tool. Rather it should be seen as a guide to "what assumptions need to be true for this stock to be under/overvalued?" For instance, if the terminal value growth rate is adjusted slightly, it can dramatically alter the overall result. Why is the intrinsic value higher than the current share price? For PUMA, there are three fundamental elements you should explore: Risks: Every company has them, and we've spotted 2 warning signs for PUMA you should know about. Future Earnings: How does PUM's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart. Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing! PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the XTRA every day. If you want to find the calculation for other stocks just search here. — Weekly Picks from Community Investing narratives with Fair Values Suncorp’s Next Chapter: Insurance-Only and Ready to Grow By Robbo – Community Contributor Fair Value Estimated: A$22.83 · 0.1% Overvalued Thyssenkrupp Nucera Will Achieve Double-Digit Profits by 2030 Boosted by Hydrogen Growth By Chris1 – Community Contributor Fair Value Estimated: €14.40 · 0.3% Overvalued Tesla’s Nvidia Moment – The AI & Robotics Inflection Point By BlackGoat – Community Contributor Fair Value Estimated: $384.84 · 0.2% Overvalued View more featured narratives — Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 02.07.25 21:03:00 | Puma Biotechnology Reports Inducement Awards Under Nasdaq Listing Rule 5635(c)(4) |  |

| LOS ANGELES, July 02, 2025--(BUSINESS WIRE)--Puma Biotechnology, Inc. (NASDAQ: PBYI), a biopharmaceutical company, announced that on July 1, 2025, the Compensation Committee of Puma’s Board of Directors approved the grant of inducement restricted stock unit awards covering 7,000 shares of Puma common stock to two new non-executive employees. The awards were granted under Puma’s 2017 Employment Inducement Incentive Award Plan, which was adopted on April 27, 2017 and provides for the granting of equity awards to new employees of Puma. The restricted stock unit awards vest over a three-year period, with one-third of the shares underlying the award vesting on the first anniversary of the award’s vesting commencement date, July 1, 2025, and one-sixth of the shares underlying the award vesting on each six-month anniversary of the vesting commencement date thereafter, subject to continued service. The awards were granted as an inducement material to the new employees entering into employment with Puma, in accordance with Nasdaq Listing Rule 5635(c)(4). About Puma Biotechnology Puma Biotechnology, Inc. is a biopharmaceutical company with a focus on the development and commercialization of innovative products to enhance cancer care. Puma in-licensed the global development and commercialization rights to PB272 (neratinib, oral) in 2011. Neratinib, oral was approved by the U.S. Food and Drug Administration in 2017 for the extended adjuvant treatment of adult patients with early stage HER2-overexpressed/amplified breast cancer, following adjuvant trastuzumab-based therapy, and is marketed in the United States as NERLYNX® (neratinib) tablets. In February 2020, NERLYNX was also approved by the FDA in combination with capecitabine for the treatment of adult patients with advanced or metastatic HER2-positive breast cancer who have received two or more prior anti-HER2-based regimens in the metastatic setting. NERLYNX was granted marketing authorization by the European Commission in 2018 for the extended adjuvant treatment of adult patients with early stage hormone receptor-positive HER2-overexpressed/amplified breast cancer and who are less than one year from completion of prior adjuvant trastuzumab-based therapy. NERLYNX® is a registered trademark of Puma Biotechnology, Inc. In September 2022, Puma entered into an exclusive license agreement for the development and commercialization of the anti-cancer drug alisertib, a selective, small molecule, orally administered inhibitor of aurora kinase A. Initially, Puma intends to focus the development of alisertib on the treatment of small cell lung cancer and breast cancer. In February 2024, Puma initiated ALISCA™-Lung1, a Phase II clinical trial of alisertib monotherapy for the treatment of patients with extensive-stage small cell lung cancer. In November 2024, Puma initiated ALISCA™-Breast1, a Phase II clinical trial of alisertib in combination with endocrine therapy for the treatment of patients with HER2-negative, HR-positive metastatic breast cancer. Story Continues View source version on businesswire.com: https://www.businesswire.com/news/home/20250702179212/en/ Contacts Alan H. Auerbach or Mariann Ohanesian, Puma Biotechnology, Inc., +1 424 248 6500 info@pumabiotechnology.com ir@pumabiotechnology.com View Comments |

||

| 22.04.25 13:00:00 | PUMA Reaches Goal of Making 9 Out of 10 Products With Recycled or Certified Materials |  |

| Sports company PUMA has achieved its goal of making 9 out of 10 products from recycled or certified materials in 2024 and made further progress in its focus areas circularity, climate and human rights, the company said as part of its sustainability report which was published on Tuesday. HERZOGENAURACH, Germany, April 22, 2025--(BUSINESS WIRE)--Sports company PUMA has achieved its goal of making 9 out of 10 products from recycled or certified materials in 2024 and made further progress in its focus areas circularity, climate and human rights, the company said as part of its sustainability report which was published on Tuesday. Since initially setting the goal of 9 out of 10 products in 2021, PUMA has sharply increased the use of recycled and certified materials, which emit fewer greenhouse gases. In 2024, PUMA used 13% recycled cotton and about 75% of recycled polyester fabric in its products. "Reaching our goal of 9 out of 10 products one year ahead of schedule is a testament to the great teamwork of everybody involved at PUMA and our manufacturing partners," said PUMA’s Chief Product Officer Maria Valdes. "We will take this momentum and continue to look for ways to reduce our environmental footprint as part of our Vision 2030 sustainability goals." While recycled polyester is usually manufactured from plastic bottles, PUMA has taken a leading role in the industry with its textile-to-textile recycling project RE:FIBRE, which uses industrial and post-consumer waste as the main source of raw materials In 2024, 13.9% of polyester used in PUMA’s Apparel products was already made using RE:FIBRE. In Climate, PUMA continued to work with its core suppliers to reduce greenhouse gas emissions in the supply chain. As a result, emissions of purchased goods and services decreased by 17% between 2017 and 2024. In 2024, PUMA lowered emissions from its own operations by 86% compared to 2017, by powering all offices, stores and warehouses with renewable electricity, (including the purchase of Renewable Energy Certificates, by increasing the number of electric vehicles in its global car fleet and by opening two large-scale solar PV plants at its headquarters and a major distribution centre in Germany). Overall, PUMA aims for a 90% absolute reduction of greenhouse gases in its own operations and a 33% absolute reduction in supply chain emissions by 2030 compared to 2017, to achieve what scientists say is necessary to limit global temperature rises to 1.5 degrees Celsius compared to pre-industrial levels. Regarding its Human Rights targets, PUMA organized further trainings on important issues such as sexual harassment for the workers in its supply chain. More than 290.000 PUMA employees and factory workers have received training on sexual harassment since 2021. In 2024, the average payment at PUMA’s core suppliers worldwide, including overtime and bonuses, was 66% above minimum wage, an increase of 3 percentage points from the previous year. Story Continues PUMA PUMA is one of the world’s leading sports brands, designing, developing, selling and marketing footwear, apparel and accessories. For more than 75 years, PUMA has relentlessly pushed sport and culture forward by creating fast products for the world’s fastest athletes. PUMA offers performance and sport-inspired lifestyle products in categories such as Football, Running and Training, Basketball, Golf, and Motorsports. It collaborates with renowned designers and brands to bring sport influences into street culture and fashion. The PUMA Group owns the brands PUMA, Cobra Golf and stichd. The company distributes its products in more than 120 countries, employs about 22,000 people worldwide, and is headquartered in Herzogenaurach/Germany. View source version on businesswire.com: https://www.businesswire.com/news/home/20250422813225/en/ Contacts Media Contact: Robert-Jan Bartunek – Corporate Communications – robert.bartunek@puma.com View Comments |

||

| 18.04.25 06:29:29 | PUMA (ETR:PUM) Is Reducing Its Dividend To €0.61 |  |

| PUMA SE (ETR:PUM) is reducing its dividend from last year's comparable payment to €0.61 on the 26th of May. However, the dividend yield of 3.0% is still a decent boost to shareholder returns. While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. PUMA's stock price has reduced by 49% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield. This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality. PUMA's Payment Could Potentially Have Solid Earnings Coverage If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, PUMA was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business. Over the next year, EPS is forecast to expand by 28.6%. If the dividend continues along recent trends, we estimate the payout ratio will be 31%, which is in the range that makes us comfortable with the sustainability of the dividend.XTRA:PUM Historic Dividend April 18th 2025 View our latest analysis for PUMA Dividend Volatility While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2015, the dividend has gone from €0.05 total annually to €0.61. This works out to be a compound annual growth rate (CAGR) of approximately 28% a year over that time. PUMA has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income. The Dividend's Growth Prospects Are Limited Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Unfortunately, PUMA's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. If PUMA is struggling to find viable investments, it always has the option to increase its payout ratio to pay more to shareholders. Our Thoughts On PUMA's Dividend Even though the dividend was cut this year, we think PUMA has the ability to make consistent payments in the future. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. The payment isn't stellar, but it could make a decent addition to a dividend portfolio. Story Continues Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 2 warning signs for PUMA that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers. Have feedback on this article? Concerned about the content?Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. View Comments |

||

| 15.04.25 09:31:00 | Rise, Run, and ‘Go Wild’ for the 5AM High Drops |  |

| As a part of PUMA's latest global brand campaign, “Go Wild”, the global sports company is launching its first global activation and inviting runners around the world to ‘Go Wild’ for the 5AM High Drops. PUMA empowers early-morning runners with a new global activation encouraging runners around the world to rise to the challenge and chase the runner’s high HERZOGENAURACH, Germany, April 15, 2025--(BUSINESS WIRE)--Global sports company PUMA announces the launch of its first global activation around the latest brand campaign and invites runners around the world to ‘Go Wild’ for the 5AM High Drops. Boston, Las Vegas, New York, Mexico City, London and Tokyo are just some of the cities around the world where PUMA will drop free pairs of PUMA’s latest Deviate NITRO™ 3, Forever Run, and other new PUMA running shoes out in the wild at 5am at high points, to reward the dedication of early-morning runners chasing the runner’s high. As part of PUMA’s Go Wild brand campaign, 5AM High Drops is timed with the start of spring and peak marathon training season. In line with the most recent approach from PUMA, joining the so-called 5am run club comes with a list of benefits that effect everything from your performance to your mental health. As more individuals embrace outdoor activity and chase the runner's high, the global giveaway inspires everyone to unleash their true selves and Go Wild. All runners need to do to win, is to be one of the first ones to run to one of the ‘high drop’ locations announced on PUMA’s participating local Instagram channels at 5am on the specified date. Between April and May, the first runners to reach their local ‘high drop’ location will receive a free pair of Deviate NITRO™ 3, Forever Run, and other new PUMA running shoes as a reward for their commitment to early morning running. Erin Longin, VP Run/Train at PUMA says, "We’re so excited to provide an opportunity for runners worldwide to Go Wild with 5AM High Drops. At PUMA, we want to champion those with a passion for running, especially as more people start to train and enjoy the outdoors this spring. "The global giveaway is built with our philosophy at heart, which emphasises sport as a space for self-expression and enjoyment. The 5AM High Drops encourages everyone to embrace their unique dedication to the runner's high with confidence, particularly during this peak running period." 5AM High Drops follows the latest brand campaign video from PUMA that found that inappropriate weather ranked as the highest barrier to running in the USA (42%), indicating that now is the most ideal time of year for PUMA to empower runners worldwide. This activation celebrates runners re-arranging their lives to chase the runner’s high, highlighting an uptake in the sport and an area for PUMA to champion those dedicated individuals that chase the runner’s high before the sunrise. Story Continues PUMA’s 5AM High Drops comes as part of PUMA’s latest global brand campaign, "Go Wild". For more information on Go Wild, see here. PUMA PUMA is one of the world’s leading sports brands, designing, developing, selling and marketing footwear, apparel and accessories. For 75 years, PUMA has relentlessly pushed sport and culture forward by creating fast products for the world’s fastest athletes. PUMA offers performance and sport-inspired lifestyle products in categories such as Football, Running and Training, Basketball, Golf, and Motorsports. It collaborates with renowned designers and brands to bring sport influences into street culture and fashion. The PUMA Group owns the brands PUMA, Cobra Golf and stichd. The company distributes its products in more than 120 countries, employs about 20,000 people worldwide, and is headquartered in Herzogenaurach/Germany. View source version on businesswire.com: https://www.businesswire.com/news/home/20250415649990/en/ Contacts Media Contacts: PUMA Kseniia Illiushina Global Brand PR Manager kseniia.iliushina@puma.com Mario Almeida Director of Global PR & Brand Activations mario.almeida@puma.com View Comments |

||